ICO Sharpe Capita — Crypto Dividend Equities Fund https://sharpe.capital/

Many have yet to realise it in the crypto space, but the fund tokens are long term game changers for those with enough nous to grab and play long. These tokens have a twin fold growth rate, based on

The net gain % reinvestment into the pool, through the funds upscaling methodology; trading, ai, arbitrage, predictions etc.

The growth rate of the crypto market capitalisation, thus building the value of underlying crypto fund reserves

(Potentially there is a triplet — being speculative play; should the token in question, also gain value)

Sharpe Capital hits all the boxes above with its investment capital fund, but Sharpe is actually a great deal more, in this article we will dig through this ever expansive FinTech Offering.

What is Sharpe Capital?

In its most simple explanation Sharpe Capital is a blockchain based fund, balancing crowdsourced sentiment with machine learning algorithms to maximise returns on the global equities market. Using this merged system of predictive economics, Sharpe plans on collecting the best asset sentiment in the world.

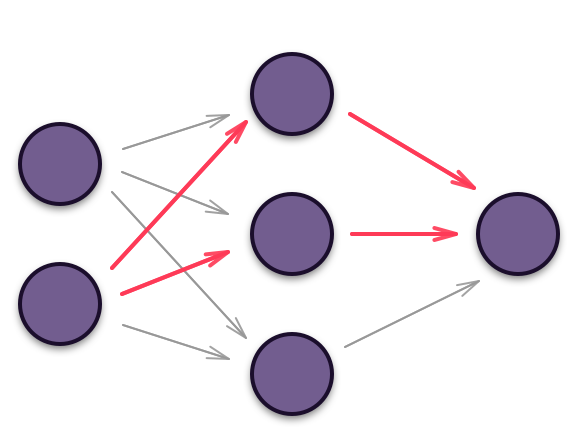

Merging Crowd Sentiment & Machine Learning Algorithms

As the saying goes, 2 minds are better than 1, but what about 10, 50 or 1000 minds, all working towards a similar set of results? A number of studies have indicated the higher the number of participants in a prediction or estimation event, directly correlates to a increase in the median accuracy. One study highlighted by the Keio University states:

“Our findings show that the crowdsourced sentiment analysis in both paid and volunteer-based platforms are considerably more accurate than the automatic sentiment analysis algorithm”.

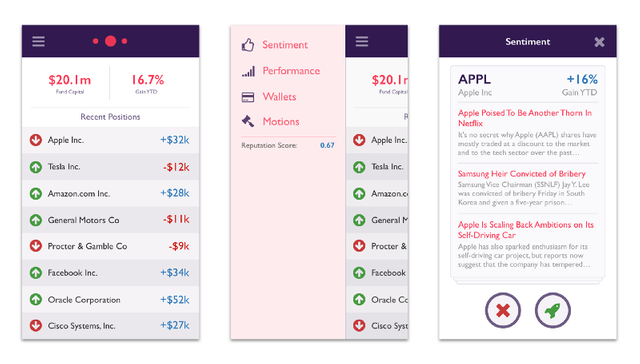

Sharpe Capital will be refining this group think with a rewards based mechanism tied to predictive accuracy. Following on from this, the SC team have developed a model to merge this sentiment with advancing Machine Learning data, which will scan for patterns in financial data. Combining both the AI and crowd sentiment models will bring about the best of both worlds in the prediction sphere.

(SHP) Token

The Sharpe Capital token (SHP) is a utility used in the Sharpe dashboard. This utility grants holders a stake in community governance as well as voting right in the expression of sentiment inside equity investments. Participants will be rewarded with quarterly payments in ETH, based off their performance and (SHP) holdings. The total supply of the (SHP) token won’t be locked in until after the crowdsale, with the ICO price scheduled for a rate of 2,000 SHP per ETH.

(SCD) Token

Without a doubt, my favourite part of the Sharpe offering, is their plan to release a cryptoderiviative token (SCD). This is located on the roadmap for a release in Q1 2019 (Subject to regulatory approval) and will be allocated to (SHP) holders at a rate of 1–1 (sure to instigate a HODL effect). The (SCD) token will pay dividends based on the growth of the fund without prior knowledge of the global equities market. This offering is perfect for the typical crypto investor who wants to diversify holdings into other market segments. The first (SCD) dividend payment is locked in for Q3 2019.

(SHP) Leveraging Bancor For Continuous Liquidity

The team at Sharpe Capital will be linking up the (SHP) token with the Bancor (BNT) Protocol in the provision of continuous liquidity. Bancor will enable the SHP token an additional counterparty measure to facilitate the ease of buying and selling. This effort will help reducing market failures while overcoming the obstacle of illiquid markets found in emerging community economies.

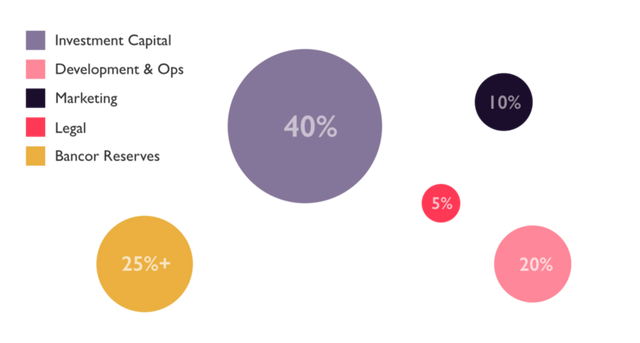

Budget

The Sharpe budget allocation will place the lions share of ICO funds into; Investment Capital and Bancor Reserves, giving the (SHP) token a backed asset basket and a more stable offering.

Team

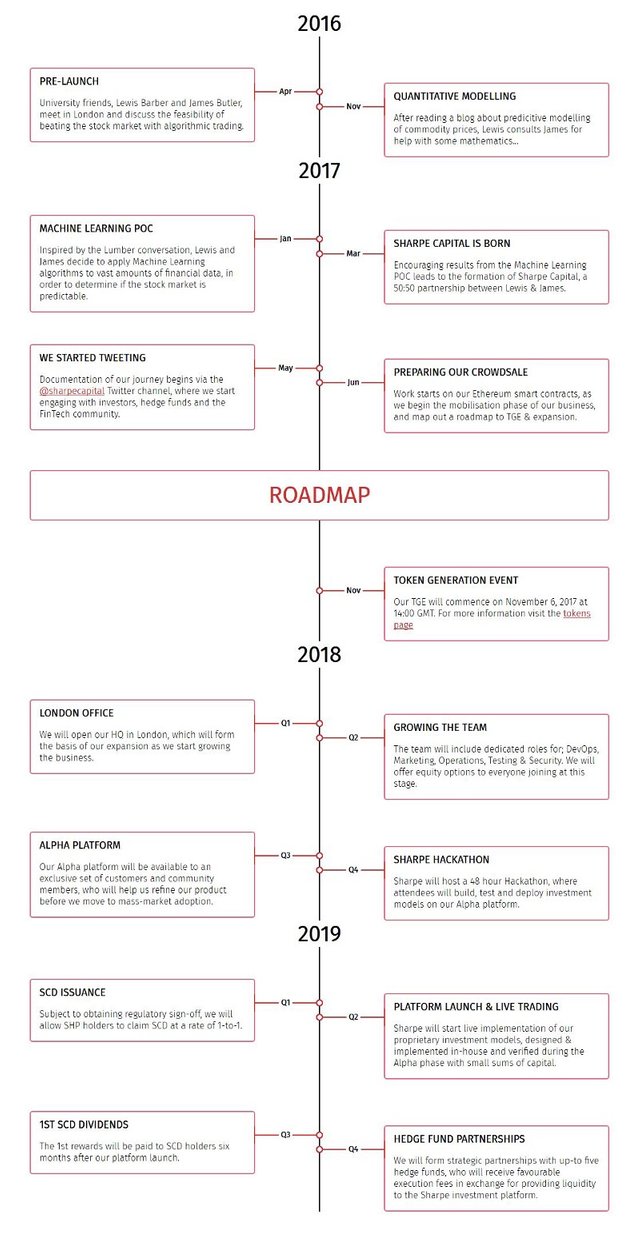

The inception of the project, came about when University friends, Lewis and James, met in London (early 2016) to discuss the feasibility of beating the stock market with algorithmic trading. Since then, the Sharpe Capital team has grown more than two-fold, collectivising a very bright bunch of individuals. The brainy capabilities of the team is evident in the Sharpe Whitepaper, which reads like a Harvard thesis. The team have backgrounds in a variety of fields, including; quantitative modelling, financial engineering and linguistic analysis. SC are eagle eyed for new team members that can add value to their offering and just recently announced a new Chief Technology Officer, and Lead Developer.

Roadmap

Some of the key highlights on the Sharpe Capital roadmap, include a release of the Alpha Platform, scheduled for Q3 2018, MVP launch w/ live trading in Q2 2019 and a dedicated push to partner up with hedge funds in Q4 2019.

Sharpe Capital Pre-Sale Locomotive

Whitelisting for the Sharpe Capital pre-sale has only been on the table for a nominal amount of time and has already smashed the 4M USD mark in pre-allocated funding. If Sharpe is basing its offering on crowd sentiment, the crowd sentiment for Sharpe is indeed, one of success.

Closing Thoughts

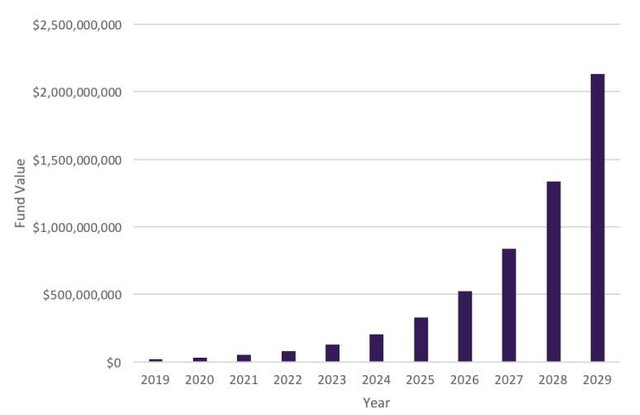

In closing, we’ve only just scratched the surface on the Sharpe Capital offering. SC is in a great pioneering position to capitalise on early crypto adoption, particularly with its offering targeting the ‘big money’ traditional markets niche. The fund is positioned well to scale exponentially with its modelling and reserves. While I am a wee bit nervous on the future of traditional markets, I know the team has the AI insight as well as the crowd wisdom to transition to a crypto based predictive fund should red flags of a financial event be waving. With the ever increasing crypto market cap tied to a pool of growing funds, Sharpe Capital could be the type of fund you could live off in 5 years time. Some may consider this far out speculation, but I would rather speculate on a dividend fund, than just speculate. Whitelisting for Pre-ICO now!

Thanks for reading awesome peoples.

[Disclaimer: please do you own due diligence when investing and don’t solely take my point of view as the only angle. I highly recommend everybody dig through the projects bitcointalk, reddit and team linkedin profiles to help formulate your own opinion — I thank you so much for reading and wish you successful dividend returns]

Ryan Jorgensen | Stock Photographer | Blockchain Nerd

Twitter: @CryptoDividends

Website: http://jorgo.photography/

Crypto Dividends focuses on the niche blockchain business models that generate passive income without the need to sell or speculate. We seek to discover and promote the best dividend yielding cryptos.

cryptobits3

https://bitcointalk.org/index.php?action=profile;u=1043526

0xb101dC14C6012D4faC2025a8f1Cdd4Daf1D9F154