Content

If you do a 2020 review of cryptocurrency, several words such as DeFi, institutions, leverage, etc. will inevitably be repeated over and over again. The public chain seems to be no longer mentioned in 2020.

This is the last era of the public chain. We have listened to the term "Ethereum Killer" for 4 years since 2016, and we have seen it all. In the last round of bull market, most of the surging public chain projects on the market are determined to replace Ethereum, become a world-class operating system, and migrate Internet applications to the blockchain network. But now, they have all disappeared. Up.

The first-mover advantage of Ethereum is extremely obvious. There is no decentralized ecosystem that can rival the number of developers, users, and applications in the Ethereum ecosystem.

So, how should the new ecosystem catch up with Ethereum?

The answer is to use practical applications that really attract out-of-circle traffic. Solana is the best example.

Introduction of new users

Not long ago, the well-known travel application http://Maps.me announced the completion of a seed round of 50 million US dollars. Alameda Reasearch led the investment, and crypto venture capitalists such as Genesis Trading, CMS, and Sino Global Capital participated in the investment.

http://Maps.me is an offline navigation application that provides services such as route planning and map guides. In November 2020, the Russian Internet giant http://Mail.ru announced that it would sell http://Maps.me to http://Parity.com Group for approximately US$20 million. Data shows that this app currently has 140 million registered users and 60 million annual active users who are still strong during the epidemic.

The purpose of financing is the launch of http://Maps.me 2.0, and the core goal of 2.0 is to introduce 140 million new users into the decentralized finance of the Solana network.

As a representative of the new public chain, Solana proves PoH through work history, base station Byzantine fault tolerance, turbines (block propagation protocol), Gulf Stream (memory-free transaction forwarding protocol), sea level (parallel smart contracts), pipelines (verification transactions), Yunsan (horizontal expansion of account database), and archives (distributed ledger storage) and other 8 technologies have solved the impossible triangle problem that has always existed in the public chain field.

This team from giants such as Qualcomm, Intel, and Dropbox uses a global virtual clock that uses time to pass encrypted proofs instead of local timeouts based on local time measurements in each validator, reducing block time and reducing consensus information transmission Overhead, increase TPS and increase the number of nodes participating in the consensus. Solana's maximum TPS exceeds 50,000, and the block generation time is about 400 milliseconds. You can have Layer2 speed without Layer2, and the handling fee is negligible.

On average, the total handling fee per 1 million transactions is US$10, which is equivalent to only US$0.00001 per transaction. Compared to Ethereum, which currently requires dozens of dollars as a fee for any transaction to package transactions first, new users on Solana are almost equivalent to the Internet experience.

In the current global financial environment, the advantages of decentralized finance are becoming more and more obvious.

The Federal Reserve, the European Central Bank, and the Bank of Japan’s currency issuance have risen sharply this year. The Federal Reserve is the most obvious one. The US dollar issuance will increase by almost 90 degrees in mid-2020.

The interest rates of various central banks are also in a downward trend. The United States, the United Kingdom, and Japan have all used zero interest rates to stimulate the economy, and Switzerland has even adopted a negative interest rate strategy.

In contrast, the interest rate of the decentralized financial world of cryptocurrency is quite crazy. The emergence of liquid mining has made the development of the DeFi world far faster than people imagine. The ecological track is becoming more and more subdivided, including lending, trading, The fields of insurance and interest rate swaps are becoming more abundant.

What attracts most traffic is the annualized rate of return of DeFi projects. Not to mention the hundreds of annualized interest rates for certain DeFi projects, the deposit interest rates on mainstream DeFi lending platforms such as Compound and Aave can also reach nearly 10% annualized.

The Internet experience of the Solana network, superimposed on the high annual rate of return of decentralized finance, can enable more than 100 million young users of http://Maps.me to enter the DeFi world with the help of the built-in wallet and become Solana's on-chain users.

And http://Maps.me is just an example of Solana ecology introducing new users, and there are many similar projects on Solana.

The layout of the new ecology

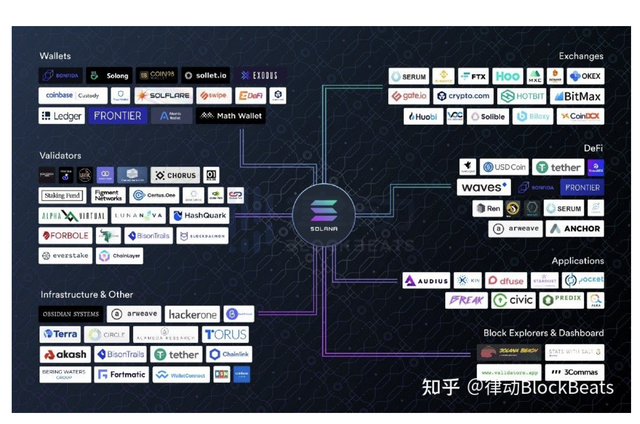

In the current public chain field, in addition to Ethereum and Polkadot, Solana's ecological development has also received more attention in the market. At present, the Solana ecosystem has covered DeFi, blockchain games and Web3 vertical fields, with more than 100 integrated projects, with a total transfer volume of more than 10 billion, ranking first in the industry, and its development speed has far surpassed other new public chains.

For example, in the most important underlying asset stable currency track in the DeFi field, Tether and Circle have announced in 2020 that they will issue USDT and USDC on Solana. So far, USDT has only 8 network support, and USDC has only 4.

The oracle field is also covered. Solana has been integrated with the oracle leader Chainlink, using Chainlink as the price data solution and standard for all Solana applications.

In addition to some other tracks already covered by public chains such as stablecoins, there are many unique ecosystems like http://Maps.me on the Solana network.

The decentralized derivatives trading platform Serum is the most watched ecology on Solana. While providing users with executable transaction prices, it allows users to experience a completely decentralized cross-chain transaction. It is based on Solana and will be integrated with Ethereum in the future. With the help of Solana, Serum has developed into a component that cannot be ignored in the DEX field, with a 24-hour trading volume even exceeding 8 million U.S. dollars.

The social platform Kin, which has 300 million registered users and completed $100 million in token financing in 2017, also migrated users to Solana last year and brought tens of millions of active users to this high-performance network ecosystem.

Human Protocol, which built the independent verification code service software hCaptcha tool, announced that it will launch a new service on the Solana blockchain. Human Protocol is a blockchain-based human-machine verification + AI data network, a protocol that allows humans to complete common tasks through tools such as hCaptcha.

Audius, a decentralized streaming media application with 800,000 active users and more than 150,000 songs, also announced that it will port its content management system from the Ethereum blockchain sidechain operated by the POA network to the Solana blockchain. Audius' status is similar to popular music players such as Pandora or Spotify, but the Audius platform allows artists to set their own terms. It also allows other developers to use its underlying content.

At the same time, for the use of the asset layer, Solana also launched its own cross-chain technology Wormhole protocol, which is a bridge between Solana and Ethereum, which connects the SPL token standard with Ethereum’s ERC-20, and circulates on Ethereum. The assets of Solana can also take advantage of the speed and low cost of Solana. In the window period when Ethereum's own Layer2 is not perfect, Solana gives Ethereum developers a new choice.

In addition to attracting high-quality projects, Solana is also involved in ecological development at the incubation level.

Eco Fund and Hackathon

On January 26, Coin98 Ventures, the investment arm of Coin98 Finance, a software company focusing on the deployment of the blockchain field, announced a partnership with the Solana Foundation to establish an ecological fund of up to 5 million U.S. dollars. The purpose of this newly established fund is to cultivate the Solana developer ecosystem in Southeast Asia.

A few days later, the Solana Foundation announced that it will jointly hold a DeFi-themed global hackathon with Serum. The winners will receive a prize of up to 400,000 US dollars, and the best 9 projects will receive 200,000 US dollars. At the same time, there is a chance to compete for a round of seed financing to continue to develop the project.

The emergence of ecological funds and hackathons will make Solana's network ecology more mature. This is a service that most public chains cannot provide, but it is essential for ecological development.

If you still have an impression, Blockstack, the world's first project that allows token financing through the US SEC, once launched a developer mining activity, selecting high-quality DApps every week and rewarding developers.

After several years of development, the ecology on Blockstack has already surpassed some of the current public chains with high market value. Just like the subsidy gameplay of the Internet App, such an operation strategy is visible to the naked eye for the improvement of the Blockstack ecosystem.

Similarly, the essence of the Solana Ecological Fund is also ecological operation. With the supplement of the Ecological Fund, Solana now has everything needed for a new application. The Ecological Fund provides developers with development funds, and the settlement of leading asset agreement projects is provided by developers. Infrastructure, network users provide traffic to developers.

The increasingly rich Ethereum ecology is a model for all public chains. These public chains introduce the original ecology of Ethereum through the high fees of Ethereum. In essence, they are equivalent to making the Layer 2 of Ethereum. But looking back at the development of the Solana ecosystem, it is actually far different from other public chains.

Since its independent online launch, Solana's ecological development speed has been visible. Not only is the DeFi ecosystem rich, Solana has also relied on the presence of traditional giants to attract users outside the circle, and has evolved a unique ecosystem different from other public chains in the industry. Solana's positioning of itself is no longer an Ethereum killer, but a decentralized solution that expands according to Moore's Law and provides high performance and low cost for large-scale applications.