Introduction

Blockchain is known as the technology behind the most famous cryptocurrency system in the world - Bitcoin. It can be said that when Bitcoin is getting more popular in the financial market, Blockchain also caused a fever in the technology world. The number of companies intending to research and apply Blockchain is increasing, the salary paid to Blockchain engineers is increasing as well. Every company wants to stay ahead of their competitors, adopting technology that is considered as the future of the world.

Problems Of DeFi

However, is blockchain application effective in these areas when blockchain has disadvantages such as investors who do not fully understand the project and dumping tokens? That is because all of DeFi's mechanisms of action are too flawed.

In particular, some DeFi projects are also thinking of using external platforms for computational purposes, however, they cannot provide a flexible solution that can make their off-chain computations compatible with On another blockchain platform, top developers can only create their dApp on a particular blockchain. Hence, this makes blockchain's goal of adoption more difficult to achieve.

DeFiFarms Solutions

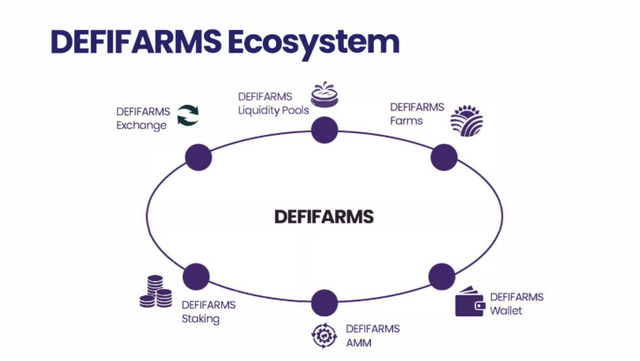

Yield Farming solutions on DeFiFarms offer large returns and a lot of liquidity assistance for projects . Akin to putting money in the bank, Yield Farming works similarly. Instead of currency, you deposit cryptocurrencies into exchanges or Defi protocols, respectively. The Smart Contract secures this cost.

Agriculture and the Automated Market Maker (AMM) paradigm are closely linked. The Uniswap, Mooniswap, and Balancer are popular AMM models.

Liquidity Providers contribute to the Yield Farming protocol's pools. A liquidity pool is a smart contract that holds money. Users can borrow, lend, and trade tokens in these pools.

When end-users take, lend, or exchange tokens, Liquidity Pool collects the transaction fee. Liquidity providers will receive a share of the revenue generated from the pool.

DeFiFarms' Yield Farming improvements

There is nothing new about Yield Farming and NFTs. Due to investor concerns about transaction security, this trend began to reverse in 2020.

This notion led to the creation of a non-fungible token (NFT). A non-fungible token (NFT) is a limited edition coin that is not a cryptocurrency.

An important part of the new digital economy produced by Blockchain is NFT. Many projects are leveraging NFT for games, digital IDs, licenses, certifications, and artwork. NFT can even provide consumers an ownership rate on high-value products, like jewelry.

AMM Yield Farm and NFTs Protocol Powerful Automatic Liquidity Acquisition decentralized exchange based on Binance Smart Chain, DeFiFarms was created to take advantage of that opportunity.

DeFiFarms' solutions ensure that the classic Yield Farming model's security flaws are eliminated. Notably, most of them rely on Smart Contracts, which are created by small entities with low capital ratios, increasing the risk of bugging them. Even though the protocols have been audited, there may be faults and errors in the system. Like Bzrx, Curve, etc., these issues prompted money theft.

For users, DeFiFarms allows them to stake and lend crypto assets, increasing their balance. With smart contract-based liquidity pool management, DeFiFarms project yield farming helps incentivize liquidity suppliers.

“Using NFT allows DeFiFarms to make stakes more dynamic. Stakes are linked to evidence of ownership, transferable NFT, rather than a user's wallet address, DeFiFarms developers explain. By becoming a Liquidity Provider, you acquire an NFT of equal value called NFT Farming.

Profits from bounty reward pools, DeFiFarms financing liquidity pools, or other organizations will be used to calculate farming payouts. Defi Yield farming allows bitcoin holders to lock away their assets while expecting good returns. Users can also earn income by investing in the Defi market. That is, using the BSC network to farm cryptocurrency. Loans are paid back with interest in the traditional banking system. In terms of cryptocurrency, it's similar to yield farming. Using the Defi protocol, an amount is leased out rather than stored in a wallet.

DeFiFarms envies a more trustworthy and beneficial exchange to users by quickly accessing the NFT application. DeFiFarms' mission is to be a reliable Defi platform that provides consumers with security and growth.

Staking

Staking is one of the earliest forms of incentivizing behavior. Users delegate their tokens to be locked away for a set length of time in exchange for a profit return on the staked tokens throughout that period. The staked tokens on the DefiFarms protocols assist protect the network by allowing the staked user to validate network transactions using their delegated token. In layman's terms, users locked the token away in a process known as staking, emphasizing a long-term commitment to the project, becoming a shareholder, and receiving a part of the project's produced revenue during the staking period.

Farming Yield

Yield farming is a popular way to make money in the DeFi ecosystem, with different degrees of enticing incentives for users to lend their tokens to the liquidity pool. DefiFarms allows users to earn massive incentives for contributing liquidity to the DefiFarms liquidity pool.

Automated Market Maker (AMM) Of DefiFarms

In the ever-expanding crypto industry, trading cryptocurrencies on exchanges appears to be a lucrative piece of business. For crypto users (like myself), purchasing cryptocurrencies such as Bitcoin, Litecoin, Ethereum, DEFIY, and other altcoins is one thing, but selling them on exchanges is quite another. The primary purpose of crypto users acquiring altcoins is to maximize return on investment by trading them. DefiFarms will offer an AMM model to allow for the rapid exchange of DEFIY tokens for other assets.

DefiFarms Wallet

This wallet enables the storing of cross-chain assets, which aids DefiFarms in dominating the DeFi market across all chains.

NFT Market

DeFiFarms Protocol will provide the NFT Marketplace. NFTs are getting a lot of hype right now and their market is valued at $250 by 2021. NFTs are issued by blockchains, which are digital products of a kind or files like business cards. , digital art, audio, assets and virtual games. The NFTs associated with the individual files are unique and can be traced on the underlying file providing proof of ownership for DeFiFarms as it can easily play back digital files.

On the DeFiFarms platform, users feel more secure and protected, and any user who refuses to share their information tends to have a hard time trying to sell/advertise their products like publicity. them. freelancers, social media marketers, etc.

Conclude :

DeFiFarms Protocol is a project with a solid ecosystem and a certain global reach. According to the project's money supply roadmap, the project is moving towards a decentralized monetary policy and empowering the community in a way that can ensure the sustainability of the ecosystem. Currently, the project is in the preparation stage of cooperation with many partners, so if you are interested in tokens, this is the right time to learn about the project and choose wisely.

This is not an investment advice article, this is an analysis of the project for the community to refer to and learn more deeply, so we will not be responsible for problems encountered during the investment process. . Every investment opportunity has certain risks, so everyone should carefully consider each investment decision to have the highest probability of success.

Follow our Project to learn more

Website : https://defifarms.org/

Whitepaper: https://drive.google.com/file/d/16rlbSp4cd_RpGDuPp7VPBpKeGTJ8_yYb/view?usp=sharing

Telegram : https://t.me/DeFiFarmsNFT

Media : https://t.me/DefifarmsNFTs

Twitter : https://twitter.com/DeFiFarmsNFTs

Medium : https://medium.com/@DeFiFarmsNFTs

Githud : https://github.com/defifarms

Publisher details

Bitcointalk Username : freshtictacs

Bitcointalk Profile url : https://bitcointalk.org/index.php?action=profile;u=1236371

BSC : 0xACf71cCb61a2cbC9556ed7b6FEc4EaaC23eB4e12

A very interesting project. I joined and have no regrets!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

An interesting reviewer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Finally, I found something reasonable for the project.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wonder what kind of platform you have to look!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it is a very useful project for everyone who wants to make money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A very promising project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

An unusual project with good prospects

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This project has been gaining strength and great success.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now there are many projects on the site, but you can stop here and start working.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit