Guys, can you imagine that one day the bank stocks in the United States plummeted collectively to the point of bleeding, and they also sent the European stock market to collapse by the way!

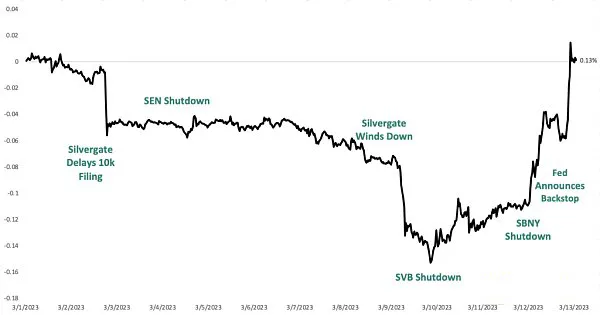

On March 12 local time, following the declaration of bankruptcy by Silicon Valley Bank, American Signature Bank was closed. According to a Reuters report, the New York State Financial Services Department announced the closure of the New York-based Signature Bank on the grounds of “systemic risk”, and the US government announced that it would provide guarantees for bank deposits to ensure depositors get back their funds.

Reuters pointed out that Signature Bank is the third largest bank to fail in the United States after Washington Mutual and Silicon Valley Bank.

Banks have been shut down by thunderstorms one after another in the United States, forcing the U.S. federal government to act urgently to prevent the “domino effect” from overwhelming the financial industry and even the entire economy.

Silicon Valley Bank: What happened?

The past week may have been the darkest period in the crypto industry at the beginning of the year. The price of Bitcoin fell below the important mark of $20,000 for the first time since January. The collapse of Bitcoin has hit the crypto industry one after another. Social media is full of words such as “financial crisis”, “Lehman moment”, and “crash”. Panic lingers in the hearts of almost everyone in the crypto industry.

However, although the crypto assets after the FTX collapsed under the double blow of the Federal Reserve’s 8 consecutive interest rate hikes and stricter-than-expected supervision, the SVB collapse has made the already sluggish crypto market worse.

Silicon Valley Bank Run, Fed’s Rescue in 36 Hours

March 9

SVB announced that nearly 91 billion US dollars of bonds in its core position will be affected by the rise in benchmark interest rates (prices fall); then it announced that it will urgently sell its bond portfolio worth 21 billion US dollars, which will bring 1.8 billion USD loss and seeks USD 2.25 billion in equity financing.

March 10

Silicon Valley Bank (SVB) was closed by California financial regulators on March 10. The California Department of Financial Protection and Innovation confirmed that Silicon Valley Bank was ordered to close, but did not specify the specific reasons for the closure.

The Bank of England (BoE) said SVB UK would “stop making or receiving deposits” as the central bank intends to apply to the courts to place SVB UK in “bank insolvency proceedings”.

U.S. depositors line up to withdraw money. By the end of the day, customers had attempted to withdraw $42 billion in deposits. Meanwhile, according to an unconfirmed report, the FDIC plans to cover 95% of uninsured SVB deposits, 50% of which will be paid within the next week.

SVB’s collapse came with incredible speed, less than 48 hours after management disclosed it needed to raise $2.25 billion in stock to shore up operations. Its stock price then plummeted, falling more than 60% on March 9, directly declaring bankruptcy and being taken over by the US Federal Deposit Insurance Corporation (FDIC).

March 11

The crypto industry began to panic. Circle had $3.3 billion in SVB, which directly led to the decoupling of Circle’s USDC stablecoin, with a loss of more than 10% of its value. The depegging of USDC led to a domino effect, which also led to the decoupling of several stablecoins. DAI, USDD, and FRAX were all affected. At the same time, the entire DeFi community was affected, and various whale wallets tried to withdraw funds from USDC.

March 12

Regulators in the US and UK began to act in response to the SVB debacle, with UK Prime Minister Rishi Sunak saying there were “immediate plans to secure the short-term operational and cash flow needs of SVB’s UK customers”.

Meanwhile, Bloomberg reported that the FDIC opened the auction process for SVB on the evening of March 11. Bidding closed at 2 p.m. ET on March 12, The Wall Street Journal reported.

March 13

However, things soon turned around. In just 36 hours, the Federal Reserve adopted an emergency rescue plan. In the early morning of March 13, US Treasury Secretary Yellen, Federal Reserve Chairman Powell and US Federal Deposit Insurance Corporation (FDIC) Chairman Martin Gruenberg published the joint statement stated that the FDIC and the Federal Reserve approved the FDIC’s resolution on SVB and will take actions to support deposits and prevent the broader financial impact of SVB’s bankruptcy.

The statement also said that losses related to SVB’s resolution will not be borne by taxpayers, although shareholders and certain unsecured debtors will not be protected, and senior managers related to the bank have also been removed from their posts. The administration is taking action to protect the U.S. economy by increasing public confidence in the U.S. banking system.

As soon as the news was released, the panic in the market was finally released, the encryption market ushered in a strong rebound, and the total market value returned to above one trillion US dollars. The price of Bitcoin and Ethereum both increased by more than 10%, and the price of USDC also returned to 0.99 seems to be lifted.

Summary

Bill Ackman, a well-known hedge fund manager, issued a document over the weekend that the US Federal Deposit Insurance (FDIC) must take action before the Asian stock market opens to provide guarantees for all bank deposits to prevent the spread of the SVB crisis.

But the problems of the US banking industry are still unresolved, and people’s concerns about the banking industry continue. Therefore, the Fed’s intervention will not be the end of this crisis, and we can only continue to pay attention to the follow-up events.