OK so browsing through the internet I came across Credit Sesame, it had nearly 5 star reviews online and on the app store (Android) so I decided to try it out to see what the program offered.

After a few Weeks of going through this app and program, even though I am personally on the No Debt side of money and finance, I have borrowed in he past. Yes, I am working on that Credit Score ( more about those pesky scores later). The app first off is secure and you do have to login with an account or Facebook. Upon clicking the social media login, I received a work in progress notice as they are working to implement that feature (ok no big deal...) And created an account. Here are son Pros and Cons to the program; user opinion and experience may vary:

CONS:

1.Requires your personal information to access your credit file. Social security number, date of birth and a few personal questions related to where you have lived in the past, past mortgages or personal loans, etc.

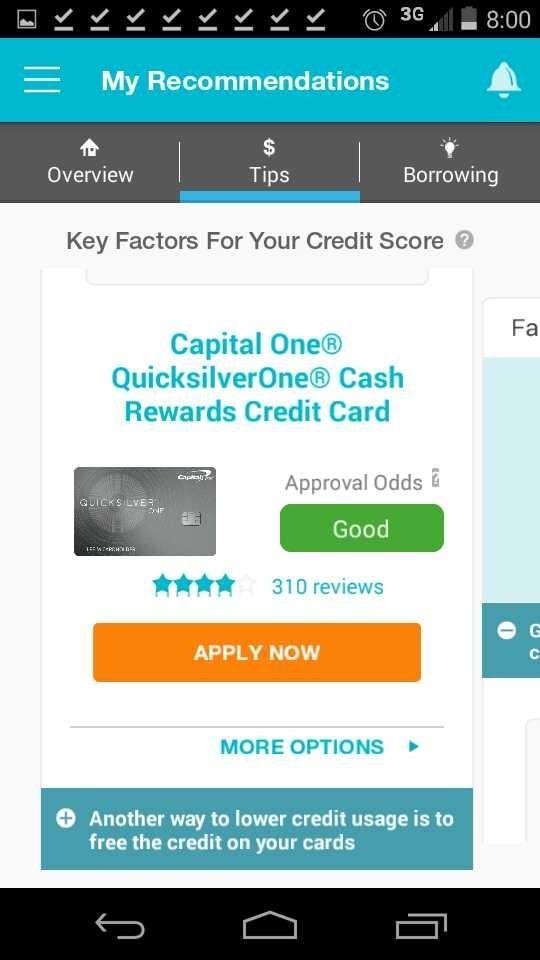

- Not so subtle placements of "get a loan" offers through their affiliate mortgage company and a big push with Capitol One credit cards "pre-qualified" to "help" you get your score up by handy "Fix This" buttons.

- These offers are on nearly every tab of the app.

- You cannot see a detailed report unless you buy the Premium package and then you can access the Premium Dashboard. (Yay for entrepreneurship! Yes, I do understand they gotta make a living.)

- Slow start-up.

- No customization of credit tracking on Free account.

Ok so got those out of the way, here are the PROS to Credit Sesame (no I am not paid or sponsored by them, this is an honest review). I did not purchase the Premium account, but I will address what is stated with the premium as a part of the program below.

PROS:

1.APP has easy to understand tabs, is visually appealing and organized.

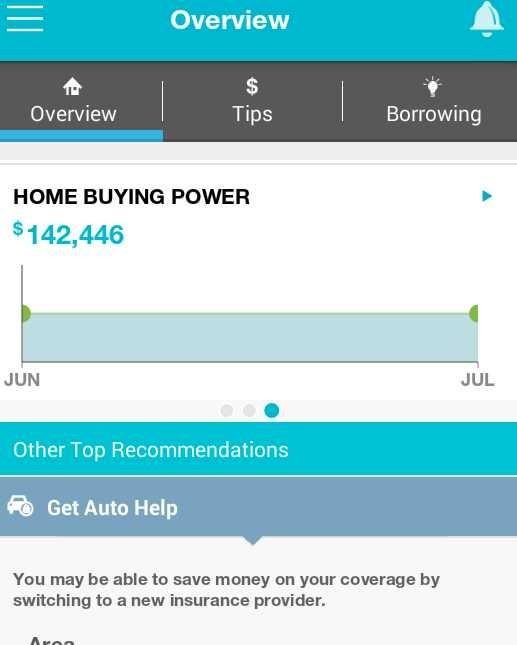

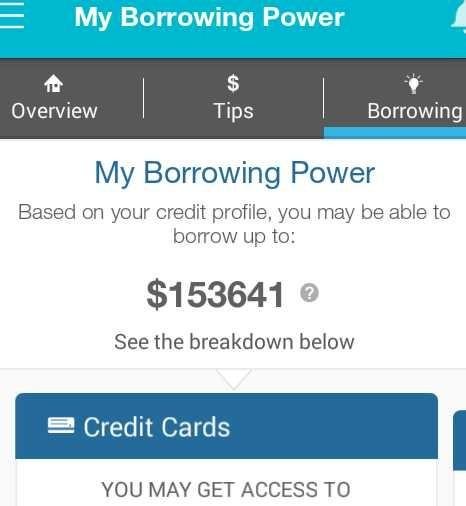

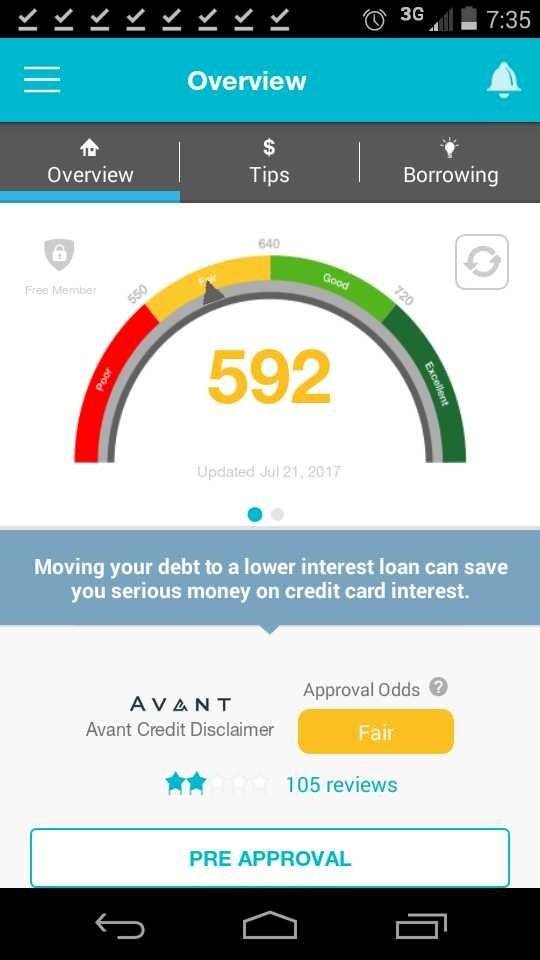

2.You get a chart of your current debt amount and status

- Estimated Home Mortgage Amount for your Score Rating

- Personal Secure PIN Login

- Your Own Score Scale that changes when a item on your credit report makes a change ( yes this is my score, not fantastic but seeing as I haven't had any new debt for nearly 5 years and have been working on the student loans... yea... Hey I'm real with this LoL .)

- Notifications on your account through the app notify you of a change to your credit report. Premium accounts get more detailed reports as to old unfixed or wrongly reported items on your report.

For example: US Bank had failed to update their report of a paid in full owed amount that had been paid for almost 5 years on my credit report and I had to pay penalties because of THEIR mistake in reporting on my new bank account for an entire year. AND it dented my credit score. (Grrrr...). No I didn't get compensated for the $120 I had to pay in bank fees either >.>...

Anyway, that is my review on the Credit Sesame app, I think it is a good way to monitor your score if you are wanting to raise it. However, you can get a free credit report fully detailed each year through freecreditreport.com and that will help you see what is on all reporting like TransUnion, Equifax etc and will help you to address any wrong reporting. However, this app would be a good up to date monthly monitoring system if you are working to establish or raise your score.

#credit #creditscore #finances #money #moneymatters #debt #debtmanagement #blog #review #education #opinion