Q1 for Spectre.ai concluded at the end of June 2018 and it did not disappoint! In such a speculative space riddled with scam tokens that have zero product or intention of delivering one, the Spectre team shows that the “proof is in the pudding” and delivered rock solid results. Let’s look at some of the facts.

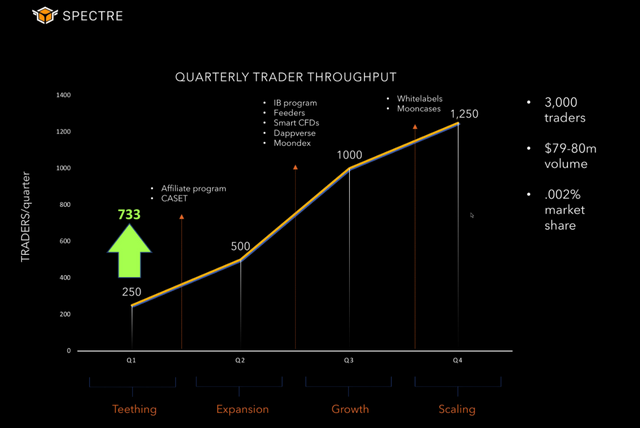

Total number of traders = 733+. This is nearly 300% more than forecasted in their Q1 guidance.

Liquidity Pool increased by 271 ETH, or 5%

Volumes traded since launch ~790k, or $250/trader/business day

SXDT dividends paid: 400+ ETH, steady weekly increase from 4–7 ETH

200+ ETH pending as end-of-year rewards

Fraud Incidents: 0

What a remarkable “teething” quarter by the Spectre.ai team. Not only did they crush their goals from a trading volume standpoint, but they also increased the size of the liquidity pool…this translates to increased end-of-year special dividends!

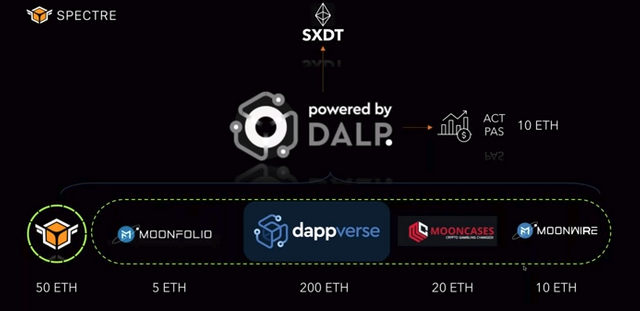

They are also continuing to crush it with their active and passive DALP participations, already booking 200–240eth in rewards for SXDT holders.

Finally, and equally important are the zero fraud incidents. Instilling confidence in traders is of the utmost importance, especially early in the platform’s life cycle. This is also equally impressive as we are in a new space that continues to see a plethora of hacks and security breaches. Kay has always said that security can’t be understated. Now he and the team are proving it.

Moving forward with Spectre.ai

As we head into Q2, the Spectre team has many additional features that they will be introducing to their users on the trading platform. These include:

Early Expiries: the ability to close a trade early and guarantee yourself some level of profit.

10 and 30 second Expiries: Spectre will be the first platform to ever offer such short expiries. Talk about an adrenaline rush as well as a volume producer!

Capital Recovery: this feature allows traders to recover up to 75% of their trade amount as a safeguard tool

Weekend Trading: Currently traders are only allowed to trade during business days. Q2 will see the launch of weekend trading, allowing for trading any day of the week. This should automatically translate to a 40% increase in rewards

New User Interface: A new UI is slated for release in September. Kay has said on numerous occasions that the new interface will be better than the old one in every facet and is of utmost importance if we wish to compete with the big boys.

These enhancements will add versatility to the platform and appeal to a wide range of traders. As an SXDT or SXUT holder, the important thing to take away from this is that each of these unique features will generate more and more volume on the platform. More volume = cha-ching!

Dividend Forecasting

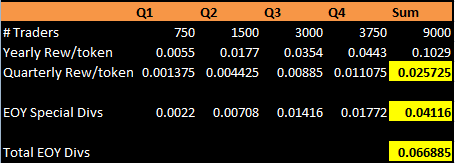

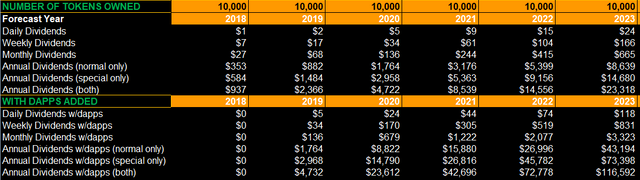

In the Q1 guidance webinar, the Spectre team offered the above forecast for Year 1. They anticipated a total of 3000 traders by end of the fiscal year. Since we had a 300% increase in expected traders during Q1, I think it’s time to look at a new forecast.

Assuming 300% growth across the board we would anticipate a total of ~9,000 traders on the platform at the end of year 1. When performing these calculations we must understand that we didn’t have 9k traders from the start. A proper forecast should be broken down by quarter.

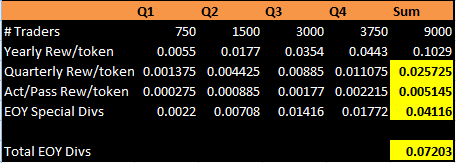

Doing some quick interpolation we can determine that SXDT holders would be looking at at making 6.7 cents per SXDT token by combining normal and special dividends rewards for Year 1. But wait, there’s more…

Looking closely at the above picture, we see that Spectre anticipates active and passive DALP participations will bring in ~20% of what the Spectre platform does on a weekly basis

Now we are looking at 7.2 cents/SXDT held. Remember, these are rewards solely from the Spectre trading platform combined with DALP participations. These figures do not include rewards from DappVerse.

Originally, DappVerse(DV) wasn’t expected to be released until 2019. However, Kay mentioned they are 6 months ahead of schedule and will be releasing their first game(Cryptoblast). This means that we can see DV as early as September.

Considering that the team believes DV will yield 4x more weekly dividends than the Spectre.ai trading platform, it isn’t unreasonable to deduce that we will see something in the range of 10 to 15 cents/SXDT token in year 1!

Currently SXDT is priced at 22cents. Assuming you buy today(disregard Q1 profits), then you are looking at a whopping 45-67% ROI. These types of returns are typically either not seen, or require years of company growth combined with an early investment.

The above figure is based on 9,000 traders after year 1, $250/trader/day, and owning 10,000 tokens. Certainly there is a level of speculation here, but there is no reason to believe this is un-achievable. For just a $2200 investment at current prices, that bottom row sure does seem appetizing!

If you are ever getting the itch to sell your tokens because you are making “less than a dollar” each week, take a step back and remember that it’s not about where we are now, it’s about where we are headed.

DappVerse: What’s to come

Above we see the team’s conservative three year forecast for weekly rewards and how they expect them to break down. We can see that the team also anticipates 400% more rewards from DV than they do from the Spectre.ai app.

Being 6 months ahead of schedule is a big win for both SXUT and SXDT holders. While it may take some time ramp up, Kay has provided plenty of leaks on a multitude of games that should be released over the course of Q2. There is no doubt in our minds that weekly rewards will see a very nice boost with the release of these games. Profits will be had!

Here are some very important takeaways from what Kay had to say about DV:

-Gaming developers are contacting him 8–12 times per day asking how they can get connected with the DALP, and that they see the concept as “revolutionary”

-Gaming boutiques are raising significant sums of money to create well polished shoot-em up games to be connected with the DALP(think Fortnight)

-In-app monetization will include both in-app purchases(think Candy Crush) as well as an in-game betting model. The combination of these two can mean serious returns for SXDT holders

-Sports/E-Sports betting could arrive as soon as early next year(Q4). This is massive for two reasons. First, betting in and of itself is a trillion dollar industry. Secondly and of equal importance, Sports betting may provide penetration and marketing into the U.S. There will be more details to come on this, but given the recent Supreme Court ruling regarding the legality of Sports Betting, it’s very possible that DV will be able to extend its reach to sports betters in the US market.

DappVerse is shaping up to be a game changer. Many developers are paid only a base salary for their work within a company. DV allows these individuals to monetize their own products and produce a steady flow of income. Developers are now allowed to dream. DV essentially takes itunes and offers an additional layer of in-game monetization with its betting model. With time, we expect to see massive interest from developers wanting to “plug into the DALP.”

Q2 and beyond: What excites us

We are full steam ahead as we finish up the teething phase and move into what is considered the “expansion phase.” This includes, but is not limited to: Whitelabels, IB program, CASET, CFD trading, and a ramp up in marketing.

CASET will be released within 2–3 weeks from the Q1 results webinar. A quick reminder on the importance of this feature. This will allow any user to get access to(and use) all applications that are connected to the DALP, by way of fiat…meaning Mr. Average Joe can now entirely bypass having to purchase ETH from an exchange, create a wallet, etc. CASET allows the on-boarding of fiat onto the platform. Being able to use fiat on the platform is absolutely crucial because it allows the team to target a much wider audience and ramp up growth in a much shorter time frame.

Kay has also mentioned that the team will be creating their own mini-games that will be available for play in Telegram channels. Those of you who have been in the Spectre TG channel have surely been exposed to these simple, yet addictive games. Creating a Telegram gaming bot will allow the team to advertise to an audience of over 100 million active users. This is an extremely clever way to generate interest in the product from those who may have otherwise never heard of it.

SpecDex: Spectre’s own decentralized exchange will provide benefits for SXDT and SXUT holders/buyers. This is important as those who use CASET would have most likely not have purchased SXUT from an exchange. This will improve the SXUT takeup factor which will have a direct correlation with price appreciation for the SXUT token. Having an in-house exchange should help with any liquidity issues that the SXDT and SXUT tokens currently suffer from.

Conclusions

Spectre has surpassed Q1 expectations by 300%

200+ ETH has already been generated for EOY special dividends

DappVerse is ahead of schedule: Expect 5–6 games to be released in Q2

New trading pairs and trading types will accompany an enhanced UI on the Spectre.ai trading platform

Kay and squad are bombarded by developers who are interested in DV. They are also in talks with a major gaming company.

Per usual, the team is meeting deadlines, being transparent, and showing results. We anticipate a lot of ICO’s will fail over the course of the coming year. SXDT has been a safe haven for investors, and once we fully ramp up there will be an insane amount of upward pressure on SXUT and SXDT prices. Our positive sentiment regarding the team and tokens has only increased as Q1 ends.

We believe there are exciting times ahead for investors. In an effort to be less speculative we will just say that we are still extremely bullish about the project and stand by some of the forecasts we made in part 2 of our series on SXDT.

Recall those projections only considered Spectre.ai and Dappverse projects. Kay and co. have shown that they anticipate Moonfolio, Cryptocases, Moonwire, and passive/active DALP participations to bring in nearly the same amount of rewards as the Spectre.ai platform(90% as much) on a weekly basis. One could possibly deduce that our forecasts from part 2 are on the lower side as we did not consider anything outside of DV and Spectre.ai in our calculations.

Cliffs: Sit back, relax, and prepare to accumulate those juicy weekly rewards!

This article was written by: @bluebarracudas2, and @Crypto_Pajeet please give them all the credits to them by using their referral link : https://www.spectre.ai/?ref=bjK42 and follow them on Twitter : @bluebarracudas2, and @Crypto_Pajeet.

Disclaimer: In no way this article is financial advice. They are not members of the Spectre team and are not being paid for these articles. Everything written here represents our their personal view and not that of the Spectre company.

link to original article: https://medium.com/@bluebarracudas7/spectre-ai-q1-results-and-analysis-8d8033cd568b

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@bluebarracudas7/spectre-ai-q1-results-and-analysis-8d8033cd568b

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit