Embracing a New Mind-set

In order for one to be able to build a portfolio of wealth, one would have to be willing to adopt to new ways and practices in their daily life. Financially free individuals are often perceived to have different believes, practices and habits from the norm. These key principles if being implemented accordingly to one’s life would enable them to build wealth rapidly.

Setting Goals

Achieving a desired amount of wealth doesn’t occur overnight unless one is luck enough to hit the Jackpot on the Powerball. Most people have stressed that they have wanted to be rich but have never quantified the amount that have been set to achieve. Research has proven that when one quantifies their goals, their probability of achieving them is much higher. For instance, if an individual sets a target of having a surplus of cash worth over USD 5 million by the age of 50 years old, he would be able to tailor his plans on achieving them when compared to somehow that says he merely wishes to have an abundance level of cash in his account.

Creating A Financial Plan

Once one has set their goals clearly, they would now have to lay the foundation in achieving their goals. For example, if John had set a goal of accumulating an additional USD 1 million into his savings account within the next 10years, he should now focus on finding the most effective way in achieving the given goal. Wanting to achieve an additional USD 1 million in 10 years time requires him to save approximately USD 100,000/year or USD8,333.33 / month. By breaking down the numbers, John would now have a clearer picture of the steps that he has to take in order to be able to achieve his goal. His goal could be either achieved by reducing his monthly expenses or acquiring new skills to be able to venture into a newer working area which enables him to demand for a higher pay.

Focus on Increasing Income

Apart from cutting expenses to be able to save more, one should always focus on increasing their income. There are various way as to how an individual could increase their income. The first method that employees resolve to would be by asking for a raise. According to SHRM, employees in the United States are able to see an average raise of 3% in their income for the year 2017. 3%? Yes, you heard it right!

The second means of increasing one’s income is by acquiring new skills and increasing their level of expertise in the given field. By acquiring new skills and experience, one would be able to venture into growing areas of demand.

Compounding Interest

“Compound interest is the eight wonder of the world. He who understands it, earns it…he who doesn’t pays it”- Albert Einstein.

“Someone is sitting in the shade today because some planted a tree a long time ago” – Warren Buffet.

The two proverbs above had definitely caught my attention.

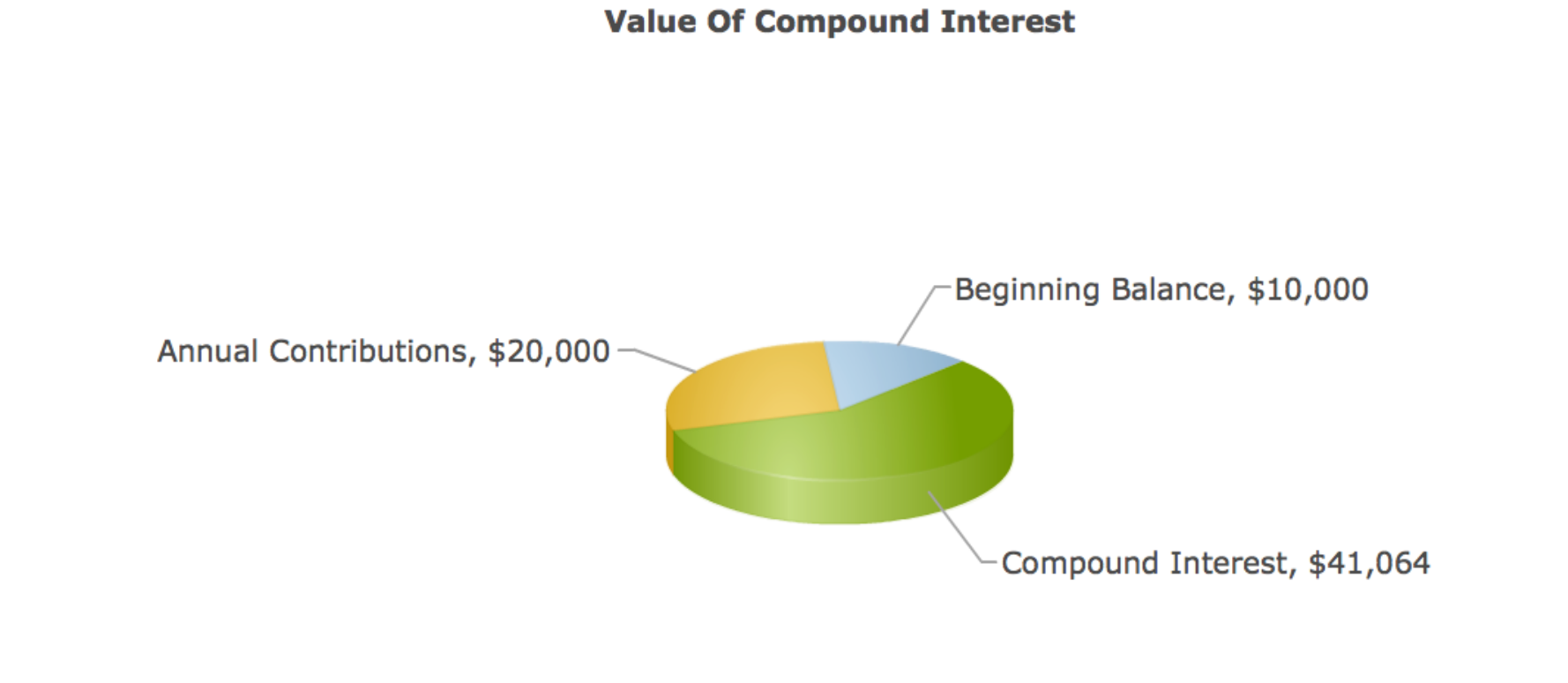

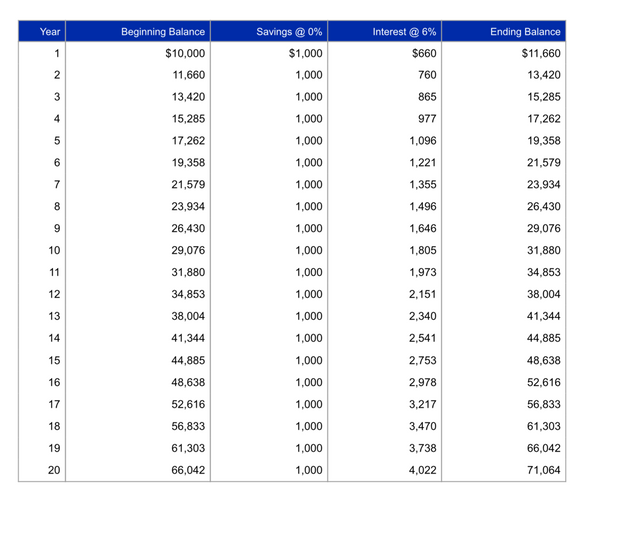

As seen from the charts above, compound interest is the difference between the cash that has been contributed to an investment and the actual future value of the investment. In this example, by just contributing $1,000/year with the annual contribution being increased by 0%/year (cumulative contribution of $30,000), one would be able to accumulate approximately $71,064 over a 20 year period. Want to know what’s attractive? You’ve earned over $41,064 in interest thanks to compounding!

Hence, one should start saving early with an aim of ensuring that compounding interest works to your advantage.

Investment

There is one other way of building wealth by undertaking the right investments. Firstly, there are various easy simple hack’s that one could take advantage of as a means of increasing your passive income. Firstly, choosing the right savings account with the highest interest rate would be the ideal step for anyone wishing to increase their savings. Investing in mutual funds are another asset class that investors could use with an aim of increasing their future returns. Experienced investors with a higher risk appetite could try to beat the returns of an Index Fund by handpicking stocks which may enable them to garner excellent returns! Types of asset classes and ways to undertake profitable Investments would be explained in another post!