Craig Hemke is probably one of the smartest men that I have come to know (virtually of course) and I have immense respect for his points of view on financial matters especially precious metals such as gold and silver. I definitely recommend following his work through various channels.

Anyway, a couple of months back he mentioned that the stock markets gets triggered in a direct correlation to USD to Japanese Yen ratio (USDJPY) and Volatility (VIX). He mentioned that when USDJPY is up and VIX is down, the market goes up and vice versa.

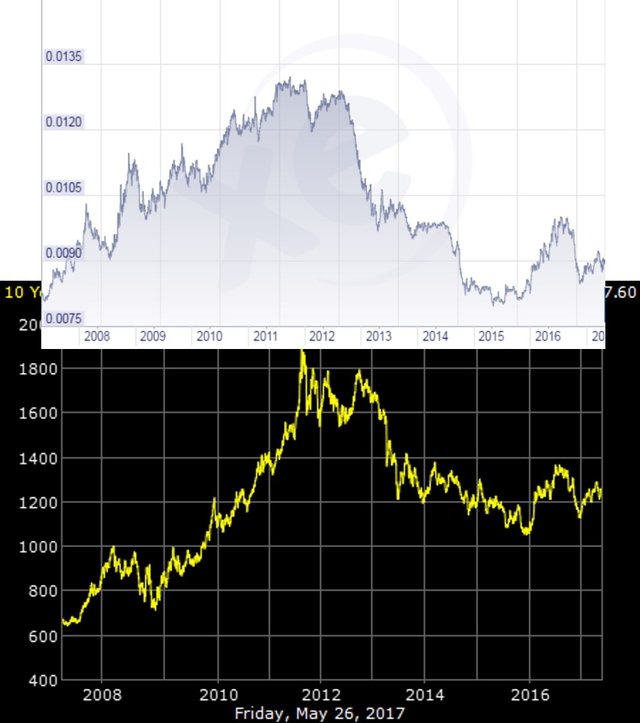

Just yesterday, by chance I found a sound bite from him, where he mentioned that if you invert the USDJPY then it is in direct correlation with gold prices. In other words look at JPYUSD (instead of USDJPY) to see where the price of gold will be for the day!! I got the data (two different set - currency and gold) and tried to superimpose one on another and I sure was star-struck! Have a look at the correlation yourself in the picture below.

Now, I am more of a silver person, simply because silver is going to get more interesting very soon and besides gold is for countries whereas silver is for people for storing wealth. So I found the charts and superimposed the two. Once you see it (see below), you will probably have the same breath-stopping feeling that I did.

Can there be any better way than this to trade silver?!

What do you think? Please leave your comments and don't forget to upvote and click follow.

Very nice, I also follow Craig's work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmmmm....something to ponder.

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit