A detailed examination of the Ripple vs Swift battle, should give XRP hodlers confidence.

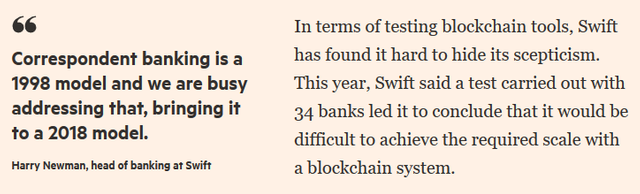

The Ripple XRP use case is that it is a settlement and liquidity tool that will replace Swift payments amongst the major banks over time. Swift is an old, inefficient settlement system, created in 1973, which, until recently, relied solely on MT messaging that was designed for telex, in the age of discotheques and flared trousers.

Swift is a high cost system, in terms of money and human resources; it ties-up a bank's cash flows for an undetermined length of time, as a bank never knows how long settlement will take. The whole process also ties-up people in the bank's settlement, middle-management and credit offices, who monitor the foreign currency limits, trading limits, settlement limits and counterparty limits to ensure that a bank's fx settlement account remains in credit.

In order to use Swift, banks have to fund nostro and vostro accounts with huge sums of money and permanently retain those funds there to facilitate settlement of Swift transactions, paying interest for the privilege of doing so, whilst losing interest on these deposits that they're holding in the meantime. Additional borrowing and lending rates are also incurred. This is referred to as a '24 trillion-dollar banking problem.'

Swift payments go through a long-established correspondent banking system, requiring the following sequence of 6 steps – 1. The payer, 2. The payer’s bank, 3. The correspondent of the payer’s bank, 4. The beneficiary bank’s correspondent, 5. The beneficiary bank and finally 6. The beneficiary. There is no automatic conversion to the destination currency.

If the payer's bank and the beneficiary's bank do not have accounts with each other, the payer's bank will have to use an intermediary bank that does. Not all banks and intermediaries use Swift's straight through processing (STP), which would speed-up settlement, but still take a minimum of 2 working days.

Although a standard Swift foreign currency deal will take 2 working days to settle, there are frequent problems with transactions, causing delays beyond 2 working days. If a transaction doesn't involve a major currency, such as USD, GBP etc and lacks liquidity, the Swift system could take up to 10 working days. The most notable downside of the Swift payment system is its unsatisfactory failure rate, meaning a transaction may not settle at all.

As a result of a bank's need to keep its exchange settlement account in credit, they have developed a habit of holding-up payments in a float for an arbitrary length of time, whilst all those in the sequence of the correspondent banking system often apply various fees and deductions that lack transparency.

All these features of Swift add time to settlement, in what is undoubtedly a long-winded and frustrating process for the payer, the beneficiary and the banks.

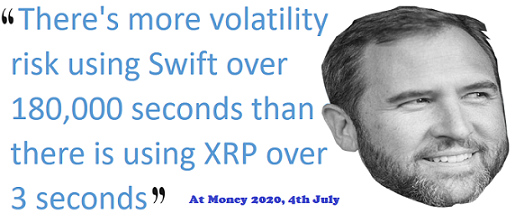

Ripple eliminates the settlement risk of the Swift model with instant validation of cross-border payments that take seconds to complete.

The Ripple Interledger Protocol (ILP) is public open-sourced and decentralized and vastly improves on the information exchange offered by Swift. As RippleNet is bank-centric, it also lowers barriers to entry for the banks, allowing banks to connect Ripple to its existing bank ledgers, in much the same way as the banks connect to the Swift network.

The Messanger service uses consensual validation of encrypted hashes, an industry standard ISO and MT form of messaging, which connects all parties on the network directly and multilaterally with a much richer information exchange, guaranteeing that the payment messages will not lose any corporate data.

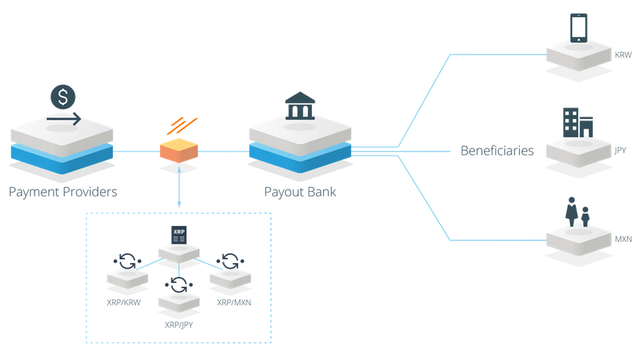

Settlement and credit risk to the banks is removed and the XRP bridge-asset provides an instant liquidity pool and an automatic conversion to the destination currency. Swift only offers a form of liquidity through correspondents.

RippleNet is optimised to allow banks to search for the best price for exchange and liquidity. Customers are no longer at the mercy of the wide spreads currently reflected in bank board rates.

Cross-border currency exchanges are completed without the risk of the traditional intermediary failures in a 5-step process of; 1. Payment 2. Validation 3. Cryptographic holding of funds 4. Settlement 5. Confirmation.

Ripple can currently settle 1500 tps a second and has the potential to scale up to 50k tps. For a typical transaction, this takes seconds to complete and with known costs of 0.00001 XRP, a 40 – 70 % cost saving for banks and end users compared to Swift.

Using Ripple technology also eliminates a bank's need to fund nostro and vostro accounts, solving the global '24 trillion-dollar banking problem.'

The unique technology, price, costs and speed advantages of Ripple, in addition to the elimination of any settlement risk are obvious for banks and corporations and should also make Ripple and XRP the preferred choice of regulators, who tend to adhere to the wishes of major banks and would therefore be highly unlikely to pull the plug on Ripple. All this bodes well for Ripple's future, as they seek to build new partnerships and retain relationships with their existing partners.

Swift's Fightback

Swift has developed cloud and API solutions, which Swift claim can make settlement "in minutes, or even seconds." Their Global Payments innovation settles more than half of the payments within 30 minutes, but they remain sceptical that blockchain has the ability to scale to the required levels, having tested their own blockchain solution.

Here is Swift's rather antiquated GPI advertisement;

GPI is service level agreement (SLA) committing banks to behave more reasonably in FX payments. GPI is essentially a tracking and data collection service on top of the existing Swift payment system, which can be viewed in near real time (rather like an Amazon parcel delivery) and ensures that the SLA is being adhered to by all intermediaries in the settlement process, whilst discouraging the banks from taking arbitrary fees and maintaining a float.

GPI is a less than convincing response to the existential threat posed by Ripple's disruptive technology. It doesn't solve the nostro and vostro '24 trillion banking problem.' The low take-up of GPI amongst the banks compared to Ripple has signalled the likely outcome in the ongoing battle, as banks and corporations realize the increasing risk of sticking with Swift, rather than opting for the competitive edge that the banks already partnering with Ripple now have.

Meanwhile, back at Swift, the new GPI is fully operational;

Ripple is increasingly described as a once on a lifetime investment by commentators in the crypto-space, as it is a real and unique company, with a business model that solves a real problem, which gives XRP a use case that 95% of the other cryptocurrencies lack, even though their values soar.

Ripple currently has is 155 partnerships (as of June 10th 2018) and they are bringing a new partnership on board every week.

https://www.ft.com/content/631af8cc-47cc-11e8-8c77-ff51caedcde6

https://globalcoinreport.com/ripple-xrp-swift-rivalry/

https://www.paymentssource.com/news/ripple-vs-swift-rivalry-heats-up-banking-may-be-ultimate-winner

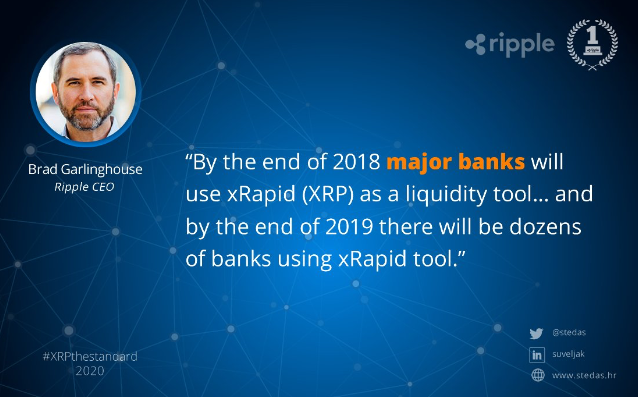

Can the ripple CEO forecast be reliable? All major banks will use ripple by the end of 2018. It seems a very narrow time window for such epochal change!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think the forecast was that major banks will start to use xrp in 2018 and that dozens will be using it in 2019. I think he has probably said this based on some prior knowledge. 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think that the Ripple will not win after all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ripple is currently bringing on board one new partnership a week and I think this number will accelerate, as the year goes on. It must be so, because Swift cannot complete with Ripple technology. It’s like a horse and cart versus a speed boat. Not to mention that Swift was hacked a few times in the last couple of years. There are also rumours that JP Morgan is in early talks with Ripple.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ripple is a stop gag for banks. Chase is creating their own blockchain and I am sure other big banks will do the same. It will have success but the hype should be tempered.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, it is true that other big banks could develop their own blockchain’s. However, this would take a few years to be market ready and without a bridge asset like xrp, these blockchains could not achieve the same cost savings of 70% on Swift fx transfers. Any bridge asset that Chase or another bank creates would also take time to establish the same influence, volume and liquidity as xrp. I’m not saying it will never happen, but, in the meantime, the price of xrp will soon reflect its current utility

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

69 66 20 79 6f 75 20 63 61 6e 74 20 62 65 61 74 20 74 68 65 6d 20 6a 6f 69 6e 20 74 68 65 6d 20

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

House!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit