Index - https://steemit.com/tax/@alhofmeister/3ibscz-accounting-and-finance-blog-index

Introduction

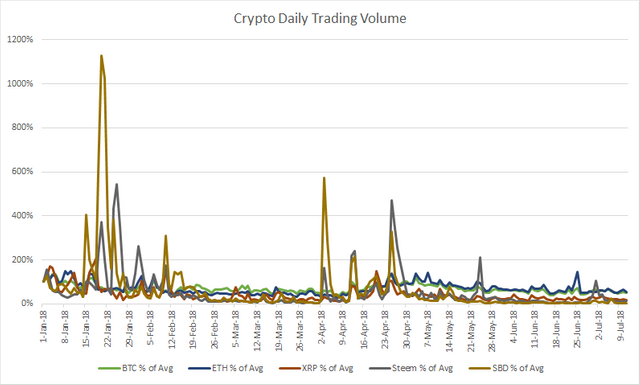

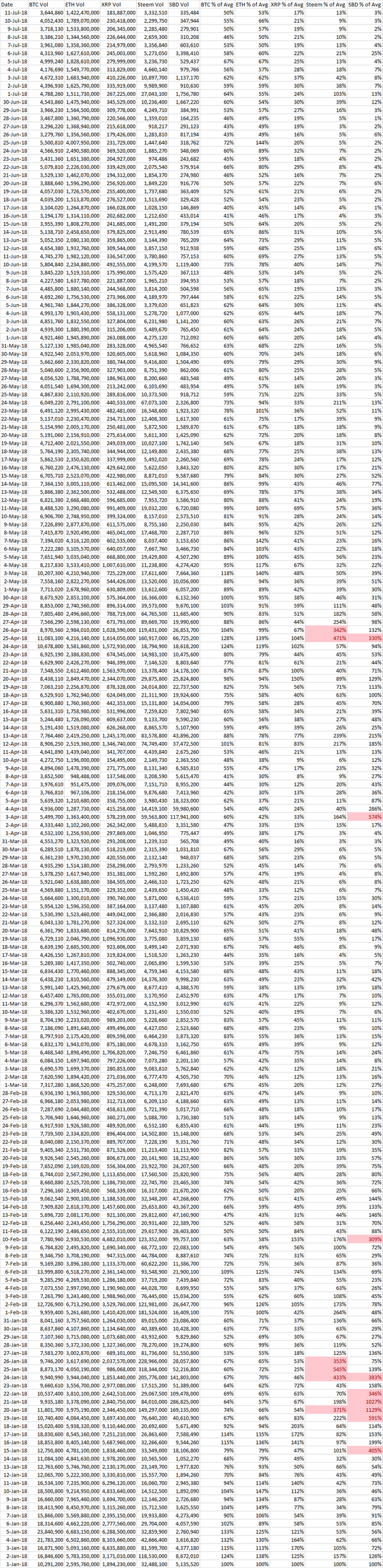

With the latest spike in Steem/SBD, I thought it would be interesting to examine the trading volume of Steem, SBD and the largest cryptocurrencies. Although high trading volumes do not necessarily indicate market manipulation, the likelihood of organic trading at +3x the YTD average trading volumes in a single day are unlikely. In my analysis, days suspected of pump and dump schemes are identified by trading values over 3x the average daily value. As the market capitalization of SBD is significantly lower than Steem, it is more susceptible to manipulation. The most recent spike is, in my opinion, likely attributed to developing news on Steem exchange listings and not market manipulation.

Chart

Raw Data

References

https://coinmarketcap.com/currencies/bitcoin/historical-data/

https://coinmarketcap.com/currencies/ethereum/historical-data/

https://coinmarketcap.com/currencies/ripple/historical-data/

https://coinmarketcap.com/currencies/steem/historical-data/

https://coinmarketcap.com/currencies/steem-dollars/historical-data/

@contentvoter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

#nobidbot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're right, this entire sphere is ripe with pump and dump schemes. I'll definitely take your 3 to 1 average daily volume to heart especially if there is no news

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice analysis much helpful.....

Do follow me @beingindian

https://steemit.com/bitcoin/@beingindian/bitcoin-price-usd20000-prediction-will-ever-be-true-726f0b8095ce8

Follow upvote & comment

For upvote & comment ✌🏼👍🏼

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit