Introduction

Applications in the area of decentralized finance are one of the most important fields of use for digital currencies today. With the help of convenient platforms such as Uniswap users can easily use innovative financial products based on Distributed Ledger Technologies (DLT). The digital currencies that are used for this purpose must be transferred to the respective ledger in which the desired financial instrument is mapped. Tokens used this way are temporarily “locked” and therefore cannot simultaneously participate in a staking protocol. The user has to make a decision, so to speak, whether he invests his money conservatively and safely by staking or more risk-consciously with greater possible profit using a DeFi product. With Savix a virtual currency is now available for the first time, which makes it possible to profit from staking rewards while keeping the token unlocked and liquid, freely available for use in any other DeFi product at the same time.

The Vision

Our main objective is to let users profit as much as possible from the new investment opportunities created by decentralized finance with as less barriers as possible. Therefore users combine multiple income streams while keeping full flexibility of token usage. The staking mechanism built into the Savix protocol works without any need for user actions. Users don’t have to lock their tokens and don’t have to claim their rewards since the staking process works completely automated.

Advantages for Currency Holders

Savix is the best collateral for decentralized finance because, it is

- Multi-Beneficiary

Since Protocol Embedded Staking (PES) allows complete availability of token usage in other DeFi products, rewards can be “doubled” using Savix. This way staking rewards are an extra Layer of passive income. The upcoming liquidity incentive program “Trinary” (see 7) will offer Savix holders another distinctive additional income stream.

- Convenient

Savix staking is embedded within standard ERC20 transfer functions and is fully automated and 100% passive with no need for user decisions or interactions to receive rewards therefore.

- Flexible

Savix is compatible with any Ethereum based DeFi project. Savix coins can be used like all standard ERC20 tokens for pooling, lending, yield farming, mining and so on, all this while continuously yielding additional staking tokens to holders.

- Fair

Savix protocol embedded staking evenly adjust all balances according to the embedded supply development curve (see 3). No preference whatsoever is given to any specific holder. All wallets are treated in the same way, independent of balances, transaction volume or other parameters.

- Transparent

Savix sources are open. All program codes and contracts are made available through Github and can be inspected and tested by anybody. Due to single contract deployment any manipulation of the contract logic or maximum supply is impossible, no minting of additional coins. Staking rewards are fully transparent and predictable.

- Stable

With Savix there aren’t any reward releasing events at the end of locking periods which could generate cyclical dumps. Except for market reasons selling Savix is never easier or more profitable at any specific point in time, creating a less volatility.

- Independent

With Savix you stay independent because the tokens always stay liquid while earning rewards (no locking) and can be freely moved or invested into DeFi products

These features are made possible by the unique Protocol Embedded Staking (PES), which implies the possibility of investing in highly profitable DeFi products with a predictable backing by conservative staking at the same time.

What Is Protocol Embedded Staking?

In order to realize the staking features mentioned above the staking mechanic has been embedded into the ERC20 protocol. The algorithm works by regularly inflating the total token supply according to a mathematical logic implemented into the smart contract. Account balances are defined by their individual share of the total supply thus guaranteeing a non-dilutive allocation of tokens. This way the relative staking profit is and remains equal for all accounts independent of size and user related parameters like staking duration, choice of staking pool etc.

The mathematical logic forming the basis of Savix’s protocol embedded staking follows the following characteristics:

Transparent supply calculation predictable for investors

Stability of the calculation towards user behavior and network effects

Effectiveness of the calculation regarding computing power and transaction costs

The Savix supply development curve is the best combination of these characteristics. Supply development is gradually defined by a sequence of straights (gradient) which determines the interest rate at a specific point in time. Start and end points (corner points) of these straights define the global shape of the supply curve. Each straight is defined by the equation:

F(x) = (Xt — X1) * [(Y1 — Y1) / (X2 — X1) ]

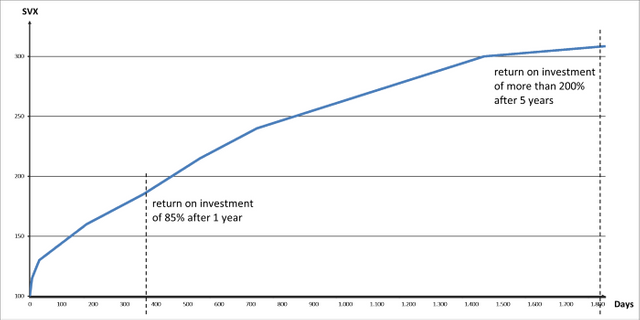

The following diagram shows the temporal development of a starting investment of 100 SVX.

This absolute transparency of temporal development of staking rewards leads to the fact that no special stimuli for token dumping arise at any specific moments, whereas common staking technologies require a locking of tokens often combined with a certain minimum locking duration. After locking periods the probability for sales of large token amounts is heavily increased. The Savix staking automatism does not stimulate any dumping situation of such kind.

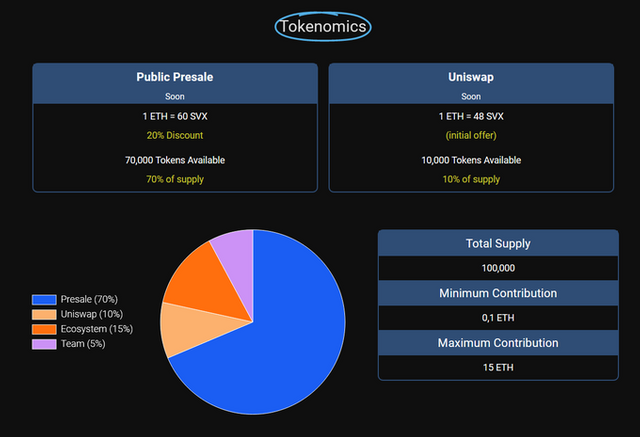

TOKENONMICS & TOKEN SALE

The introductory price of the SVX token at the market will be 50 SVX / ETH. A private sale will not be executed. Public presale will be spilt into three phases, each phase – and possible sub-phase – having different discounts and processors. The public sale will start at Uniswap first and then be extended to traditional exchanges for increasing the reach of the token.

Token Distribution & Budget Allocation

● 5% Initial Public Presale

● 20% IEO Launchpad

● 40% Unicrypt Presale

● 20% Uniswap Liquidity (Public Sale)

● 7% Ecosystem Fund

● 3% Bounty Program

● 5% Team

BUDGET ALLOCATION (ETH):

● 36% Uniswap Liquidity

● 7% Ecosystem Fund

● 30% Further Development

● 17% Marketing

● 10% Reserve

Token Details:

● Ticker: SVX

● Platform: Ethereum

● Token Type: ERC-20

● Available for sale: 70,000 SVX (70%)

● Total supply: 100,000 SVX

● IEO Price: 1 SVX = 0.0166 ETH

● Accepting: ETH

● Bonuses: 20% Discount

What Do We Plan In The Future?

We intend to integrate as many DeFi investment opportunities as possible in a simple-to-use Dapp for all Savix users. In our view, profiting from new way of income by decentralized finance should not stay reserved for users who are particularly tech-savvy.

Savix “Trinary” will be the first element of this Dapp demonstrating the power of ERC20 embedded staking:

Users receive ETH for providing liquidity on automated market making platforms (AMMs) like Uniswap. The more liquidity you provide, and for longer, the greater share of the ETH pool you receive.

GENERAL CHARACTERISTICS OF THE INITIAL PUBLIC PRESALE:

The presale goal is to raise a maximum of 83 Ethereum without a minimum. Savix is privately funded and already shows a working product with (internally) audited smart contract. Contributions of the initial presale will be used for next developments, external audit(s), marketing and partnerships.

Unsold tokens will be moved on to the next presale phases.

● Presale Exchange Rate: 1 ETH = 60 SVX

● Adjustment on Feb 4th 2021: Additional bonus of 10% (10SVX/ETH) taken from ecosystem fund

● Token contract address: 0x8a6e8e9f7d61e97bde7e66336dbeea4fcbb388ae

● Presale will complete on Feb 8th 2021 or when the maximum amount of ETH is raised.

● Minimum Contribution: 0.1 ETH

● Maximum Contribution: 15 ETH

Uniswap Liquidity Pool

Shortly after the presale we will list Savix on Uniswap for public trading.

● Initial Price: 1 ETH = 50 SVX

● Estimated Liquidity (Presale Goal Reached): ~ 800.000 – 1.000.000 USD (Depends on Ethereum volatility)

● Estimated Market Cap: ~ 1.800.000 – 1.900.000 USD

The Uniswap Pool will be locked for 6 month, long enough to build trust with the community. Locking the pool longer than necessary represents a certain risk to the liquidity in case the Savix contract needs to be updated or migrated in the future.

Roadmap

● For December 2020 the public token sale and start of the UNiswap liquidity pool is planned.

● Directly afterwards the development of the Savix trinary Dapp will start along with creating partnerships to other DeFi providers.

● Approximately in March 2021 a first Alpha version of Trinary should become available.

Key Notes:

The Savix project aims at making decentralized finance products available to non-tech-savvy users. The Savix token enables gas-free automatic staking rewards.

Learn more about the project:

● Website: https://savix.org/

● Telegram: https://t.me/savix_org

● Twitter: https://twitter.com/savix_org

● Whitepaper: https://savix.org/wp-content/uploads/2020/11/SAVIX_Whitepaper.pdf

● For documents and media see: https://savix.org/media

● Medium : https://anatol69.medium.com/

● Github : https://github.com/SavixOrg

AUTHOR

BTT Username: stevany025

BTT Profile: https://bitcointalk.org/index.php?action=profile;u=2458620;sa=summary

Telegram: @Awr_A

ERC-20 wallet: 0x8C5E2A7914Ca0Fa544206cA59Aaec790Cc7048eE