Index - https://steemit.com/tax/@alhofmeister/3ibscz-accounting-and-finance-blog-index

Introduction

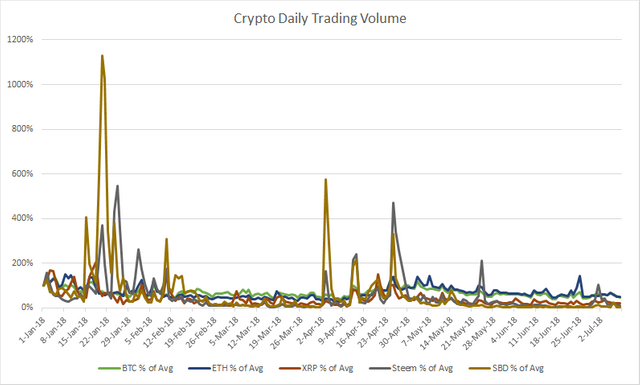

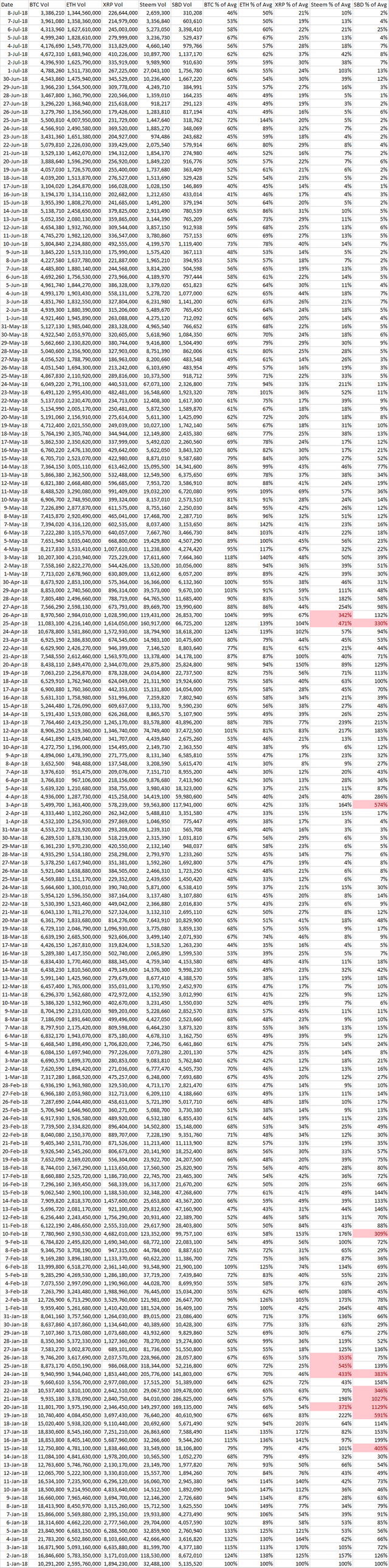

With the latest spike in Steem/SBD, I thought it would be interesting to examine the trading volume of Steem, SBD and the largest cryptocurrencies. Although high trading volumes do not necessarily indicate market manipulation, the likelihood of organic trading at +3x the YTD average trading volumes in a single day are unlikely. In my analysis, days suspected of pump and dump schemes are identified by trading values over 3x the average daily value. As the market capitalization of SBD is significantly lower than Steem, it is more susceptible to manipulation. The most recent spike is, in my opinion, likely attributed to developing news on Steem exchange listings and not market manipulation.

Chart

Raw Data

References

https://coinmarketcap.com/currencies/bitcoin/historical-data/

https://coinmarketcap.com/currencies/ethereum/historical-data/

https://coinmarketcap.com/currencies/ripple/historical-data/

https://coinmarketcap.com/currencies/steem/historical-data/

https://coinmarketcap.com/currencies/steem-dollars/historical-data/

#nobidbot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@contentvoter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In my opinion also Pump and dump is happening in the market and it's manipulating the market for sure. And in my opinion it's really inorganic in nature and many potential profits are convert into losses.

But in my opinion in future when Institutional Investors will enter into the market then possibly we can see more stability and organic market trends. And truly this data is reflecting really deep.

Wishing you an great day and stay blessed. 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome. 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good opertunity in trading money by steemit you are very interesting and informative data provided in steemit trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit