The lack of access to venture capital (VC) is one of the elements contributing to the conservative progress in the security token space. Most VC funds remain uncertain of how value is going to be accrued in the space as well as the regulatory climate. As a result, the early VC rounds in the space have been relatively small compared to other technology trends and only a handful of startups remain well-capitalized to face what seems to be a long development in the market. A few months ago, I published an analysis about what a potential “series A crunch” in the security token market that causes a lot of the early startups to capitulate and they fail to raise subsequent rounds of financing. My original thesis was solely based on the early VC skepticism and the difficulty of identifying winners in this nascent market. Many signs indicate that we have already entered that series A crunch period and now there is another factor that might accelerate it: the pivot onto security token networks.

The initial phase of security tokens was solely based on tokens issued on the Ethereum blockchain. That trend is likely to continue developing but has faced major roadblocks in order to attract support for large institutional capital and asset owners. Alternatively, the market has been slowly gravitating towards the creation of permissioned security token networks that enable the creation of issuance and exchange of digital securities among a constrained number of parties. Security token networks seem to be one of the most relevant trends in the next phase of security tokens and one that has severe implications on how capital will be allocated in the space. The emergence of security token networks is a manifestation of the constant friction between applications and infrastructure in technology markets.

The Pendulum Shifts Towards Security Token Infrastructure

The dual driving forces between infrastructure and applications is one of the regular dynamics in technology markets. Some phases of technology trends are driven by applications which push the boundaries of existing infrastructures until it forces the creation of new infrastructure capabilities. Other phases are dictated by infrastructure investments which will power the next generation of applications. Some tech markets such as cloud computing start as infrastructure driven while others like artificial intelligence begin with a focus on applications. Different markets at different times are governed by different dynamics between infrastructure and applications.

It is safe to say that the security token markets started with a strong focus on token issuances(applications) but has been confronted by technological and financial barriers. Those friction points have shifted the focus towards building more sophisticated infrastructures such as security token networks that support more sophisticated issuance and the onboarding of financial institutions. The next phase in the security tokens market seems to be driven by infrastructure and security token network will be at the forefront of it.

The thing about security token networks is that they are expensive to build and grow in order to build long-lasting network effects. Therefore, the companies embarking in this phase of the market need to be well-capitalized to navigate long, painful sales cycles that are more resembling of enterprise sales than crypto-tokens.

Who Will Be The Payers In Security Token Networks?

If security token networks are going to be one of the next big things in digital securities, the next logical question is to identify the potential groups of key players in the space. Based on the current market dynamics, there are different constituencies that are likely to play a significant role in the creation of security token networks:

· Well-Capitalized Security Token Startups: Some of the early platforms in the security token space have expressed ambitions to create a new generation of infrastructure based on security token networks. However, the group of security token issuance platforms that are well-capitalized to make this transition is a very very very small list.

· Tier 1 Blockchains: Non-Ethereum blockchains such as Corda, Tezos or Hyperledger Fabric are likely to launch solutions to support the creation of security token networks.

· Financial Institutions: Many financial institutions will participate as nodes in different security token networks but some others will venture into creating their own.

· New Startups: The emergence of security token network has the potential to foster the creation of a new generation of infrastructure-focused startups in the digital securities space.

· Libra: If Libra get passed the current regulatory uncertainty, it is likely to play a significant role as a network for digital securities. This will be the subject of a different article so please hold your hateful comments until then 😉.

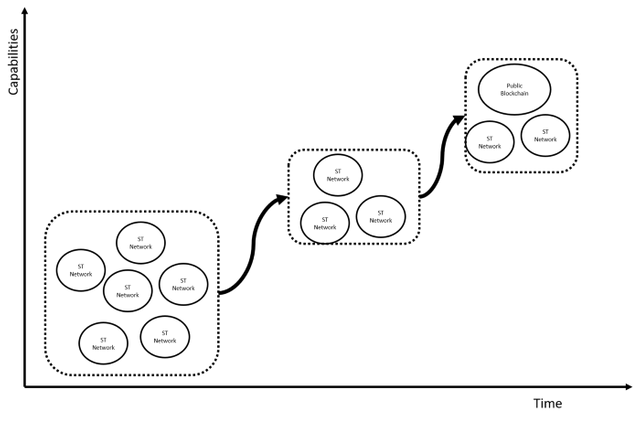

Fragmentation Now, Consolidation Later: Why Security Token Networks Are A Few-Sum-Game

As a market dynamic, the shift towards security token networks is likely to bring an initial wave of fragmentation into the digital securities market followed by a phase of consolation. Modern technology are typically fragmented at the application layer but rarely at the infrastructure layer. Think about the dominant cloud infrastructures (AWS, Azure, Google Cloud, Bluemix….) or mobile operating systems(Android, IOS…) and your list will be constrained to a handful of players. Both of those markets went thru phases of fragmentation before their infrastructure layer was consolidated. Something similar is likely to happen in the digital securities space.

In the next few months, the digital securities market could witness the launch of several security token network initiatives driven by the different groups of participants we discussed in the previous. However, the challenges of growing a security token network together with the length of the sales cycles and the inevitable improvement in public blockchains will drive the market towards a consolidation phase. For startups, remaining competitive during this phase goes beyond technology innovation and requires access to capital.

What Does That Mean For Security Token Startups?

The emergence of security token networks could become a disruptive force for the current generation of security token startups. The transition from issuance platforms to security token networks will not only shift the market attention to different segments but also the capital allocations. For venture investors, security token networks represent a play in which they can replicate the patterns of growing enterprise software companies. To transition into this new phase, security token startups will need to raise larger funding rounds which have proven to a challenging endeavor thus far.

If security token networks become a relevant trend, the digital securities market will start looking closer to an enterprise software market than to the crypto space. The limited capitalization of the current generation of startups means that the transition to security token networks is likely to reshape the entire ecosystem with only a handful of the current platforms staying relevant.

Originally written by Jesus Rodriguez