Introduction

The humans have always exchanged goods, assets, commodities with other humans since the start of civilization in order to fulfill their needs. The needs of a human being is multi-dimensional and that is why humans have to be dependent upon others and that dependency is also a subject of being social. With the passage of time, the regions started being regulated, centralized, where this exchange becomes regulated by some means. But one thing still remains and will always remain that is exchange of goods, commodities, values etc. It may become more polished as we progress in civilization.

Whenever there is dependency, there will be an exchange between humans and that exchange sets up a market place. That further gets polished in to business with the passage of time. Business is an organized form of exchanging goods, assets, values, money etc. As we are in an era where everything undergoes with a valuation, the terms money or a currency becomes more prevalent. As the money is more prevalent, the business is also more centric with money. Regardless of what you exchange, that will certainly be gauged upon with money. So money further brings up many dimensions and one of such dimension is a loan- The purpose of a loan could be to buy a service or an experience or an asset or goods or commodity etc.

Out of the many types of assets we have in real world, crypto asset is one such asset which is emerging significantly. People have started to realize that inherent inflation of paper currency is doing no good to the society and they have realized the worth of crypto asset with a blockchain technology. As the crypto ecosystem is also expanding, the needs of humans within this ecosystem also compels the idea of crypto based loan and lending platforms. One such lending platform is ETHLend which will be main attraction of this article.

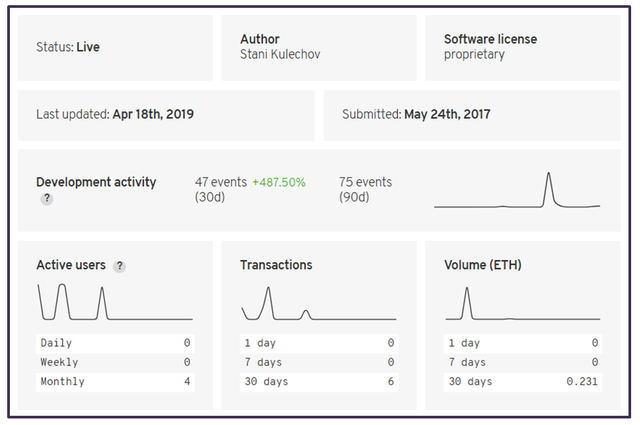

Ref:- https://www.stateofthedapps.com/dapps/ethlend

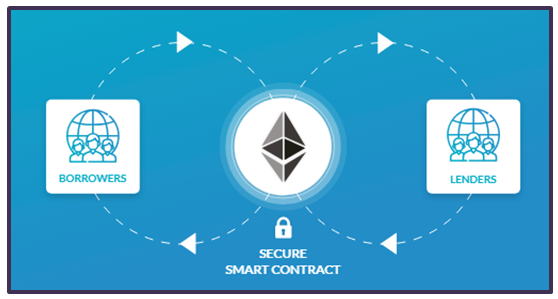

ETHLend is a dapp built on the Etherum blockchain which allows p2p lending backed by Smart Contract. In this particular dapp, Smart Contract is the key feature that makes it distinct among others.

The objective of ETHLend is in sync with the decentralization which is also at the core of blockchain technology. It is a dapp on Etherum chain which allows p2p lending through Smart Contract. Here no third party sets the rule for the lender and borrower, rather it is the borrower and the lender who formulate the rules, so that either party can get into an agreement through a Smart Contract.

Getting Started with ETHLend

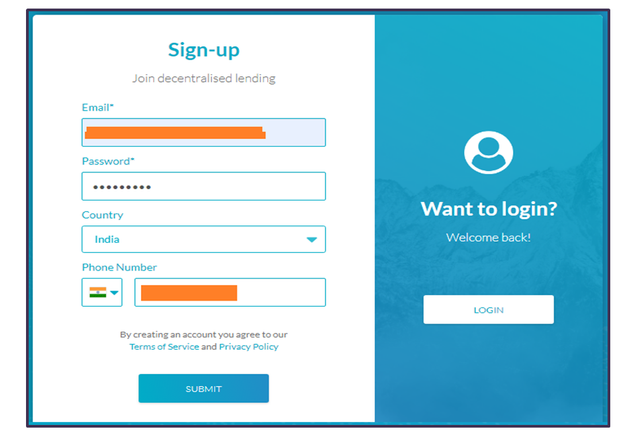

(1) Go to - https://ethlend.io

(2) Click on Get Started (right corner of the page)

(3) Fill all the relevant details like Email, Password, Country, Phone Number. Then click on Submit.

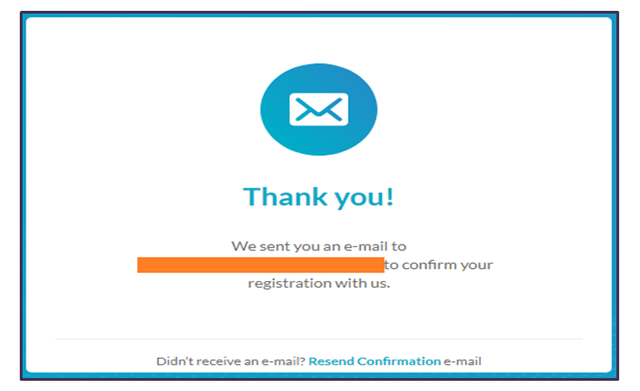

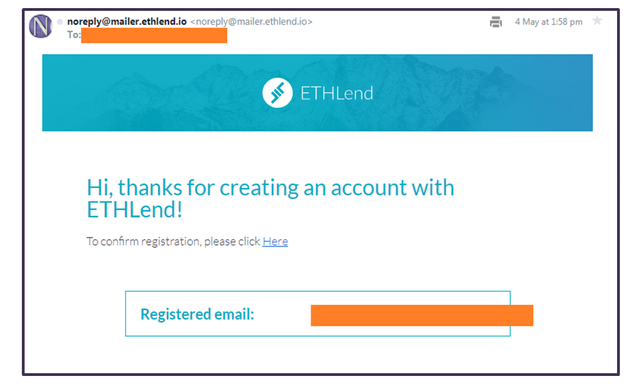

(4) Check your Email inbox where you can see an email from ETHLend saying to verify your registration. Clicking on that take you to the login page of ETHLend again.

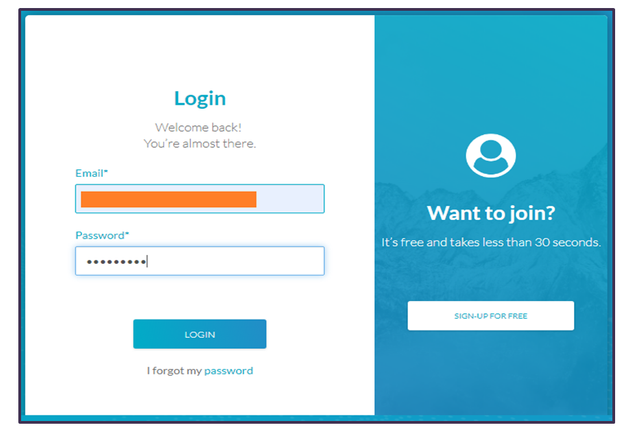

(5) Fill the login details and then click on login.

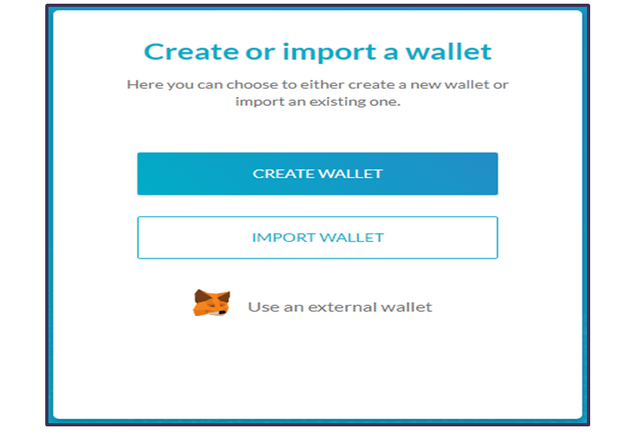

(6) You can see now, there are three options appearing: Create Wallet, Import Wallet, Use an External Wallet. If you don't have an ETH wallet, you may click on Create Wallet and then keep your 12 phrase seed at a safe location and have a new ETH wallet . If you have an existing one, then you can import your wallet by putting your seed phrase. The third option is Metamask wallet and if you already have installed Metamask plugin in your browser, then you can directly use that by clicking on Use an External Wallet. But do remember that using an external wallet will not enable you to use bitcoin in the platform.

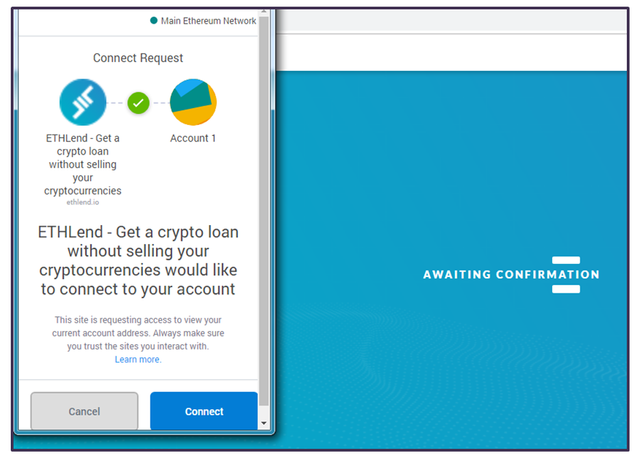

I have selected Use an External Wallet in my case, so it redirects me to connect to my Metamask wallet. After clicking on connect, it will automatically take me to my Dashboard.

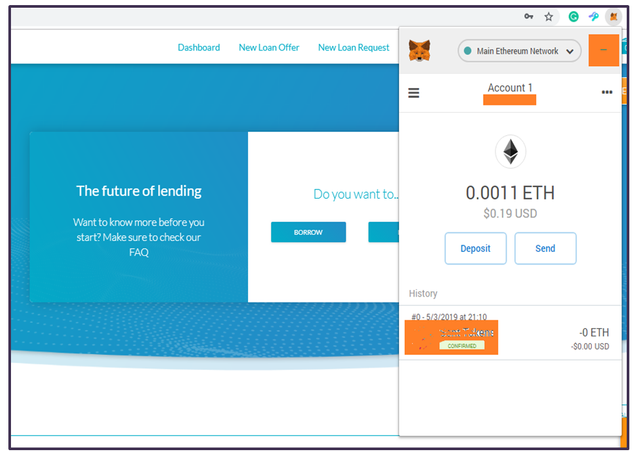

(7) Now there are two options appearing: Borrow & Lend. You can choose either of them as per your requirement. I have chosen Borrow in my case.

(8) Clicking on Borrow shows me two options: Create & View All Offers. In Create I can create & customize my own loan request. In case of View All Offers, I will be redirected to the page where various existing loan offers are already put by the lenders. So it is giving the flexibility to both lenders & borrowers.

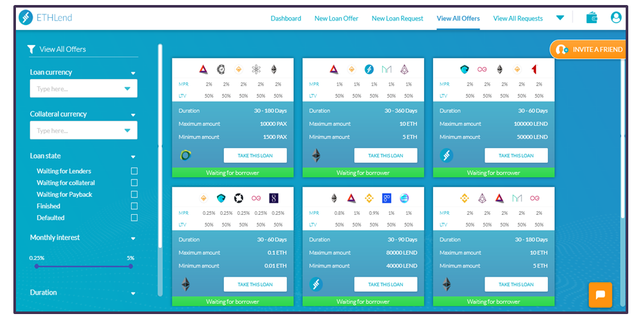

(7) If I click on View All Offers, I can see a list of available offers with wide options of interest rate(MPR), LTV, collateral, tenure, etc. I can check all of them and as per my suitability, I can choose the most competitive one.

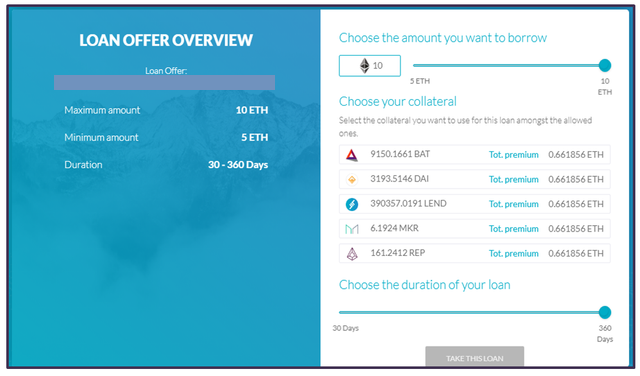

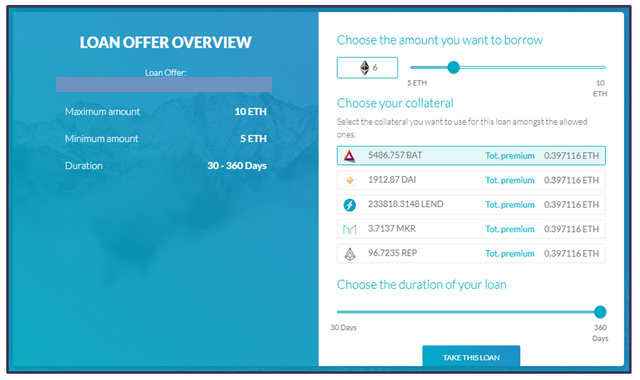

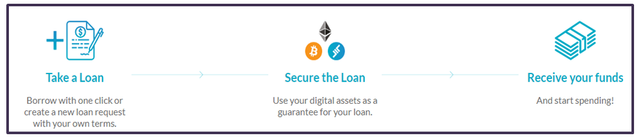

(8) If I select a particular offer, then it will give me further details of that offer and according to that, I have to finally choose the borrow amount, collateral & duration and then can click on Take this Loan.

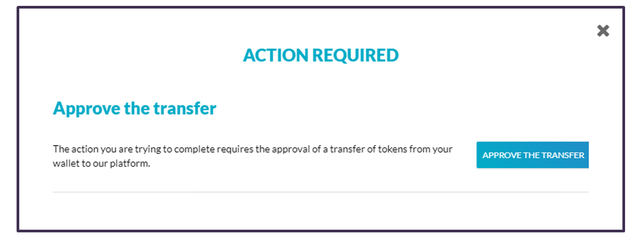

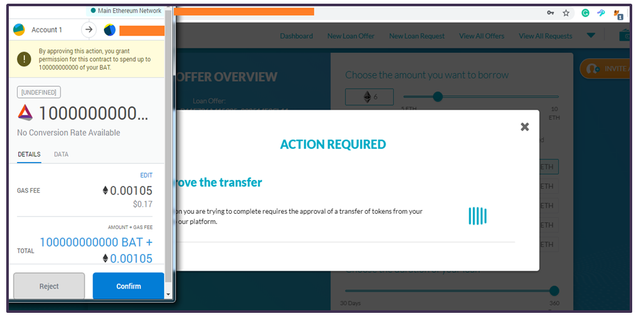

(9) The borrower is then required to Approve the Transfer and after approving the transfer the loan will be executed.

Main Components of ETHLend

The biggest strength of ETHLend as a lending platform is its decentralization. Crypto assets in no way are held by ETHLend and it works through Smart Contract.

Terms agreed between lender and borrower

The funds are released after a borrower agrees on the terms and conditions. Borrowers had to make regular interest payments. Moreover, the interest rate charged could be fixed or floating and can vary based on certain factors like market situations, quality of the collateral, the tenure of the loan and more.Since cryptos are volatile in nature (at least for now), it may happen that value of collateral drops beyond a certain level. To protect borrowers in case of a sharp drop in the value of the collateral there is the margin call possibility: borrowers can call their loan back.

A borrower can simply take a loan in ETHLend by backing his crypto assets as collateral. It is completely transparent, no verification, no paper documentation, no authentication, etc & everything gets executed through a Smart Contract. The collateral can only be released to the borrower when the loan is paid back fully, or to the lender in case of collateral call or when the loan wasn’t fully paid back at the end of the loan time. In case the borrower defaults, the lender can be able to liquidate the collateral. A borrower is at the liberty to prematurely close the loan at any time.

LTV

LTV(Loan to Value) for all crypto assets is 50% where as for LEND tokens it is 55%. However if the collateral worth decreases below 50%, then it would trigger a notification call to add more collateral. So ideally the LTV has to remain equal to or greater than 50%.

Fees

The fees in this platform is 20% of the interest on the lender side and 2% origination fee on the borrower side(in first installment only). In case of default, the platform fee is 5% of the collateral amount.

Pegged Loans

It is true that cryptocurrencies are highly volatile. So planning and taking a loan in crypto terms may be or may not be advantageous and it generally exposes to extra bit of risk. Considering this fact, ETHLend also allows users to to receive or fund loans pegged to fiat currencies and that definitely helps to account for volatility.

Collateral & Loan option

At the moment, ETH lend accepts ETH, BTC, LEND and more than 180 liquid ERC20 tokens as collateral. One can avail loan in various options like: ETH, LEND, DAI, TUSD, ETH pegged to USD, EUR, GBP, INR, KRW, JPY and CNY.

LEND Token

LEND token is an ERC20 token and it is the native token of ETHLend platform. It is used as a utility token in the platform and users can borrow and lend using LEND token. As it is the native token, it offers extra privileges to the users in borrowing & lending.

The various advantages of LEND token are:-

- Zero Fee Lending. When using LEND as loan currency there will be no platform fees.

- 50% Discount on Fees. Using LEND tokens as collateral will reduce the platform fees by half.

- LTV Boost to 55%. LEND token allows users to boost the LTV up to 55% when using it as collateral.

- Featured Loans. You can use your LEND tokens to feature your loan displaying it in a very prominent way allowing to highlight your loan so it get funded faster.

- Become a premium user. Use your LEND tokens to become a premium user and you will be allowed to fund loans one hour before the normal users.

- Microstaking. The microstaking model allows any user in the platform to interact with the LEND token economy and get rewarded with their microstaking fees in LEND tokens over the time the users are active in the platform. You can check here for further details about the Microstaking model.

Pros of ETHLend platform:-

Holding crypto assets have long term benefits as it is an emerging asset and long terms price appreciation will fetch more gains for hodlers. Apart from that, it keeps you safe from inherent inflation of paper currency. So at a time of emergency, when a person runs out of money, one can leverage on the crypto assets to take a loan in ETHLend.

It is the most decentralized lending platform.

Its user interface is very friendly and has a very professional design.

It has an wide option of collateral. As many as as 180 ERC-20 tokens are accepted as collateral.

Both lenders and borrowers have the liberty to customize their offer.

A borrower can easily choose a most competitive offer from the listing.

It is boarder-less. Borrowers and Lenders can easily make a deal with out any regulatory compulsion across the globe.

It is a secured form of loan(backed with crypto assets as collateral). Hence lenders can feel more secure in offering better rates.

All the parameters like interest rate, LTV, tenure, collateral types can be easily set as per the choice of borrower and lender. Simply put, it offers extra flexibility so that lender & borrowers can get into an agreement by an ease.

Cons of ETHLend platform

Even though the loan offers can be customizable, if we check the listing and find an average value of MPR then we can see that it is still above 2% and APR if compounded can very well go above 27% or more than that. I am of the opinion that, the idea of decentralization is not just to bring more transparency but also to make the business more competitive for both borrowers and lenders. If we compare this interest rate with the traditional banking, then it still stands on a higher side. In traditional system, it is believed that because of third party's role, cost does not get effective for a user, so in a decentralized system which does not include a third party should be more cost effective. Of course it is p2p and people will decide and customize their offer. But too much interest also make a lending platform less attractive. Further, if more competitive offer will float, then it will attract the non-crypto players to join this ecosystem and that will also help the adoption of cryptocurrency in real world.

ETHLend has worked towards interoperability by allowing BTC. I am a strong proponent of leveraging on cross-chain compatibility more than what it is now. So the the team should also look to enhance more on cross-chain compatibility so that other blockchains can be made compatible with this lending platform, which can further enable other types of coins and that can seriously boost the business potential of this lending platform.

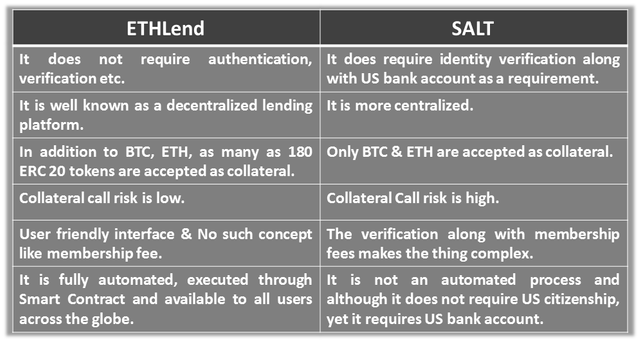

Comparison of ETHLend with other lending platform(SALT)

Rating

I want to give a 4.2 star rating out of 5 star considering all features of ETHLend.

Summary

The decentralized lending platform ETHLend definitely benefits both short term and long term objective. While the lender gets a business opportunity, the borrower fulfills his immediate fund requirement by leveraging on crypto assets. The easy to use interface further makes users very comfortable. The flexible offers, wide range of listing of offers help a lot to the users to get a competitive offer that can suit the requirement as well as repayment capability. Keeping an LTV of 50% definitely reduces the risk of volatility and the options like pegged loans to fiat currencies can also suit to the type of borrower who don't like volatile asset. The ETHLend has all the potential to become a leader of global lending platform in coming days.

References used:-

(1) https://www.stateofthedapps.com/dapps/ethlend

Task Reference:-

https://steemit.com/dapp/@dapplovers/review-a-featured-dapp-and-earn-rewards-ft-state-of-the-dapps

Image Courtesy:-

ETHLend & Stateofthedapps