- "Moon? No Moon? Polo When?" A single-minded focus on token price does NOT serve the best interests of Crypto, Token holders and Society at large.

- There is no gap between the interests of Token holders as a class and those of Stakeholders and the broader society!

- #Crypto Governance deals on a daily basis with the most myopic, moronic, opportunistic, self-destructive, and pathologically asocial subset of Token holders.

- What is good for Token holders might be bad for other stakeholders.

- The proper goal of Crypto governance is NOT to maximize Token holder wealth.

...

Please take the time to digest these aphorisms. I will elaborate on them in further articles.

These aphorisms lead me to the hot topic of #Siacoin.

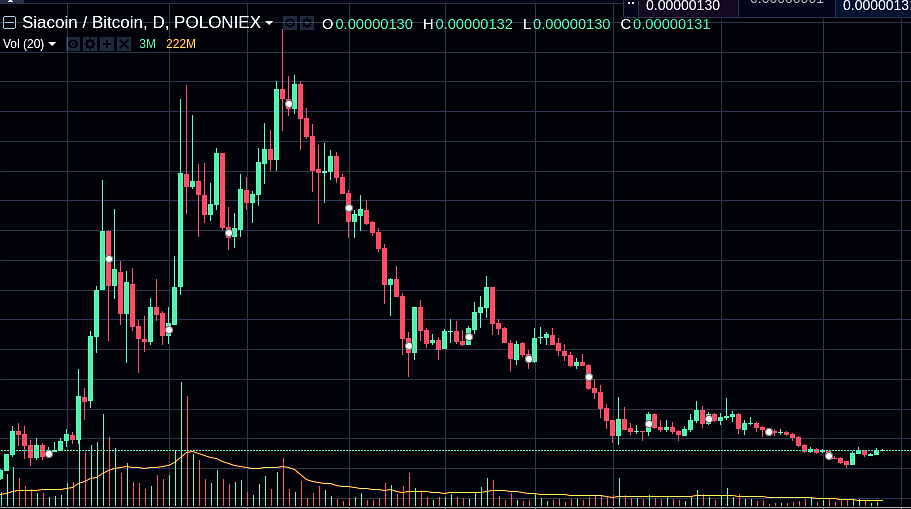

A lot of speculators - they have been very vocal - have recently been complaining about the declining price of the token, and have been implicitly or explicitly blaming the Siacoin team for this decline.

What Lynn Stout says in "The Shareholder Value Myth" can easily be applied to the world of Crypto.

You probably know by now where I am headed but I will keep writing anyway :)

The Siacoin Team is under no legal or implicit obligation to prop up the price of the token, by releasing timely news items, for example, and to look after the interests of Token holders. Like it or not, token holders are on their own here.

The idea that the focus of corporate governance should be to maximize the wealth of Token holders is derived, mainly, from the work of economists such as Milton Friedman and Eugene Fama, who believed that "a corporation’s share price was always the accurate reflection of the enterprise’s worth", an idea that, with time, morphed into this other one: "The proper goal of a corporation was to boost its share value. [here, token value]".

The Shareholder Dogma is best illustrated by the work of people like Jack Welch, also known as "Neutron Jack", who went above and beyond in order to maximize shareholder value.

This idea, that the interests of token holders should come first, has created a bit of an unhealthy climate on forums, reddit and whatnot. On twitter, it is a bit of a painful read sometimes. Speculators clamor for news and rebranding campaigns a la Digibyte, hoping these will affect, in a good way since the opposite is definitely conceivable, the price of the tokens they hold.

And thus, Corporate governance (Siacoin team I am looking at you) has had to deal, as I wrote earlier, with the most myopic, moronic, opportunistic, self-destructive, and pathologically asocial subset of token holders. This cannot be easy.

As you know, certain teams buck under the tremendous pressure exerted by the Crowd. The Siacoin team knows how difficult it can be to resist a Crowd chanting for green Dojis. A Crowd is a scary thing when it is let loose.

“…if people crowd together and form a mob, then the dynamisms of the collective man are let loose – beasts or demons that lie dormant in every person until he is part of a mob. Man in the mass sinks unconsciously to an inferior moral and intellectual level, to that level which is always there, below the threshold of consciousness, ready to break forth as soon as it is activated by the formation of a mass.” (Carl Jung)

Listening to the call of the Crowd leads teams to re-allocate resources in a non-optimal manner - in order to keep things "exciting" for speculators. This is all very short-sighted and "dialectical" in nature as pleasing the Crowd, which is always hungry for more green Dojis and cannot be satisfied, sometimes turns out to be detrimental to other stakeholders and the Crowd itself.

I will elaborate more on this theme in future articles :)

If you liked this very short article, you can choose to support me as I plunge into the crazy world of Crypto Governance.

BITCOIN: 12s38XpWFGZnVpQ3Ye89cLDjzgKugBDExr

ETHEREUM: 0xac04ca8484076566791e4914a78f6aad107e26bd

RIPPLE: rPVMhWBsfF9iMXYj3aAzJVkPDTFNSyWdKy

...

References:

Le Bon, Gustave. "Psychology of Crowds.", Sparkling Books edition, 2009.

R. Straub, “Shareholder Value – A Theory that changed the course of history – for the better or the worse,” Drucker Society Europe, June, 2012.

Jensen and Meckling, “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure,” Journal of Financial Economics, October 1976.

Lynn Stout, “The Shareholder Value Myth,” Harvard Law School Forum, June 2012.

Yves Smith, “Maximize Shareholder Value” Myth, Naked Capitalism, May 2014.

Diane E. Davis, “Political Power and Social Theory,” MIT Cambridge, 2005.

Steve Denning, “The Origin of the World’s Dumbest Idea: Milton Friedman,” Forbes, June 2013.

Steve Denning, The Dumbest Idea in the World, Forbes, Novmber 2011.

Yvan Allaire, “Activist Hedge Funds: Creators of lasting wealth, What do the empirical studies really say? Institute for Governance of Private and Public Organizations, July 2014.