Gone are the days when the CFOs’ role was tied exclusively to back office tasks. Now they are widely viewed as “powerful digital guardians”, and their disruptive influence is expected to be a primary source of innovation for thriving businesses.

Indeed, according to a 2019 Grand Thornton report based on the answers of 378 senior finance executives from companies with revenue between $100 million and over $20 billion, CFOs will lead the way to the digital world.

If you stop for a second and consider things like the need to locate the right data, or to thoroughly evaluate and manage business risks and costs, it becomes clear to see that the challenges that CFOs face are far from trivial. In particular, for the CFOs' who aim to establish a differentiating competitive advantage for their company. This is why they seem ready to invest in emerging technologies like robotic process automation, which promise a quick and robust ROI.

The numbers speak: 25% of the CFOs questioned for a Grant Thornton report, have already implemented RPA throughout 2019 (as opposed to only 7% the year before). 23% of CFOs plan to invest in RPA during the next 12 months (more than double compared with 2018).

Challenges that CFOs could solve through robotic process automation (RPA)

We now list 8 challenges that CFOs face, and hint to how RPA may be of help in approaching them successfully.

1. Streamlining business processes

This is a crucial step towards the goal of rendering the finance activities that keep your company running, such as revenue management, cash disbursement, financial planning, payroll, accounts payable and receivable, record-to-report, etc., more efficient.

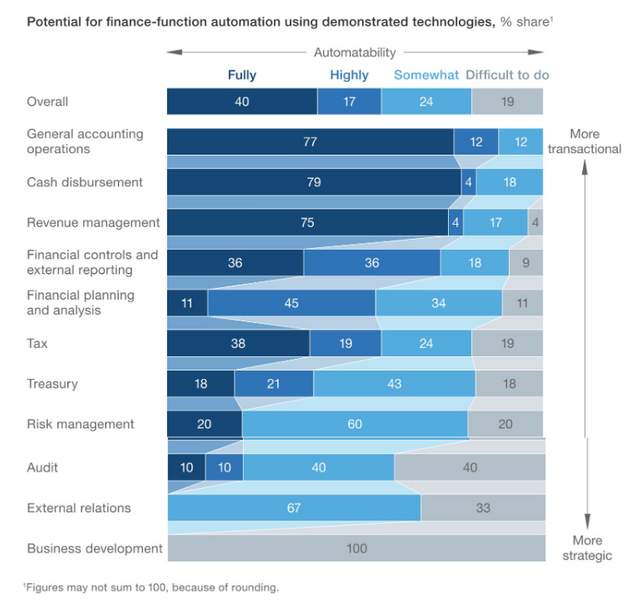

According to a report published by the McKinsey Global Institute, 40% of finance activities are amenable to full automation, and 17% can be automated to a large extent. Consequently, approaching this challenge by resort to RPA, and achieving the expected efficiency bonus via process simplification and establishment of standardized reporting mechanisms, seems to be the right thing to do.

Source: McKinsey Global Institute Analysis

2. Getting budget approval

Business proposals are often marred by vagueness when it comes to specifying the potential benefits, or a temporally anchored ROI. Robotic process automation facilitates putting together a strong business case, which shows its value for the whole company.

Don’t forget that, given their scalability, bots ensure enterprise-wide business process improvement. The RPA-assisted feasibility analysis increases the likelihood of getting the approval from those who join the budget meeting.

3. Managing productivity levels and operational costs

Talent management is also among the demanding duties of financial officers. By swapping bots for human employees for the menial, monotonous tasks, CFOs can get one step closer to optimum efficiency.

Use of performance support in the form of, e.g., in-application guidance, task automation, can assist employees in adapting to software novelties. This would decrease the risk of error and greatly improve productivity.

CFOs are also among those who can educate the human workforce about what software robots can and cannot do, allowing the employees to move beyond the unfounded myth of robots stealing people’s jobs.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cigen.com.au/cigenblog/8-challenges-cfos-face-can-be-solved-through-rpa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit