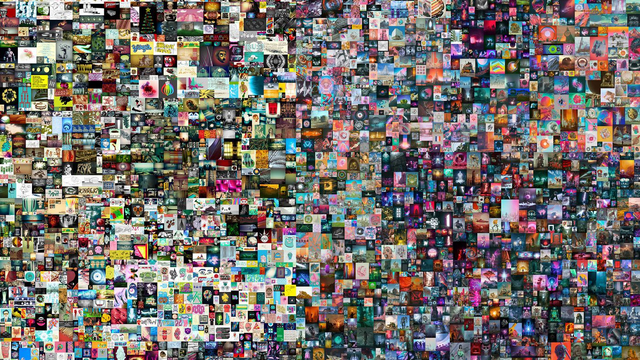

Beeple’s collage, Everydays: The First 5000 Days, sold at Christie’s. Image: Beeple

I’m sure if you have been following the news on finance you have heard two terms with infuriating frequency. Crypto, and NFT’s. Whilst Crypto has been dominating financial headlines for several years now, NFT’s are a new phenomenon.

A non-fungible token (NFT) is a unit of data stored on a digital ledger, called a blockchain, which represents an asset of financial value. The NFT certifies the authenticity of the asset it represents and is unique. Therefore, they are not interchangeable with other tokens. NFTs have gained recent notoriety with the $69.3 million sale by Christie’s of the above digital photo collage by South Carolina-based graphic designer Mike Winkelmann. The JPEG file’s maker, known to the art world as ‘Beeple’, is an undeniable trailblazer in the NFT market and this sale is of history-making capability.

With the recent $1.3 trillion plummet in the value of the cryptocurrency market, the question of how the digital currency realm can affect the value of NFTs becomes an interesting topic of discussion. Ethereum, a decentralized open source blockchain of which Ether (ETH) is the native cryptocurrency, is most commonly used to buy digital artworks as NFTs. Therefore, it is logical to conclude that the fluctuations of the USD price of ETH may have drastic implications for the NFT-sphere, as the appreciation of its value would make the price of the NFTs also soar — and vice-versa.

With a record-breaking dip in the combined crypto market value, how did this affect the NFT world? Dubbed a ‘mega-whale’ (a big player in the cryptocurrency world), NFT collector “Pranksy” revealed that the value of his crypto portfolio dropped by over $10 million since the crash. Despite this, he noted that he still regarded his 100,000-strong NFT collection to have the same value because he had not sold them. Perhaps this is indicative of the faith that NFT owners have in the market and in the possibility that its renaissance will appreciate the value of their assets.

This supports the theory that an NFT could be regarded more as a store of value as opposed to only an artwork. This means that the monetary value of the NFT eclipses its significance as a piece of art, with the latter becoming redundant if its numerical worth is all that is considered by the owner. This begs the question of whether it matters if the NFT is art-related, as it may just be a way of embellishing an entry on the blockchain with acclaim.

Whether an NFT is a store of monetary value, or art to be enjoyed no matter the state of the cryptocurrency market, a recent spike in transactions on the Ethereum network due to an influx of panic sales has also caused gas prices to rise. This refers to the fees incurred when data is added to the blockchain.

However, Co-founder of NonFungible.com, Gauthier Zuppinger has claimed that the NFT market is increasingly uncorrelated with the cryptocurrency market. He states that he predicts no change in the NFT space even if cryptocurrencies continue to plummet, concluding that even crypto-rich investors could see NFTs as less risky an investment than cryptocurrencies because they are backed by the use-case.

Therefore, unlike currencies such as Bitcoin or Ethereum, NFTs are an asset that uphold their value: they are artworks, to be treasured and pondered upon, the stuff of poetry. As graffiti artist Banksy famously said: ‘Art should comfort the disturbed and disturb the comfortable.’ It is safe to say there is no lack of discomfort given the current ailment riddling the cryptocurrency market, whether NFTs are kept as indicators of value or new-age artworks.

What do you think? Does the long-term value of NFTs depend upon the value of cryptocurrency market? Find out more about us in our article, or visit our website: Tokenise.io