Today I wanted to talk about silver, how I decided on to aim at stacking 1,000 oz, and by what metrics do I measure the value of my silver stack. Also I discuss the importance of reimagining how you measure wealth, and at what point I might sell some silver.

In today's video I discuss:

- Why I stack silver,

- How I decided to stack 1,000 oz of silver,

- What is my plan with my silver stack, long term,

- When, why, and what would I sell my silver for,

- And by what metrics do I measure the value of my silver.

Measuring Wealth Wisely: How much SILVER do I need?

My Thoughts & Opinions on Silver:

In the linked video my main point is this, stacking silver is a wise idea, but knowing how you might eventually use it, and what things you would consider trading it for, is an important mental preparation that all stackers should walk through.

It's one thing to hold silver for the future, it's another thing to plan how you might put that silver to use.

Stop Measuring Wealth in Fiat Value:

I see a lot of YouTubers talking about selling silver at $50 or $100, or $1,000 USD, but what I am talking about today, is how can I put my silver stack to work for me, leveraging its value by moving into other things I want, as my silver appreciates relative to those other things like: gold, real-estate, and stocks.

Measuring Silver against Gold:

I am talking about reimagining the "value" of my silver, moving away from how much USD is to worth, into how many ounces of Gold can it buy me, etc.

Silver is undervalued compared to Gold today, and I expect that ratio to swing a long way back, favouring silver, resulting in the value of my silver rising in terms of what it affords, and that is when I would spend silver. My expectation is that I would start that process as silver:gold moves closer to 20:1, and perhaps I would finish that plan when its 15:1.

Historical Data: Silver to Gold

Silver compared against Real-Estate & Stocks:

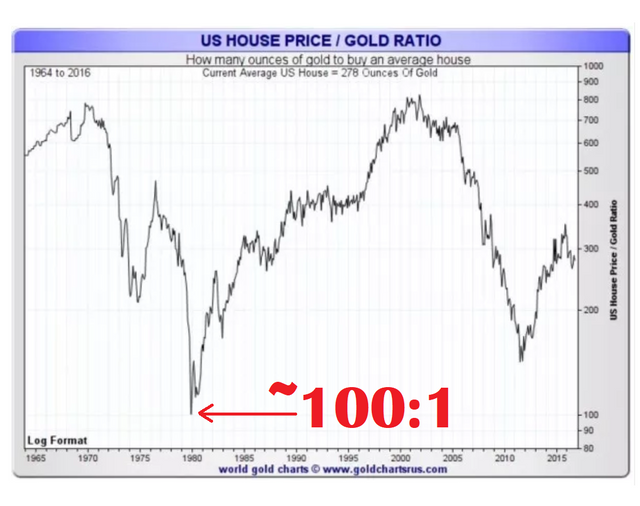

After that I would use my gold to move into real-estate, as that ratio moves closer to 100:1 (gold to real-estate), and also from gold into stocks as the gold:dow ratio approaches 5:1.

Historical Data: US Housing vs Gold

Historical Data: Dow Jones vs Gold

Conclusion:

I think silver is an investment in the future, a means to preserve wealth, and if you agree you should stack silver. Once you start stacking, you still need to plan your exit strategy because all investments cycle from bear to bull, and silver is no exception. There will be a time when silver is overvalued, at that time it will be wise to sell and move into undervalued gold, stocks, or real-estate.

That is why I have begun reimagining my wealth, not in terms of fiat value, but in terms of gold ounces, or real-estate acres owned, so that I can plan for a time when I might sell my silver to grow my affluence and prosperity.

Questions & Comments:

What do you think? Do you agree that silver should at some point be sold as the market shifts, or not? What, if anything, would you sell your silver for? In your mind how much is enough silver?

As always, thank you for your time and attention, have an awesome day and God bless.

Thank you for your continued support of SteemSilverGold

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you have a good way of looking at it. We can't really think about measuring in dollars because that's going to be irrelevant and meaningless. If silver is at $1,000/oz, will it really help you to sell if it costs $500/gallon for gas? Probably not. It might be a short-term fix if you're trying to get out of a bad situation, but if you're actually looking to preserve wealth, that's probably not the best way to think about it.

The silver to gold ratio is crazy high right now. I'm surprised that it hasn't started correcting, but it just means it's a great time to be picking up more silver. That's more stuff that we'll be able to trade later. It means being informed though. Because if we don't know that certain ratios are out of wack, then we're not going to consider getting those undervalued assets now so we can trade them later.

Good stuff, man!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @infidel1258!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 2.392 which ranks you at #17942 across all Steem accounts.

Your rank has dropped 9 places in the last three days (old rank 17933).

In our last Algorithmic Curation Round, consisting of 212 contributions, your post is ranked at #150.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit