Ever since my account value increased over ten fold in recent months, I have been dreading the prospect of Capital Gains Tax (CGT). Generally the rate of CGT in Ireland is 33%*, so I was expecting to pay something like €30,000 on my Steem Power alone, never mind the Steem traded on exchanges.

As it turns out you only owe capital gains in Ireland when you sell the asset. That includes trading it for Bitcoin, or for another good. So, if you're a long term holder like myself who actually plans to use it as Steem Power, you will only owe CGT on the smaller amounts you power down and withdraw/trade.

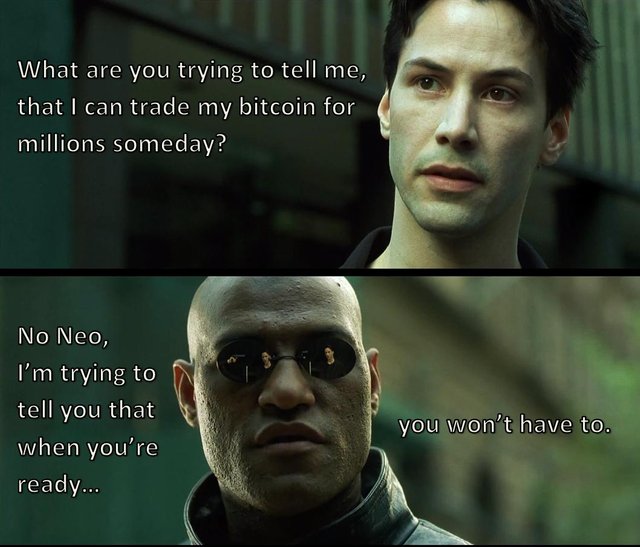

This creates a powerful incentive Irish residents not to power down speculating on a drop in price, in the long run you will owe far more tax doing that, and you may not even make the profit to cover it by speculating, at least if you intend to hold Steem like Neo holds Bitcoin.

Not everyone will do that, but it's my plan, for the most part. Right now I'm feeling relieved that the state won't be expecting as much of my money as I thought.

* It's a little more complicated than that, you can check the link to understand in detail.

Wow Smart move! I really hate these extra taxes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey there, @demotruk,

Man, you saw the potential in Steemit and invested very wisely. I'm thinking the price will continue in an upward trajectory from now and keep on hitting new highs over time. Very nice word on the tax situation if people decided to cash out. I'm not touching what I have, bro. I'll try to amass as much as possible for now, lol.

Great post, man. Wishing you and @beanz well, bro...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey, if you hear anything or plan anything for a meet up in London, let us know. I'd be totally up for it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Without a doubt, brother! That goes without saying. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's very interesting. I was wondering about the tax implications recently. I had only considered the case where you sell your steem. At some point though, particularly if most of your wealth is tied up in steem, you would need to sell it. Unless you think Steem power will be a means of paying for most goods and services?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steem is different to most cryptos in that it has utilitarian value even if you don't spend it. 100% of the value of Bitcoin is derived from the transfer of Bitcoin for goods and services, and it's at that moment when you make use of Bitcoin that you are exposed to CGT.

Steem Power continues to have utilitarian value just by holding it. If you want to 'cash in' and buy luxury items etc., then yes you have to sell it and you're exposed to CGT. But then, that also depends on your expectations. For example, I expect Steem to rise several orders of magnitude in price over the long run. At each one, I will only sell 1/13th (one week's power downs). At each level that's a significant amount of money for me and those power downs will be taxed. However it's never going to rise 13 orders of magnitude so I'll always have the vast majority of my SP, which won't be taxed. Even without powering down, the curation rewards on the SP are a large source of income, at only $5 it would easily replace my day job.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good point! Thanks for the info.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Does capital gains not kick in only when you convert to fiat? Does it matter when you convert Steem or SBD to Bitcoin or other digital asset?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It doesn't matter what you exchange for it. In any case it counts as 'disposal', and you owe tax on it (as long as you made a gain, of course).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

At best it's a very gray area.

Does converting to SBD count as disposal? I am not so sure. Also the jurisdiction of where the disposal takes place will factor in and where you are tax resident. A distinction would also probably be made of income (such as from posting) which may be traxed at your marginal rate and capital gains from the increase in the price. You can also offset losses.

Whatever way you look at it it's not 100% and may change in the future depending on how governments decide to react. For example they could take a hard line at a later date.

Nice problem to have though :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't think it's a gray area. I would think the conversion of Steem Power to Steem could be a gray area since there is no exchange made with another party, but if you trade an asset for another, it's definitely still a taxable event.

Further down on the page:

Calculating income tax and CGT on curation and author rewards will be pretty complicated, or at least time consuming. And yeah, governments could change how it works. I'm hoping the state will be disrupted by voluntary consensus networks before they do that :-P

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok I'm a complete noob in these matters, but how will they know anything you're doing with your steem or bitcoin unless you convert them to fiat currency?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well my real world identity is connected to this account, it's also connected to my accounts on various exchanges.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh Lol, if you had a chance to go back in time and remain a total anon (assuming you'd still make equivalent STEEM) on this platform, would you?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe...

Ultimately if I participate in events like Steemfest my identity is going to get out there anyway. Tax evasion would probably be quite difficult for Steem users (my post recommends tax avoidance instead).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're a handy guy to know. I suck at that kinda stuff.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How does Ireland treat SBD earnings? Is the Tax point when SBD is exchanged to BTC or to Euros?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I assume that counts as income, taxable at the normal income tax rates (that gets complicated). I assume that it would count as the value at the time that you received it. If you somehow make losses on your SBD after that, you can at least count those losses against any capital gains you made.

Disclaimer: I'm not a lawyer or an expert on tax, I only have a layperson's understanding.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really love that neo morpheus caps. :) Upvoted and followed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looking at the tax stuff for this year, my first year of Crypto investing, is gonna be a headache... glad to hear your situation is easy enough to handle.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Damnit, 100% powered up :-/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no tax

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Still counts as income. They get you on everything :-P

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing..

Upvoted and followed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit