Square’s decision to incorporate Bitcoin payments into its app could be a real cash cow for the company according to Wall Street firm Credit Suisse. An analysis from the firm believes that a $30 mln revenue bump is completely possible in the next two years.

Square recently announced a rollout to a limited number of customers, using pooled wallets to allow Bitcoin payments without the current high fees. This news sent Bitcoin’s price tearing towards $7,000 about a week ago.

This high-level adoption from a major payment app is both a positive for Square, who are taking the plunge, but Credit Suisse see it as an even bigger win for the crypto-asset industry.

.jpg)

‘Confers legitimacy’

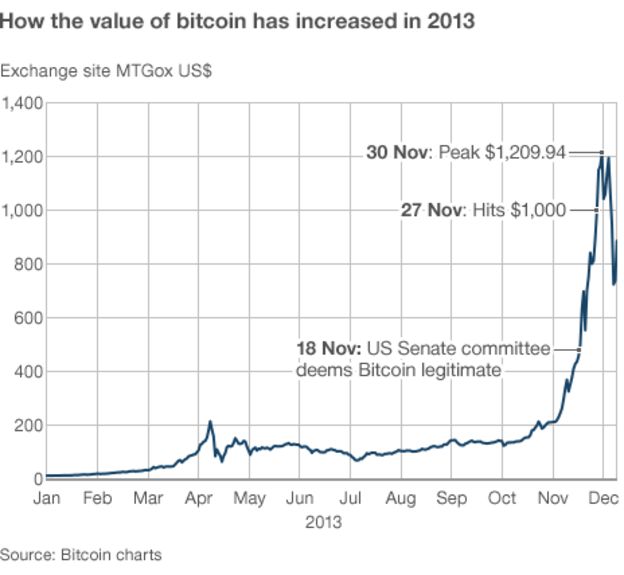

There have been some recent barriers that Bitcoin has broken, leading to new all-time highs almost daily. In terms of adoption, the other big news was that CME announced it would be offering Bitcoin futures soon.

Now, with a payment app like Square joining the party, aiming at streamlining Bitcoin’s possibility to be a functioning currency, there is further legitimacy being placed in Bitcoin especially among traditional companies and investors.

"While we are positive on Square's strategy, to the extent it confers legitimacy on Bitcoin and prompts adoption by other providers the biggest beneficiary may be the crypto-asset industry," Credit Suisse analyst Paul Condra said.

.jpg)

Big boom coming

Doing a little predicting of their own, Credit Suisse added that they believe that if Square can accumulate a good amount of users, they will be turning over a lot more revenue.

"We estimate that if Square can accumulate 10 mln Bitcoin buyers over two years, this could drive an incremental $30 mln in revenue," Condara added.

Condra said the company may charge a fee of 1.5 percent per transaction and the average customer could spend about $200 a year in Bitcoin purchases, according to his estimates.

Seeing if it’s real

Square’s CFO, Sarah Friar, in their own way, are listening to the growing noise that is coming from the regular consumer. She explains that their foray into Bitcoin is still an experiment, but it is driven by demand.

“The only way to get people invested in figuring what is the what of something new is to create a product and get it out there,” Friar explained. “We spent a lot of time listening, and what we heard from our customers is individuals, using Square Cash to make payments, saying they want an easy way to buy and sell Bitcoin, so we are doing an experiment to say: ‘okay, is this real?’”

Things look positive already for something that is meant to be just an experiment. But the attitude of Square could see them extend the experiment if things continue on that path.

Then, there could be further adoption as many companies are adopting a ‘wait and see’ approach. If this becomes a success, as Credit Suisse is predicting, it could spark off a much bigger adoption wave for payment networks to utilize Bitcoin.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/big-things-in-squares-bitcoin-future-credit-suisse

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit