The major part of funds attracted in the second round of ICO will be allocated to form one of the key components of the corporation — the Zodiaq Economic Stability Trust (ZEST).The main goal of this Trust Fund is to ensure profitability for the token holders.

The major part of funds attracted in the second round of ICO will be allocated to form one of the key components of the corporation — the Zodiaq Economic Stability Trust (ZEST).The main goal of this Trust Fund is to ensure profitability for the token holders.

How does it work?

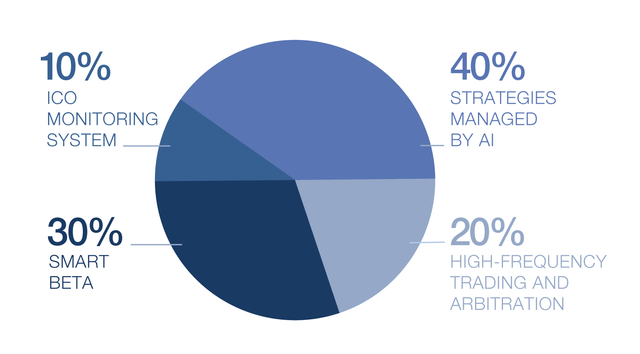

The ZEST hedge fund, in which management of assets is based on the methods of big data analysis and deep machine learning, invests in cryptocurrencies, digital assets and related production tools in order to reduce the overall volatility of the portfolio and minimize the market risks.Our goal is to create an actively managed investment portfolio, that will produce in the long run better incomes than the ones from passive investment in cryptocurrencies. For this purpose, the assets of the fund will be divided into four parts, each pursuing a different investment strategy:

30% — Smart Beta

Smart Beta is a set of smart strategies that replace the standard capitalization indexes, focusing on the use of alternative, non-price parameters. Thus, it is possible to form a well-balanced portfolio in terms of risk and return, which allows Smart Beta to combine the advantages of active and passive investments: transparency, liquidity, low cost, outperforming results in the long term.

40% — Alpha strategies managed by AI.

Alpha, often considered as an active return on investment, assesses the effectiveness of investments in terms of the market index used as a benchmark, as it reflects the whole development of the market. According to our experience the most profitable way of extracting alpha from the price movement is to use both — endogenous and exogenous information, which implies that the trading bot should take into account not only the price data, but also news, public sentiments and other relevant information, which defines price fluctuations.Since the crypto-world contains a huge amount of data, we are going to implement AI / deep machine learning technologies.

20% — High-frequency trading and arbitrage

High-frequency trading is the main form of algorithmic trading in financial markets, which uses modern equipment and algorithms for rapid securities trading.Arbitrage is the practice of taking advantage of a price difference for the same or related assets between two or more markets.

10% — ICO Monitoring System

The amount of new tokens is constantly growing, making it extremely difficult to track and evaluate all new ICOs and make the right investment decisions.Our automated screening system selects the most promising ICO start-ups and makes appropriate investments.The combination of these types of strategies will allow us to provide liquidity for all transactions within the system, as well as the required level of profitability generated by ZEST.

Subscribe to our blog and find out more about other infrastructure units in the Zodiaq ecosystem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit