.png)

There are a thousand and one reasons why millions of people all over the world wouldn’t take an interest to invest in cryptocurrencies of any kind.

If they are not citing the volatility of the coin as a reason, they would be referring to how hard it is to invest and trade cryptocurrencies.

Indeed, the cryptocurrency market is volatile, and is mostly swayed to either side (bullish or bearish) depending on the side Bitcoin whales want it to go.

Out of the volatility in the crypto market, one of the things you should be consistent with is how you can preserve your capital.

That is where many cryptocurrency investors make the mistake. More often than not, some cryptocurrency traders would Buy the High, thus, putting themselves in a position to lose money.

Trading with the stablecoin pairs ($USDT, BUSD) of crypto assets appears to be a way out.

But, none could be as powerful as a rebase token if only the token has the relevant features.

With many rebase tokens not living up to expectations, the Rise Protocol has been launched to fix some of the loopholes in the traditional crypto token economy.

WHAT IS DIFFERENT WITH THE RISE PROTOCOL?

Wasn’t this how many other rebase tokens were launched – claiming to be better, but ending up being worse than the predecessors?

So, what makes the Rise Protocol a better rebase token?

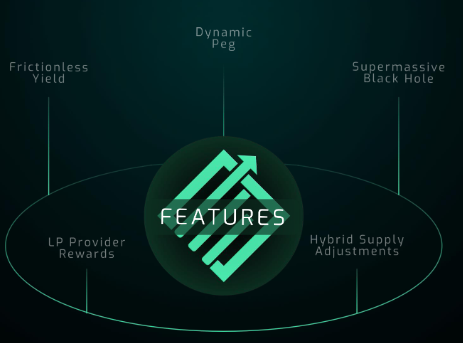

Find out below some of the unique working products that crypto investors cannot ignore, as far as the uses of rebase tokens are concerned:

LIQUIDITY PROVIDER REWARDS

Many cryptocurrency investors wonder why most rebase tokens end up being an opposite of what they proclaimed to be.

Well, the reason is not far from the fact that most of those tokens are traded on liquidity pools where the Liquidity Providers (LPs) are not adequately rewarded for their services.

The Rise Protocol does something different this time by providing rewards for Liquidity Providers (LPs).

These rewards would be remitted in the form of the Rise Token ($RISE). The rewards would be sourced from a portion of each transaction that is processed on the Rise Protocol.

The calculation is that 1% of every sell order on the Rise Protocol would be set aside for those rewards.

Besides, Liquidity Providers (LPs) are not expected to do additional work like interacting with a staking interface before they can earn the tokens.

All they need to do is to provide liquidity in the Rise Protocol, and hold the LP tokens from Uniswap in their crypto wallet.

Once they meet those conditions, they would be automatically selected to benefit from the 1% Liquidity Provider Rewards that would be distributed.

DYNAMIC PEG

The Rise Protocol team figured out that an excellent way of stabilizing the value of the $RISE token was to use dynamic pegging.

That is why the $RISE token is fully adaptable to change alongside the market. Thus, the token can be pegged to many crypto asset classes, including $LINK, $BTC, $USDC, and $DOT.

FINAL WORDS

The Rise Token ($RISE) is a synthetic crypto asset class that would change your perspective of rebase tokens.

RISE #ieo #blockchain #dot #bounty #defi #Rise #RiseProtocol #RebaseToken #FrictionlessYield

USEFUL LINKS:

Website: https://riseprotocol.io/

Reddit: https://www.reddit.com/r/riseprotocolofficial

Telegram: https://t.me/RiseProtocolOfficial

Medium: https://riseprotocolofficial.medium.com/

Explorer: https://etherscan.io/address/0x3fa807b6f8d4c407e6e605368f4372d14658b38c

Whitepaper: https://riseprotocol.io/wp-ontent/uploads/2021/02/RISE_Litepaper.pdf

Twitter: https://twitter.com/RiseProtocol

AUTHORS DETAILS

Bitcointalk Username: Gopalwu

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2759913;sa=summary