Hey guys! Today I'd like to share with everyone how we can all help keep the price of Steem up (at least not down too much) by creating buy pressure and why it helps everyone! This post will likely be re-posted a few times, each time with some slight edits!

Firstly, you'll need a Binance account which you can create by clicking on that link! I choose Binance because it has the largest volume for Steem, thus the greatest affect on price.

Disclaimer: it's my referral link, ALL money from referrals will be used to keep Steem buy pressure up.

Why it Helps all of us!

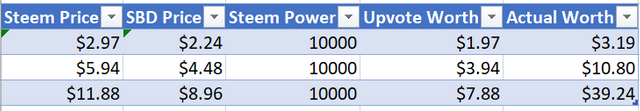

If you're an author here on Steemit, you get post rewards. These post rewards are half in SBD and half in Steem. With an increase in Steem price, the author rewards go up! Assuming SBD price stays the same (which isn't the case, it usually goes up with Steem price), your rewards will scale up linearly. However, if SBD price goes up with the Steem price, your rewards will scale up quadratically, I'll illustrate what I mean below:

Although we cannot guarantee that SBD price will follow Steem prices perfectly with a 1.0 correlation, but we can assume that the correlation is positive, thus an increase in Steem price will lead to an increase in SBD price.

Conversely, a decrease in Steem prices will cause a drop in rewards, which is why it's in everyone's best interest to ensure that Steem price stays high!

Steem Marketplace

Steem is quite a unique cryptocurrency, as in it's not purely speculative. It's got a use and utility. This means two things, it's FAR ahead of other cryptos in terms of adoption BUT it also gets sold a lot due to people living off Steem. Due to this, the price doesn't 100% match sentiment and we could have a lot of sell pressure.

A Lesson in Crypto: How $1 Could Increase Market cap by $1 Million

Because a crypto has a market cap of (let's say) $1 million, doesn't mean that much money was invested in it.

For example, if Coin A has 1,000,000 circulating supply and they're $1 each, but recently had news of a massive partnership, so people expected the price to moon. The sell orders at $1.00 were taken down and now the cheapest sell orders are at $1.10. However, no one wanted to buy it that high so everyone increased their buy orders to $1.05. The people who had sell orders at $1.10 now see the buy orders creeping up and think the coin might moon more

and take their sell orders off, so now the sell price is at $1.25. This keeps happening until someone finally buys half a coin at $2. Now the total market up is $2 Million, and only $1 worth of coin was actually sold.

However, due to the nature of Steem, this won't happen to that extent.

How to create confidence

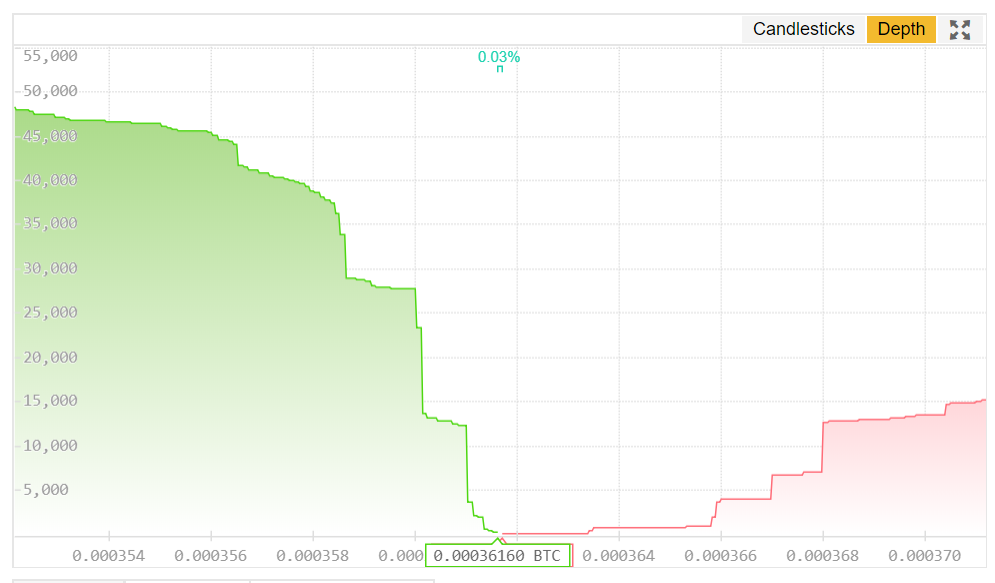

Despite Steem not being able to super moon, we can create confidence in the marketplace by using the theory that buy orders increase confidence.

I day trade a lot but also hodl some crypto like bitcoin and ethereum. Whenever I'm holding these, I don't like just leaving it on an exchange not doing anything, so I normally put it in orders, in case of a flash crash or to increase confidence. Lately, Steem has been my main coin. I think it has great potential to be very bullish so I put some of my spare ETH and BTC up as buy orders in fairly low prices, around the $2.90 mark (I adjust it every day or two). This way it creates more buy pressure in the market and confidence, which would likely lead to more buys, thus creating even more pressure, another domino effect.

I also don't mind if those orders get filled, as I have confidence Steem will go up again. If the orders do get filled, I simply hodl some Steem for a while and sell it when I'm in profit, so I have more crypto to boost the Steem market. However, I normally don't put sell orders up, I just fill the buy orders as putting sell orders up hinders market confidence.

The Community Effect

With just me doing this, I doubt it has a very large effect honestly. But if enough people do this, I'm sure it could have a very large effect on the price of Steem without people actually investing more money into Steem. Imagine constantly seeing massive green walls on the market depth, that should increase market confidence and create more buy pressure from others like day traders, thus create the effect I mentioned above, where sell orders get taken down and buy orders keep creeping up!

Steem Price History

20/05/2018

Thanks for reading!

What do you think of this idea? Feel free t discuss the effectiveness below!

What to be in the draw to win FREE STEEM EVERY WEEK? Click here for more information!

Want to sell your vote for about 30% ROI per year PLUS the freedom to stop selling at anytime without waiting 1 week to get your delegation back? Sign up to Minnowbooster here!

OR read more about it here

It does make a difference. I did this to bring SBD up. I put a sell order of steem to buy SBD.

When I cancelled the sell order I could see a small change.

It can be a mere coincidence too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If more of the SBD market uses the internal Steemit market for SBD, the price will be more closely correlated with Steem!

This way we don't need to boost both SBD and Steem, we just need to boost Steem!

If more people does this on Binance (the largest market for Steem atm), I'm sure we'll be able to see an increase in prices!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent article and a great idea, thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

amzaing post much informative im new to steemit help me to grow on steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good post... Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit