Just this morning I wrote the blog about the turning point. If you haven't read please do before reading this blog. https://steemit.com/turning-point/@ajain/important-turning-point-today-june-21-2017

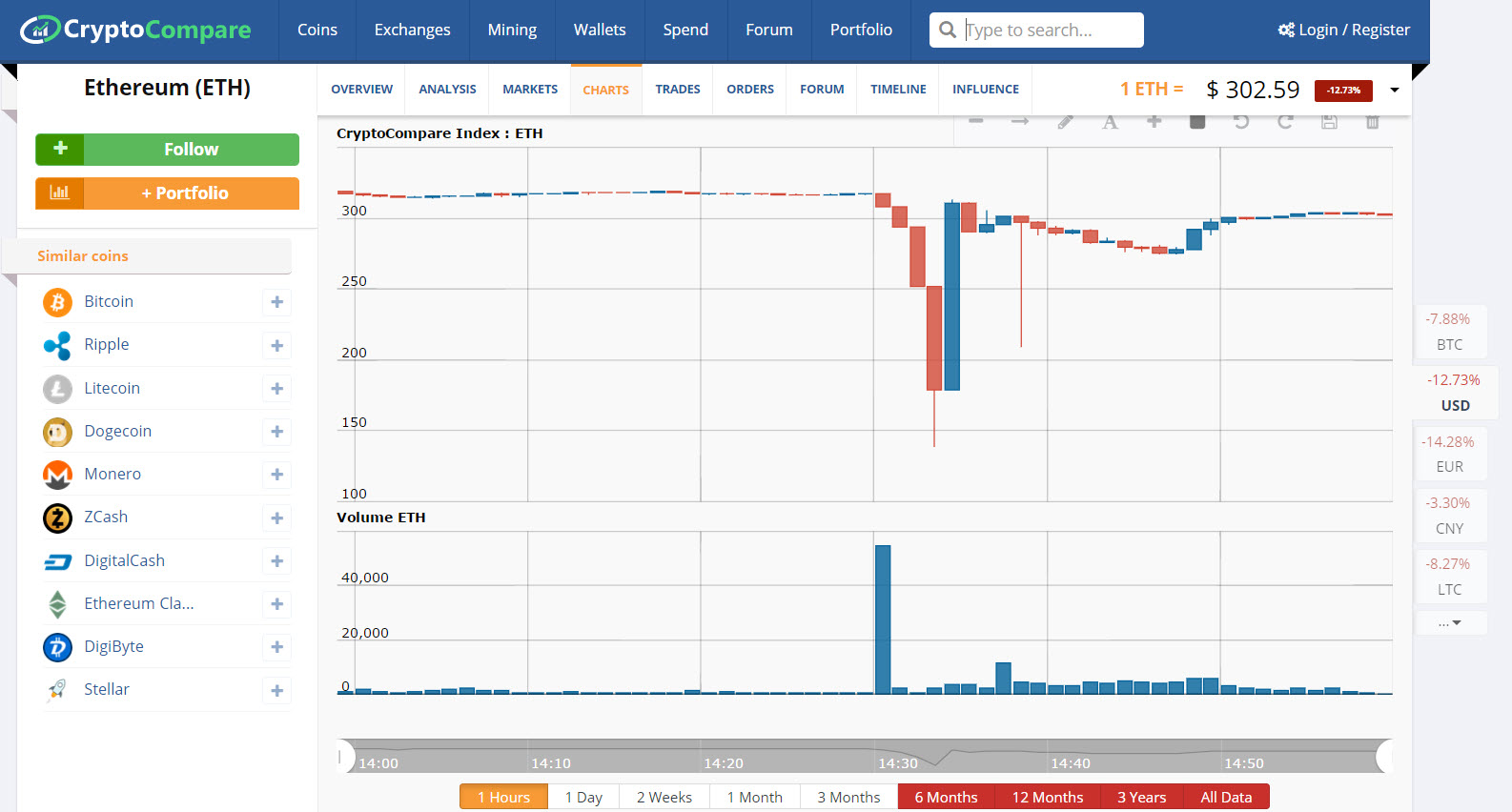

So look at the chart above and tell me if you notice something strange. Most people wouldn't have caught the movement today unless you were looking for this pattern. I was!

Ethereum dropped from $308 to $143 and then bounced right back.

So all those people who think cryptos can't be manipulated, please take a note. The emotional intensity for the cryptos is so high that it is far easier to manipulate it. The entire market cap is about $100 billion and that is a peanut amount of money for the cabal to be print. Compare this to $8 Trillion that is outstanding for delivery for gold and silver. So again, I am not against cryptos but merely am suggesting that be careful. The basic principle of trading is not to lose the principle. If you have made the money then you may consider taking your principle out and ride the way with profit. It would be a terrible idea to put all the eggs in one basket.

Please read my blog on Ethereum and Bilderberg connection. https://steemit.com/ethereum/@ajain/ethereum-will-be-the-best-performing-crypto-but-not-for-the-reasons-you-think-it-will

Stocks were marginally down (excepting Nasdaq) and gold was up - a turning point indeed. Silver closed just one cent lower and had turned 1 cent higher at one point - again a turning point. These dynamics will continue to be in play until the morning of June 26th. There will be fluctuations till June 26th. Currently, there is about 10 ton of delivery scheduled for Gold and the the futures buyers are not budging from their positions and want delivery. They have refused to roll the positions over even with a sweetened offer (yeah, these sweetened offers are available to institutional buyers and not for retail buyers). This amounts to $852 billion worth of gold and there is about $450billion worth of silver that buyers are demanding physical delivery. It will be very interesting to see how this pans out.

The reason that Nasdaq was up was not because suddenly there was love to be found. Nor because it was beaten badly last week. It was simply because traders panicked due to oil, bond yield and credit carnage which continued on today and they jumped on biotechs.

Caution: In your best trading interest do not have significant open positions (either long or short) until June 26th.

This is a repeat of warning from yesterday.

Oil was absolutely hammered today closing a full dollar below. I expect oil to below $40 (unbelievable, but that's what I am banking on). The pressure on oil is going to continue till August 25 and thereafter it may explode (explode may be a stronger word but has the sense of drama).

The drama is what we are going to see from August end/September beginning and if you are following my blog then I guarantee you the front row seats!

Great post, pretty educational. I should look into diversifying into precious metals.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit