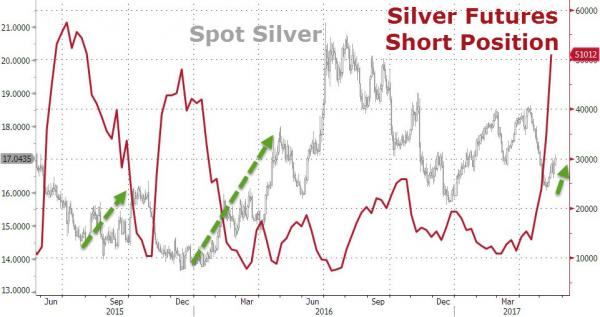

The so-called 'smart-money' has been piling into short silver positions in the last few weeks (creating the biggest hedge fund silver short in two years as of last week)... as silver rebounds from a record losing streak.

The last two times hedgies were this short, silver managed notable gains.

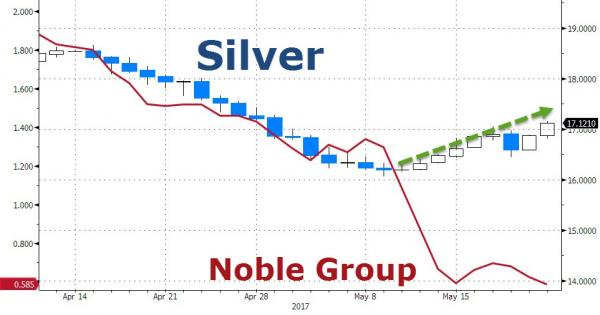

It appears that after a record-breaking streak of losing days - amid what may have been forced liquidations from Noble Group..

$16 has brought back the buyers (and perhaps Noble has ceased its commodity liquidations).

good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Funny, the hedge funds want to jump in on the Bullion banks' little scam and crowd on to the short side of the trade. The bullion banks, now that their trade is getting crowded, decide to get on the other side since they can move it wherever they want. That way they can mop up those shorts from the hedge funds. I call it (drumroll please) THE HEDGEY WEDGEY.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit