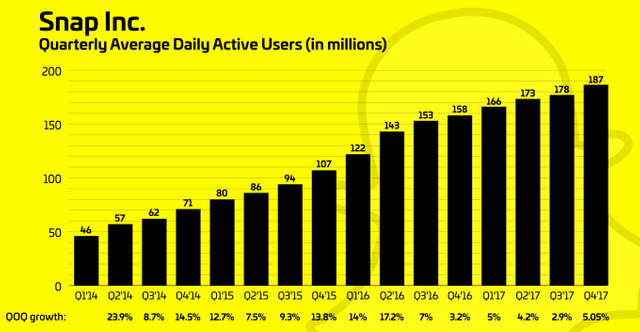

Snapchat is starting to turn things around, boosting its sluggish user growth rate and beating Wall Street’s expectations for the first time with today’s blockbuster Q4 2017 earnings report.

It added 8.9 million daily active users, to reach 187 million, with a quarter-over-quarter growth rate of 5.05 percent percent in Q4, compared to 2.9 percent in Q3. That translates to a DAU growth of 18 percent year-over-year, compared to Facebook’s 14 percent. Revenue was $285.7 million, up 72 percent year-over-year, with earnings per share of -$0.13 adjusted compared to estimates of $253 million and a -$0.16 adjusted.

Snap lost $350 million compared to $440 million last quarter as operating expenses grew to $261 million, but cash burn dropped to $225 million, down 49 percent from last quarter. That brings 2017 losses to a total of $3.45 billion. Still, Snap Inc. shares closed up about 1.52 percent, to $14.06 earlier today.

In after-hours trading, shares skyrocketed 26 percent immediately following the earnings release before settling at 19 percent up. Wall Street apparently loves to see Snapchat’s growth rate recovering after a long decline since Instagram Stories launched. Snap currently has $2 billion in cash left for hiring, expenses and acquisitions.

The rocky redesign shows potential

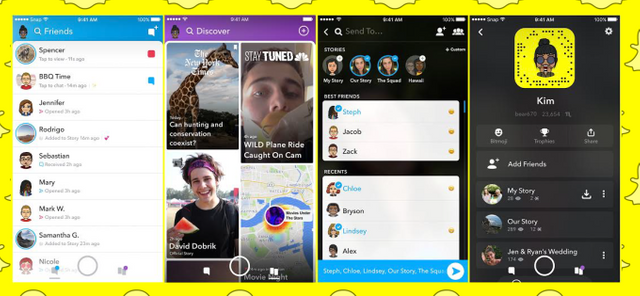

Snapchat’s big redesign will reach all users during Q1 2018, up from 40 million users currently. It was due to be fully rolled out by now but that has been delayed following poor reception in countries like the U.K., Australia and Canada. Amongst some of the first users to review the update, 83 percent of App Store reviews were negative, citing a confusing interface, ads mixed into the message inbox via Stories and people who don’t follow you back getting pushed into the Discover section. We’ll hope to hear more about Snapchat’s big redesign in the Q&A.

In the earnings report’s prepared remarks, Evan Spiegel acknowledges “it will take time for our 5 community to get used to the changes” from the big redesign. However, he says publisher Stories on Discover grew 40 percent compared to the old design, and core metrics are up disproportionately for users older than 35, showing the navigation simplification may be a success.

Ninety-seven percent of all Snaps sent on Snapchat are now created using the company’s camera. And each week more than half of all 13- to 34-year-olds in the U.S. play with Snapchat’s AR lenses. These stats prove Snapchat’s potential to monetize via sponsored creative tools for editing and adding augmented reality to their photos and videos. Meanwhile, Snap says it earned $100 million for its content partners in 2017.

Spiegel explained that improvements to Snapchat’s Android app performance boosted retention by nearly 20 percent compared to a year ago, showing a solid increase after the company neglected Android in its first few years. Snap is also working wireless carriers in a dozen markets to reduce the costs of using Snapchat via data discounting programs. Next, Snapchat wants to expands its embed system for bringing Stories out of its app so that Snaps can appear on stadium Jumbotrons and elsewhere.

Snap becomes a real business

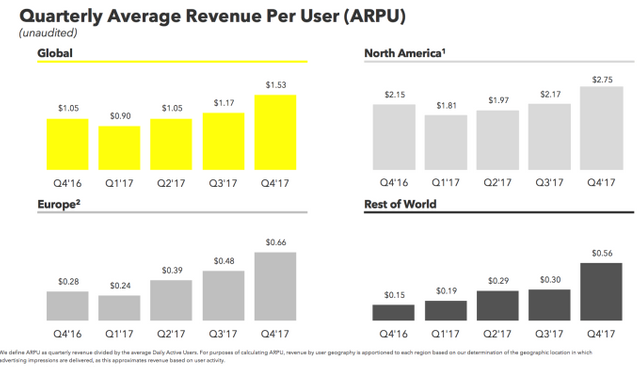

Investors are surely excited to hear that more than 90 percent of Snap Ads were bought programmatically, so the shift to an auction system that hurt ad prices is largely behind the company now. Snap is also getting more efficient, as average revenue per user grew 46 percent year-over-year to $1.53 as costs per user grew only 2 percent to $0.98.

Notably, ARPU in the Rest of World region of developing nations nearly doubled from $0.30 to $0.56. That shows Snapchat is figuring out how to serve ads over slower connections to older phones even though the app depends on data-heavy video. Total revenue in the Rest Of World region doubled just this quarter.

Snap Ad impressions were up 575 percent year-over-year and 90 percent quarter-over-quarter. App install ads performed especially well, showing Snapchat can deliver mobile gamers who keep playing rather than downloading and forgetting. Back in 2013, app install ads let Facebook build a monster mobile business, and now they’ve given Snapchat a big boost.

One blemish on the earnings was that Snap was mum on Spectacles sales in Q4 despite aggressive display advertising for the video glasses across the web. It warned that sales would be substantially down in Q1 2018 from the $8 million it sold in Q1 2017 — which was still disappointing. It appears Snap will have to win with software, or an augmented reality hardware device that does much more than put a camera on your face.

Hiring pace slowed significantly for Snap, with it adding just 100 employees at one-third the rate of recent quarters thanks to improved efficiency. Now that the business engine is purring, it needs fewer workers to drag it along.

Building Snapchat for everyone

Q4 was when Snapchat finally patched the hole in the bucket, improving app performance and retention, monetizing the developing world and changing its app to attract older users.

Looking back, Snapchat acquired adtech startup Metamarkets for less than $100 million in Q4, which could help it squeeze more revenue out of its existing users since the total number isn’t growing quickly any more. Snap also launched a new “hands-on augmented reality” ads where you can interact with a brand’s products. But we might need to wait until Q1 to see the impact of these on revenue. Snapchat is expected to generate $1.18 billion in U.S. ad revenue in 2018, up 83 percent over last 2017. That would give Snapchat a 1.3 percent share of the U.S. digital ad market.

In the meantime, Snapchat has been racing to release new features to keep users loyal despite the onslaught of competition from Facebook’s Instagram and WhatsApp. Snapchat launched Bitmoji 3D world lenses where your personalized avatar dances in your Snaps, and an augmented reality platform for geolocated art in Q4. Snapchat’s new Lens Studio for creating AR experiences has seen 30,000 Lenses created in the six weeks after launch.

Making Snapchat more competitive with its army of clones could be difficult as top talent keeps leaving the company. VP of product Tom Conrad, one of CEO Evan Spiegel’s top lieutenants left in January following TimeHop founder Jonathan Wegener and others. Today’s share price boost could make it more interesting to sought-after tech workers.

Overall, Snapchat is finding ways to become indispensable to users in the face of Instagram’s convenience. The momentum from this quarter could help it make the hires, acquisitions and confident product changes needed to entrench itself as the teenage messaging app while becoming appealing to those who grew up on Facebook.

Source: https://techcrunch.com/2018/02/06/snap-inc-earnings-q4-2017/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://techcrunch.com/2018/02/06/snap-inc-earnings-q4-2017/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i understand completely why they jumped, but man 40%?? That's a little absurd considering it's just an app with ads...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit