Aussies are slowly but surely trying to move away from 9-5 jobs and pursue their dreams. It is not weird that there are more and more jobs available, people quit because they start to realise that life and living are limited and they deserve better or more than an office or factory job. The drawback is that it is not easy to achieve a life where working is optional.

Cryptocurrencies have a unique way of allowing investors to earn passive income while they sleep. Warren Buffet, the CEO of Berkshire Hathaway and one of the richest men in the world, has said that it is essential to find passive income streams to provide you with a life where you can both work hard and do what you love. I found cryptocurrency and am teaching you how to do the same!

The Top 3 ways to make passive income with crypto!

The following are some of the safest common passive income investing options. There are several others available, and you may want to explore these options on your own. I do not count pyramid schemes or Ponzi schemes as viable, so I did not include them in this list.

1 - Staking blockchain coins.

Risk level: Low

Average Return - 3 to 20%.

What is staking? Staking (also called forging) is a term used in the crypto world for nodes that are running to confirm transactions. They do this by competing for the right to validate new blocks, based on their amount of coins, and transaction history. The more coins you have (your stake), and the longer your coins have been in your wallet, the more likely you are to mine a block.

Staking often has less risk than other options, and can offer the highest yields. Here's an overview of some of the coins with the greatest staking rewards through the Australian exchange CoinSpot.

Algorand (ALGO) - 8.5%

Avalanche (AVAX) - 6.9%

Axie Infinity (AXS) - 7.8%

Binance Coin (BNB) - 5%

Cardano (ADA) - 5.1%

Crypto.com (CRO) - 11.1%

Cosmos (ATOM) - 10.9%

Elrond Gold (EGLD) - 12.1

Fantom (FTM) - 4.2%

Polkadot (DOT) - 12.5%

Solana (SOL) - 6.6%

Terra (LUNA) - 8.1%

Tezos (XTZ) - 4.2%

Tron (TRX) - 5.9%

If you're looking for safe, low risk and consistent yields, cryptocurrencies that offer staking rewards should be your first stop.

Any users reading this that have a Coinspot account and want to stake your Crypto assets check our blog on how to stake with coinspot.

2 - Yield farming with USD stable coins

Risk level: Low

Average Return - 1 to 20%

Most DeFi protocols offer nice yield generating options for your stablecoins by lending them out to other investors. These protocols essentially use your funds in contract interactions similar to a Flash-loan. The rewards on these options usually differ per volume or use of your funds, and if you are getting any yield rewards in the form of the platform's native token.

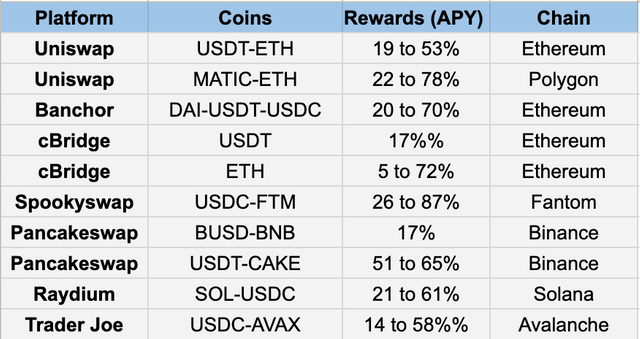

The rates are often different from platform to platform, and some even have additional features that can increase your yield. These investments are low risk because the stablecoins can’t go down in price. However, if you’re using DeFi you need to take smart-contract risks into account. The table below shows some of your options and their yields.

3 - Providing Liquidity

Risk level: Low/Medium/High —

Average Return - 5 to 500%

DeFi and decentralised exchanges would not exist without liquidity pools and Liquidity Providers (LPs). LPs provide assets on both sides of the pool — 50% in USDT and 50% in ETH. The fees earned are proportional to the amount of assets contributed. Liquidity pools generate higher yields but they also expose investors to more risk, such as impermanent loss. When the prices of the assets start to rise or fall, investors must decide whether to hold the asset or provide liquidity.

It's important to do your homework before investing in these pools. When providing liquidity, you should consider the following risk levels.

High-risk, high-reward pools are bound to two assets on both sides. Medium-risk, medium-reward pools require only a stablecoin on one side, and an asset on the other side. Low-risk, low-reward pools are bound to one asset on one side, and stablecoins on the other side. Below are some of the different options!

Source: Crypto Buy Guides