The traditional credit score and risk assessment system that financial institutions use to verify whether someone is credit-worthy, leaves a lot to be desired. In the United States, credit scoring is controlled by one single organization (FICO) and it requires borrowers to first take on debt before they can receive a credit score, leaving millions of people unscorable.

Other countries either work with similar scoring systems or they require potential borrowers to submit proof of credit-worthiness through other means. There is no such thing as a global credit score system, meaning that credit scores from one country are not transferable if you move to a country that uses a different system.

Bloom is a decentralized end-to-end credit score protocol built on the Ethereum blockchain, that provides both traditional and cryptocurrency lenders with identity verification, risk assessment and credit scoring of potential borrowers. In simpler terms, this means that you can receive a credit score via Bloom, not by going into debt, but by providing other types of information to prove your credit-worthiness. This information is securely stored on the blockchain, in a way that keeps you in control of your data & protects you against identity theft.

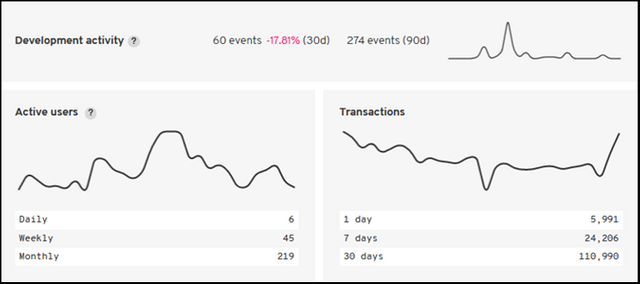

Compare Bloom against other financial DApps on State of the Dapps!

Building Your BloomID Reputation

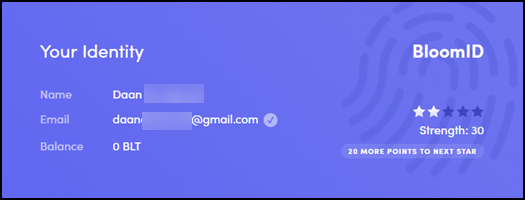

After you've registered and logged in (requires Metamask), you will be greeted by your Bloom identity and reputation overview. You will have to gain 'Strength' in order to build your reputation on Bloom. You can easily do this by providing Bloom with identifying information through various means. You'll also notice a BLT token balance on your profile, these tokens are currently mainly used as a proposal mechanism on Bloom. You can purchase these tokens on various exchanges.

At a later stage you can also provide Bloom with proof of your finances. Keep in mind that this info is only available to you and as soon as you submit this info, it will be encrypted. You always remain in control of your data, you choose with which institutions or services to share this information with.

As you can see, it's easy to start building your profile strength. Completing the Starter & Social Set only takes around 10 minutes, as soon as you submit these bits of data, you will be prompted by MetaMask to encrypt them. The higher your profile strength, the more access you will have to various financial service providers that make use of Bloom's credit score protocol.

Real-World Applications

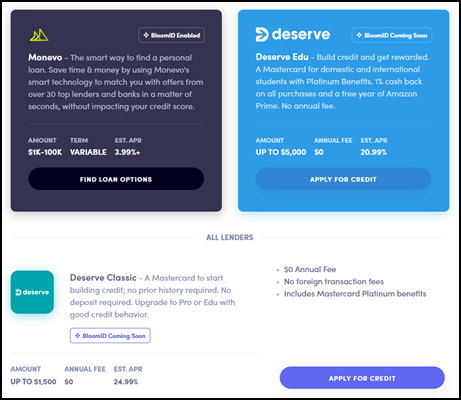

By having control over both your credit scores and your personal identifying information, you can easily submit this info to services that make use of the BloomID protocol. This may remove the need to provide companies with KYC through different services in the future, thus protecting you against possible data-breaches.

Currently, there's already one loan service that makes use of BloomID, you can already apply for a loan through Monevo with your existing BloomID. More banking services are ready to implement BloomID soon, as you can see on the Bloom Marketplace.

Bloom enables people who currently do not have access to traditional banking services, to potentially receive loans or other services from financial institutions. It is completely border-less and if it manages to get adopted by enough businesses, we might start seeing a shift from traditional credit ratings, to this new form of decentralized credit-risk-assessment on the blockchain.

What Bloom Could Improve Upon

Currently, much of the technical information is laid out in the whitepaper and various blogs scattered on their website. especially information regarding the security of personal data, is often explained in a very technical manner. In my opinion, the information regarding the security aspects of Bloom should be explained by making use of laymen's terms & it should have a more prominent place on their website.

Bloom does not have an FAQ page on their website, which is something I really missed when writing this review of their DApp.

It also wasn't immediately clear what the BLT tokens intended purpose was, while they did have a prominent place on my Bloom profile dashboard. Again, users should not have to read the entire whitepaper to find that information.

How Does Bloom Stack Up Against Top Ethereum Finance DApps of 2019?

Conclusion

When I first heard about Bloom, I thought that it was going to be yet another project that had made wild promises, without being able to deliver on them. My opinion completely changed when I actually went to their website and saw what they had already accomplished.

I was surprised to see that they had already made connections with existing banking service providers and that their BloomID system was already working as well as it did.

Sure, there is still room for improvement, but I have to commend them for having created such a great protocol to offer decentralized credit scores, identity verification & risk assessment for financial service providers to make use of.

That's why I have absolutely no problem giving them 4 out of 5 stars!

Links

Bloom's profile on State of the DApps

Bloom Website

Disclaimer

This is not financial advice. Please do you own research before investing in cryptocurrencies or any digital asset. This blog post is done for entertainment and knowledge purposes only.

Images are screenshots from the respective website, using them consists of fair-use.

Wow, this is pretty awesome. I hadn't heard of this service before now so I am glad that you did this review. It is pretty cool that they can do all of this without having to run a traditional credit score. I also like the idea that organizations can link to them to make for a seamless experience!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First I heard of this and sounds so interesting and has potential since it already has some contact and potential agreements with lending providers and organizations,

you find and share such interesting things like this keep them coming

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will do! Thanks for the comment ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

MOst welcome Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This could be really interesting @daan. I always hated the concept of "having debt to build credit" I guess the banks hold the all the cards, but this is worth watching. Thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, not much you can do about it, except build your own financial system. Like we're doing now with cryptocurrency!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's quite crazy that the current system first requires one to go into debt before you can get a credit rating, will certainly take a look at Bloom!

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, that's how it works in the US and the UK, they first have to see if you're able to pay back previous debt, in order to give you a credit score.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello!

This post has been manually curated, resteemed

and gifted with some virtually delicious cake

from the @helpiecake curation team!

Much love to you from all of us at @helpie!

Keep up the great work!

I remember joining this platform long ago when they showed up at earn.com and it seemed interesting. Great to see some progress there though I don't think I'll be looking at loans any time soon (I wonder if they'll have credit cards at some point. That would be interesting).

Manually curated by @eonwarped.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Glad i hear about the bloom from you for the first time. But why are project keep building on ethereum

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love your work man

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @daan!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.184 which ranks you at #3128 across all Steem accounts.

Your rank has improved 4 places in the last three days (old rank 3132).

In our last Algorithmic Curation Round, consisting of 220 contributions, your post is ranked at #103.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been chosen as one of the daily Whistle Stops for The STEEM Engine!

You can see your post's place along the track here: The Daily Whistle Stops, Issue 457 (04/15/18)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I need to correct your assertion about MetaMask -- Bloom has had mobile apps for iOS and Android since before you posted your review. You can use the mobile apps without interacting with MetaMask in anyway, which is how the majority of people use the Bloom protocol now.

App Store - https://apps.apple.com/us/app/id1380492735?mt=8

Play Store - https://play.google.com/store/apps/details?id=co.bloom.app

Thanks for the review!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit