Financial resilience is beneficial to our peace of mind. Even if we have only been able to put up

a meager amount of savings. I am always searching for strategies to improve my financial

resilience, because it tends to reduce tension in relationships during difficult economic times,

much like today.

So, here are some basic concepts that you can implement starting today to improve your

financial resilience.

Step 1 Savings Plan = Cash On Hand

Start a savings plan. I like to say, “Pay Yourself Second.” Now, I know what you are thinking,

Hey, isn’t that supposed to be pay yourself first? Well traditionally it is, but as you will learn

when we cover the basic concepts of Spiritual resilience, we consider Charitable Giving as our

First Responsibility. Start small if you must but start right away. We feel that our basic savings

goal should be 10% of our earnings, but do not get concerned if that is not possible. Just begin

with what you can and build up as you are able.

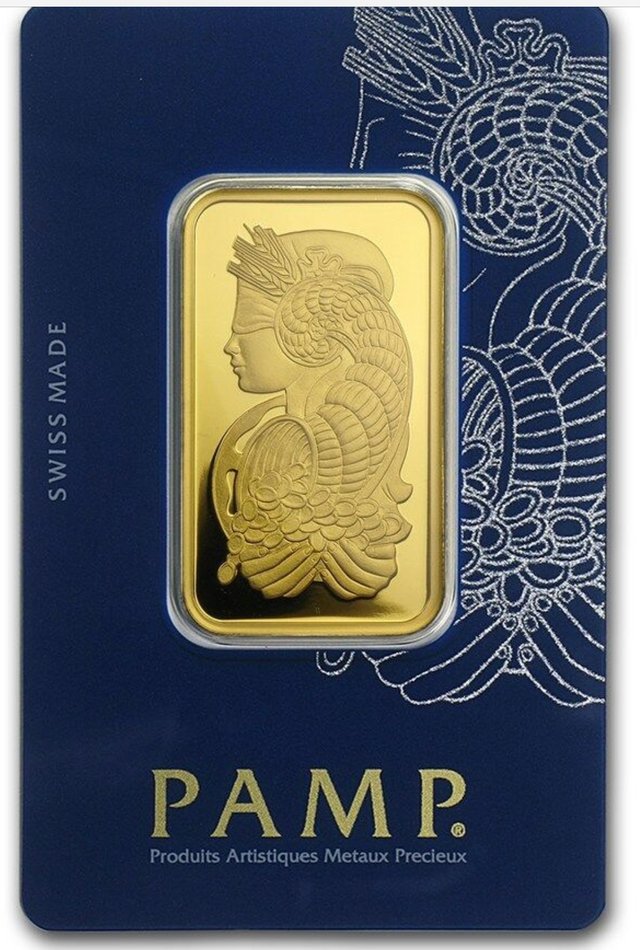

Step 2 Diversify Your Savings

Gone are the days of parking our hard-earned savings in a savings account or a bank certificate

of deposit and collecting a nice return while still having fairly liquid access to our savings in

times of need. Sadly, gone are the days of keeping savings in one instrument. For most people

in the US that savings instrument is the US Dollar. It is unfortunate that the currency managers

at the Federal Reserve have been so careless with our currency, but that is irrelevant to us

because that is out of our control, but there is a simple solution. Diversity is the simplest way to

reduce risk to the lost of purchasing power, that is your ability to get the goods and services

that you expect, of your savings. You might ask, how do we diversify our savings? Some options

may include commodities such as gold and silver or possibly Bitcoin. There may even be a place

for some foreign currency holdings, especially of nations with responsible and conservative

central banks.

Step 3 Explore Options of Increased Income

Of course, who doesn’t want a simple way to increase our income. The internet and powerful

mobile devices have opened a whole new universe of opportunities to explore. There are many

internet marketing and affiliate opportunities to explore.

Also, the gig economy has opened up other opportunities for those who are willing to drive

others around, run deliveries, or provide a service to others such as website creation or

illustration.

One final choice may be to just be to pick up any available overtime at your current

employment, or perhaps take on a second job to establish your savings pool.

So, there you have it, 3 basic steps to vastly improve your financial resilience and provide you

with peace of mind that you might not otherwise have in a time of instability or uncertainty. Of

course, none of this will improve your peace of mind if you do not have it in place prior to

instability. So, don’t waste any time implementing these strategies right away.

As with all things do your own research and consult a personal financial advisor before making

taking any action. We provide this information as an educational service and you are fully

responsible for your financial decision. Take charge today and bring some Financial Resilience

to your life now.

To Your Success