SAVING AND INVESTMENTS AS A FUTURE SECURITY

High income earning has become the wish of almost everybody employed on the basis of salary, wages and the self-employed. Some people earn high income while some gets little of what they wished for.

Both the high income earners and the low income earners has a future been anticipated for and there is a need for FUTURE SECURITY

What is FUTURE SECURITY?

According to me (anikys3reasure): Future security is described as an extreme preparation aimed at avoiding all kinds of threat most especially FINANCIAL THREAT in a moment yet to be experienced.

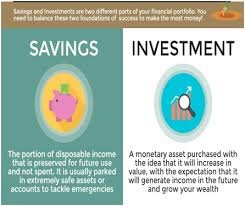

What is SAVING AND INVESTMENT?

Saving

Saving can be define as that part of a person’s income that is not utilize or spent either on expenditure or consumption. It is also a percentage of a person’s income that has been kept aside in a safe and reliable place for future use.

SAVING is a concept different from SAVINGS: SAVING is simply incurring more asset and SAVINGS is that part of one’s asset (usually CURRENT ASSETS: MONEY) kept in the bank or any other safe place for future use. source

source

Investment

Investment is defined as the allocation of assets (fixed or current) and other valuable resources including time, human and material resources with the sole aim of generating profit in/for the future. It is also the act of committing capital and engaging resources (human and material resources) into any legal business with the objective of getting a return (profit). In this context CAPITAL is said to be wealth, money or anything use in the day-to-day running of a business, WHILE BUSINESS is any legal activity engaged in by a person with the aim of making profit. source

source

Relationship between Savings and Investment

The main relationship between savings and investment is that, both are to secure the future .Benefits, Profits and Returns from both are for future use and the percentage (%) of income set aside for both are out of expenses and consumption pool. source

source

Differences between Saving and Investment

Saving are usually to meet short term goals, goals that are closer to a person , goals within a year ,2 or 3,Saving is strictly can a person can have access to at any point in time or moments of needs ,example of Saving is a savings account opened with a bank source which an ATM card is issued for accessing your money at any point in time, WHILE INVESTMENTS are to meet long term goals, In investment access to your money or capital is limited to a specified agreed time immediately you invest But Investment yield more than Saving.

source which an ATM card is issued for accessing your money at any point in time, WHILE INVESTMENTS are to meet long term goals, In investment access to your money or capital is limited to a specified agreed time immediately you invest But Investment yield more than Saving.

The Relationship between Investment, Saving and Future Security

Having known that savings are meant to achieve short term goals .It is adviceable that achieving your short term or nearest future goal ,there is a GREAT need for Saving either by opening a savings account or a pension account or any other means of saving money a person could think of .By doing this YOUR NEAREST FUTURE IS SECURED

Investing your money in any legal business e.g Buying of shares and stock,Buying assets(PROPERTIES) and selling them when their values must have appreciated (Increase in Value) over time more than the initial value you invested in buying them is certainly a FUTURE SECURITY

Dear Readers/Steemians

Both the low income earners and the high income earners needs a FUTURE SECURITY.jpg) source to avoid financial threat in the nearest and distanced FUTURE.A percentage (%) of your present income can be set aside for saving or Investment which will in turn YIELD a profit, Return or Benefit in the Future.

source to avoid financial threat in the nearest and distanced FUTURE.A percentage (%) of your present income can be set aside for saving or Investment which will in turn YIELD a profit, Return or Benefit in the Future. source

source

THANK YOU FOR READING THIS.

Authors get paid when people like you upvote their post.

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

Every wise person should engaged in investment and save for future purposes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks boss.... Watch out for The world's most moving and money making businesses today... Thanks to all steemians whom took their time to read this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Structured investment vehicles funds structuring invest in high-quality assets. The vehicles borrow short-term funds through issuing commercial paper, and then invest the proceeds in long-term assets. The funds are usually borrowed from money markets. This allows them to invest in the same assets as a bank, but without the bank's risk management. It also allows the SIV to profit from the credit spread between short-term and long-term securities. This spread is calculated and shared with the investment manager. Typically, the higher interest rate is 0.25% to 0.50% higher than the cost of funding.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit