Hey Steemit, I know many of you are thinking "retirement seems so far away" or maybe even "retirement is impossible". Well I want to let you know that even if BTC, ETH, XRP, LTC, SBD (...etc.) don't go to $100,000 per coin - you can still retire, even early!

It turns out that when it boils right down to it, your time to reach retirement depends on only one factor:

Your savings rate, as a percentage of your take-home pay

If you want to break it down just a bit further, your savings rate is determined entirely by these two things:

How much you take home each year

How much you can live on

While the numbers themselves are quite intuitive and easy to figure out, the relationship between these two numbers is a bit surprising.

If you are spending 100% (or more) of your income, you will never be prepared to retire, unless someone else is doing the saving for you (wealthy parents, social security, pension fund, etc.). So your work career will be Infinite.

In between, there are some very interesting considerations. As soon as you start saving and investing your money, it starts earning money all by itself. Then the earnings on those earnings start earning their own money. It can quickly become a runaway exponential snowball of income.

As soon as this income is enough to pay for your living expenses, while leaving enough of the gains invested each year to keep up with inflation, you are ready to retire.

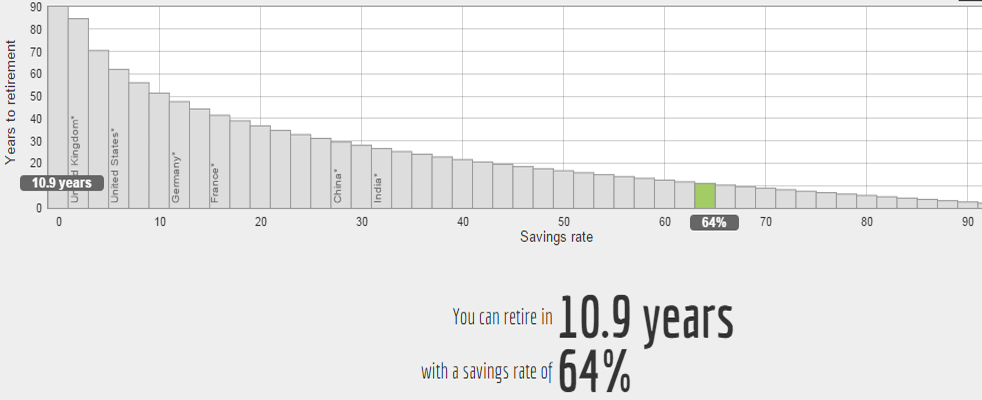

If you drew this on a graph, it would not be a straight line, it would be nice curved exponential graph, like this:

If you save a reasonable percentage of your take-home pay, like 50%, and live on the remaining 50%, you’ll be Ready to Rock (aka “financially independent”) in a reasonable number of years – about 16 according to this chart and a more detailed spreadsheet* I just made for myself to re-create the equation that generated the graph.

So let’s take the graph above and make it even simpler. I’ll make some conservative assumptions for you, and you can just focus on saving the biggest percentage of your take-home pay that you can. The table below will tell you a nice ballpark figure of how many years it will take you to become financially independent.

Assumptions:

You can earn 5% investment returns after inflation during your saving years.

You’ll live off of the “4% safe withdrawal rate” after retirement, with some flexibility in your spending during recessions.

You want your money stash to last forever, you’ll only be touching the gains, since this income may be sustaining you for seventy years or so. Just think of this assumption as a nice generous Safety Margin.

It’s quite amazing if you can do the above, but it really boils down to practical and intentional living. Take a look at a middle-class family with a 50k take-home pay who saves 10% of their income ($5k) is actually better than average these days. But unfortunately, “better than average” is still pretty bad, since they are on track for having to work for 51 years.

But simply cutting cable TV (Netflix and chill is cheap!) and a few lattes would instantly boost their savings to 15%, allowing them to retire 8 years earlier!! Are cable TV and Starbucks worth having two income earners each work an extra eight years for???

The most important thing to note is that cutting your spending rate is much more powerful than increasing your income. The reason is that every permanent drop in your spending has a double effect:

If want to retire within 10 years, the formula is right there in front of you – simply live on 35% of your take-home pay