We're Doomed!!... Again!!!

source

It was really just a matter of time....

Part of the latest hard fork was to raise the SBD/STEEM debt ceiling, and only kick the print rate reduction of SBD when the debt ratio hits 9%, and reduce it rapidly to 0% as the ratio approaches 10%. This was a change many Steemians were against, and discussed at length why it was a bad idea, which would come back to bite us later....

Well, we're very close to hitting that threshold.. again. This times it's right up therie against the 10% ceiling...

The big question now is: What happens as we approach the 10% mark? Will there be mass panic selling into the perceived stable $1 SBD (which is really only $0.94 right now)? Will the sell-off result in a much larger price crash of STEEM, and a pump in the SBD price to make things worse? Will there be a SBD bonfire or mass conversion of SBD into STEEM to burn off the Debt in an attempt to save face?

Things are about to get interesting.....

The Numbers:

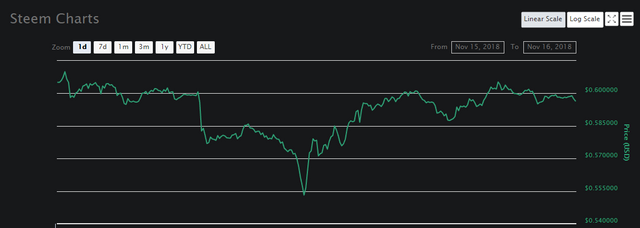

Due to the STEEM price feed moving average lagging behind the markets, we can see where the price will be heading, based on the price graphs of services like coinmarketcap.com or coingecko.com. What we are seeing now is that the price feed is at $0.71, but the current market price is right down at $0.60. That's a lot of ground to make back in the current state of the crypto market. Not impossible, but I don't see it happening quick enough to prevent the price feed going down significantly in coming days.

With the current price feed, SBD and STEEM Supply, the current on-platform SBD/STEEM debt ratio is about 6.85% (remember before hf20, 5% was the threshhold to bring the SBD print rate to 0%, and SBD printing reduced from the 2% up to 5% Debt window, so we would already be in the zero-SBD rewards zone) and the SBD print rate is still at 100%. According to coinmarketcap.com, there is a total supply of 302031078 STEEM, and 14696923 SBD in supply (at the time of writing this post).

Now, keeping the Supply of SBD and STEEM constant, if the price of STEEM remains where it is now, in 48 hours time the price feed will be showing very close to $0.60. If it reaches that, and keeping the STEEM and SBD supply the same, that new debt ratio would be 8.1%.

By my calculations, if the STEEM price feed drops bellow $0.54, which the market price almost reached a few hours ago, we'll be at, or within a whisker of the 9% SBD/STEEM debt ratio threshold, and will start seeing the print rate reducing rapidly to try and keep the ratio below 10%.

Looking back at @buggedout's post, The STEEM DOLLAR Purge Begins : This is what we need to DO from 3 months ago about this same topic before hf20 was implemented, he ends off his post with this warning:

The other thing I would encourage people to do is talk to the top Witnesses about the proposals in Hard Fork 20. One of the proposals is to effectively Lift the Debt Ceiling to 10% so that even more SBDs can be printed in future. If this policy had been in place now then we would have even more SBDs in circulation right now. Our Debt Level and the problems we currently face would be even worse and the chances of us hitting the SBD Haircut threshold would be significantly higher. This policy proposal in my opinion makes the STEEM platform even MORE unstable and it will likely create a lot of potential SBD bagholders during the next boom/bust cycle. Now I know this might seem a long way away, but it’s important to keep an eye on the future. Increasing the Debt Ceiling is not going to work out well for the USA, so why would we think it’d be any different here?

You called it, @buggedout! And we're on the eve of the next purge, or worse...

If the Crypto market doesn't improve quickly, or continues to drop as it has been, hitting the 10% debt ratio will be inevitable, and things could get messy real quick. That 1% SBD print ratio reduction window won't last long the way things are heading, I just hope all the cards don't come tumbling down before we get a price recovery.

What happens when the 10% threshold is reached?

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Once 10% debt ratio is reached, there will be no SBD production at all, and from the whitepaper (pages 10, 11 and 12):

and...

I guess we'll see how this works out in reality...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hoping with you....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hopefully this latest price drop is just a bit of panic induced from the BCH fork (and threats) because we really do need a bounce.

STEEM continues to have some big problems though. We are losing ground on other cryptos even when they are also selling off. Down to rank 42 now.

I did make the warning but even I didn't think it would happen this quickly. The purge is currently going "next level" with the notorious freedom account now doing some massive conversions.

This is the biggest I've seen so far :-

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hopefully it is just a short panic period over the BCH business. The sharp price drop has definitely sped things up.

That's a big conversion there. We may see a lot more of that if things keep moving the way they are...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't think the downside is over. Since BTC broke some major support levels there's a good chance it will drop into the 4000s (and maybe lower) before the next bull market, and this could play out over months not days. Just my 2c.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your continued support of SteemSilverGold

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Funny how markets seem more powerful than human concepts and ' neat ideas'.

Never seen that before...lol

https://steemit.com/blog/@lucylin/the-story-of-the-going-to-the-moon-part-ego-deflation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not sure I understand the whole SBD thing...

Is the idea that we should always convert our SBD into liquid Steem? Are you able to explain this further?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

SBD is supposed to be a stable token, pegged to be equal to 1USD of STEEM, so it should hold its value at that, but doesn't quite do it all the time. The platform is designed that the SBD shouldn't equate to more than 10% of the total STEEM market cap, as it is a convertable debt token.

When the SBD/STEEM debt ratio gets too high, post rewards change from being in SBD and SP to STEEM and SP, to boost the amount of STEEM being produced, and halt SBD production.

Whethet to hold STEEM or SBD depends on whether you think STEEM will be going up or down in value, and whether you want to power up into SP for more influence (and reward) on the platform.

Hopefully a few words in there makes some sense...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit