Swarm redistribution is a p2p system for algorithmically forgiving debt, up to a basic income per month, self-regulated by a governance mechanism I call Taxemes. It is based on the Ripple system. Ripple uses trust-lines and credit-lines, IOUs.

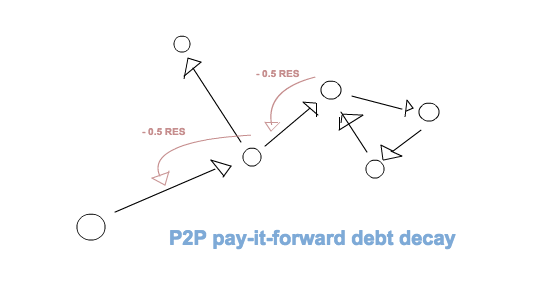

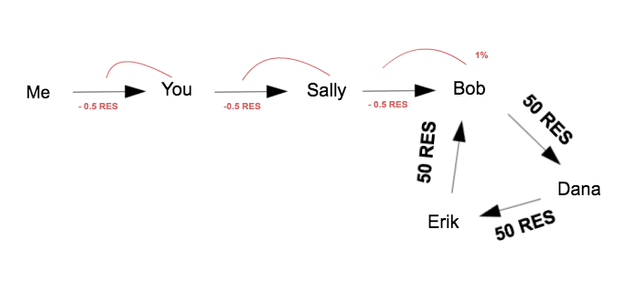

The Swarm Redistribution system runs every time value is added to the network, which happens during credit clearing, and every node in that credit clearing will forgive a small amount of debt to those who have debt to them, decaying their credit lines, and those nodes will in turn slightly decay the credit lines of those who have IOUs to them, and so on.

I developed the concept of dividend pathways to be able to experiment with swarm redistribution using central bank currencies, but when using IOUs then dividend pathways are credit lines, and when dividend pathways decay, its really debt that decays as a tiny bit of it is forgiven.

So imagine a map of how value is created in the world, where Ripple credit clearing is a good way of measuring that, and that each time that happens, there is a trickling-down of debt being decayed, where A forgives a bit of debt to B, who forgives a bit to C, who forgives a bit to D, until it reaches the end of the branching scheme.

This map of value being created is mapped over time, and so it shows growth.

With Ripple, you connect to the financial web via people you know, so the anti sybil problem of people not having multiple accounts is solved by your credit being given by peers you know, and those same peers are the ones who forgive a tiny part of your credit, during swarm redistribution. This means that if you created 10 fake accounts and issue IOUs to yourself, then you would also be the one to forgive their debt, making your fake accounts a closed system.

What kind of money will be consistent with the new self, the connected self, and a world in which we increasingly realize the truth of interconnectedness: that more for you is more for me? Given the determining role of interest, the first alternative currency system to consider is one that structurally eliminates it, or even that bears interest’s opposite. After all, if interest causes competition, scarcity, and polarization, then might not its opposite create cooperation, abundance, and community? And if interest represents the proceeds from the ancient and ongoing robbery of the commons, might not its opposite replenish it?

What would that opposite look like? It would be a money that, like bread, becomes less valuable over time. It would be money, in other words, that decays—money that is subject to a negative interest rate, also known as a demurrage charge. Decaying currency is one of the central ideas of this book.

Charles Eistenstein, Sacred Economics (2011)