After reading comments under @clains's excellent video post, I've noticed there are still a lot of misconceptions flying around. @clains did a great job explaining where the money in Steem comes from.

But the core question still stands:

What makes Steem valuable? What gives us a reason to think that Steem (and Steem Power) will appreciate in value despite the inherent inflation?

In my view the answer is very simple: it's the Steem Dollar.

The existence of Steem Dollar (SD) is the main reason here. And it's a very solid reason.

Now I'll try to explain why. But first, let's deal with some misconceptions.

@moonjelly asks a very valid question:

I could understand that if Steem price was supported by companies or ads therefore creating revenue in the form of Steem, sustaining creators and payouts. But as far as I know there's no plans for that in the near future.

A similar issue is raised by @moviefan:

I think the problem with many of us who are investors is a lack of direction in regards to monetization from the Owners. What you just mentioned sounds interesting but I have never seen an article or monetization plan from Ned and Dan. I would love to invest more but I can't just invest on a hope and a dream, we need to see the future vision to earn money. All we are seeing is how to give it away and dilute our investments thus far.

So it's a question about plans for monetization of the Steem ecosystem. FB and other social networks have big market value because they have the potential to make money through advertising - by selling their users' data. Does Steem have a similar potential and will it follow this path? Some people expect this to happen, e.g. @steemrollin says:

Not sure why you think companies won't purchase Steem for sponsorship or ads in the future. The ad model will be different than traditional online advertising, but imagine any company can buy $1 million worth of Steem, probably be able to payout a few hundred a day a day or $100k/yr in rewards as blogger sponsorship or to promote their own posts. That's valuable. We're also not even including the payments/commerce part of the ecosystem. That's valuable too as well as the network effect.

Here is the thing: Steem could do that but I think it won't be necessary. There is a much bigger fish to fry: creating a ubiquitous monetary system, with Steem Dollar as its main currency.

Demand for SD will drive demand for Steem (and Steem Power). Why? Because SD is backed by Steem, it's an IOU guaranteed by the Steem blockchain. SD is just plain Steem under the hood.

Steem Dollar? Why would I want it?

This part is easy: if Steem as a social network becomes huge and, as a result, SD becomes a ubiquitous currency, people will want to acquire SD for daily shopping. More and more people (even those not interested in the social network aspect) will either earn or acquire SD and keep it in their wallets - not only as an investment (it pays a nice interest rate) but also because they could buy and sell stuff for SD on a daily basis. So there will be a tremendous amount of SD just sitting in people's wallets - ready to be spent when buying stuff, or just received from selling stuff.

If you think carefully, this is exactly the same vision as Bitcoin supporters have. Why does Bitcoin have value? Because there are people who expect it to become a ubiquitous currency sitting in the wallets of millions of people - the same argumentation applies both for Bitcoin and Steem Dollar.

Some people have a different explanation: for them Bitcoin has value because they believe that eventually a sustainable business model will emerge which will be based on the revenue generated from transaction fees. Again, this a huge misconception. If you do the math, you'll see that transaction fees would have to rise significantly (which would kill Bitcoin as a payment system) to be able to sustain Bitcoin economy in the long run.

Anyway, after 8 years of its existence, most people understand the potential of Bitcoin investment. @moonjelly rightly says:

You buy Bitcoin because you think it will appreciate in the future, as with most other investments.

So why the same logic cannot be applied to Steem? There seems to be another misconception which prevents this. This is what @moonjelly claims:

The difference is that if you buy Bitcoin you buy into the blockchain tech, your money is "safe" and should appreciate as long as Bitcoin works as it's scarce. That's why it has been appreciating annually since it was created.

And the above view is backed by this argumentation:

Steem on the contrary is a highly inflationary currency, you buy on a Monday and by Friday there's thousands more Steems created, so the price will go down. What value does it have for the buyer? I get that there's value in content, but there's a disconnection there. Buying Steem doesn't give anything back to the investor, it'll always dilute unless it's supported monthly by an external agent like a company or via ads/revenue. Speculators and traders won't cut it.

And here is the crux of the matter. Bitcoin is perceived as a deflationary currency, while Steem is treated (rightly so) as "highly inflationary currency". It's a false perception (in reality Bitcoin is also highly inflationary) but still, perception is all that matters. Steem takes an undeserved beating here. It's undeserved but it's hard to fight with perceptions so I think we must identify and address the underlying problem.

Why is Bitcoin perceived as deflationary?

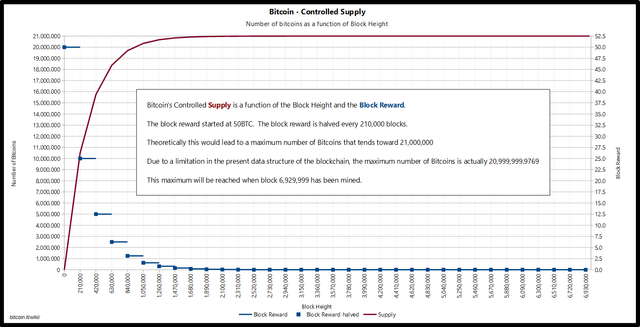

Most probably because it has a well defined limit to its supply. There will never be more than 21M Bitcoins in existence. Nobody reading this will be alive when this limit kicks in (year 2140) and no investment horizon extends that long, but still it makes a significant psychological impact: yeah, there is some inflation but it is decreasing in a predictable manner and eventually it will stop.

People believe it matters, and, as a result, it does matter.

Conclusion

Maybe we should consider, purely for psychological reasons, establishing a cap for Steem supply in the very long run and decrease Steem inflation a bit every couple of years. This will not affect in any significant way our economic model for the next 100 years but it may create a positive signal in the eyes of investors.

Maybe @moonjelly is right when s/he says:

It's like you are trying to sell me US dollars "to keep the economy up".

The FED can afford to get away with an infinite inflation because US dollar is still perceived as the ultimate currency. Steem is not in this position (yet) so maybe we should acquire a more humble approach. At this stage, our benchmark is Bitcoin, not fiat money. Once we have a total supply limit hard-coded in the blockchain, nobody could really argue with this claim:

If Bitcoin economically makes sense, so does Steem.

EDIT: Initially I thought my argumentation would end here, but now I think there is an extra twist to it.

Is inflation such a bad thing?

The answer is no! Actually, inflation is crucial when you try to bootstrap a new currency, as it enables its distribution to a wider population. You just cannot do it without inflation. Bitcoin would have never taken off if all tokens had been already created and stayed in the hands of the first initial miners.

Without inflation Steem would fail because the whole ecosystem wouldn't be able to expand. So inflation is an asset, not a liability, and we should embrace it. And if we added a long-term cap for the total supply, it would be even easier to accept it.

Sure there are potential problems with the steemit model as it stands but you shouldnt forget steemit it still in its infancy and is only in beta at the moment. I hear dan and ned have many ideas for the platforms future. We havent scractched the surface as far as reaching the masses goes either so i wouldnt write steemit off yet. Have faith and watch the magic unfold : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steem is highly inflationary, SP isn't. Deliberately so. Investors have got to be willing to wait a few years to allow an entity like this to develop and grow before pulling the plug/ dumping. Investors unwilling to do this are not investors they are speculators.

SP rewards investors that are active participants in the growth of the platform. It also makes authors, commentators and curators stakeholders in the enterprise.

I agree with you that SBD has the potential to becomes a ubiquitous currency, to me this is yet another string to the bow, not the only one.

Onboarding of institutional investors (ad agencies/ media companies) is possible as is moving to some (optional) ad based model.

The monetisation opportunities are vast, however the priority should be user adoption and gaining critical mass. From this, all things are possible.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In fact, SP is a significantly inflationary as well. The inflation rate for SP is something around 10% - which is similar to Bitcoin's average inflation.

What might matter is that Bitcoin's inflation gradually decreases, whereas SP's inflation is meant to stay at 10%. That's why I suggest we consider changing this a bit in order to make SP more similar to Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The 10% SP inflation can be offset by participating in the growth of the platform and earning SP (and SBD) Rewards. I take your point about perception though, however I think this is best combated through explaining how Steem/ Steem Power works, rather than aping Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I also prefer education to marketing tricks. But if helping perception costs us almost nothing - maybe it's worth considering.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This requires indefinite growth. however. Paying off investors with only the funds of future investors is the definition of a ponzi scheme. There has to be additional value in the system itself.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

See initial comment for additional value in the system. Not to mention others I haven't mentioned (value of being able to consume quality content, value of social networking etc). Steem is less of a ponzi than other cryptos that are simply bought on the speculation that they might have future utility or to be pumped and dumped for a profit.

For a ponzi there needs to a "non-existent enterprise" and "quick" returns for the first investors. None of these apply to Steem/ Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article and I'm flattered I'm quoted so much here because I know nothing (Jon Snow levels of nothingness). Your arguments are perfectly ok but you still dismiss or I would say undervalue the psychological/fundamental aspect.

Bitcoin is inflationary yes, however, there's an upper limit, it can't be mined forever. It doesn't matter if there's 16 or 20 millions for sale, like gold it's scarce and unique, that alone has value as long as it works. Many BTC were lost over the time too and will be lost in the future too.

Steem is the single point of failure in Steemit platform, it doesn't have a cap or upper limit as you mentioned and anyone knows it's highly inflationary, that by this time next year it will double its supply. Liquidity is scarce yes, but the incentive for the speculator or trader (who won't even use Steemit) is not there in the long term. And those are the only ones supporting the price right now. Unless they get a clear economic projection for the future, the market will continue to fall.

To me it all points to a very poor long term investment decision, that is to buy Steem and turn it into Steem Power. On top of a highly inflationary currency you are also choosing to lock it down for 2 years. Yes it's safe from inflation (not 100% though...) but only if you don't power down. So again, what's the clear incentive to turn BTC, fiat or any other cryptocurrency and turn it into Steem or SP?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I undervalue the psychological aspect??

My intention was quite the opposite - to stress its importance.

Steem is not meant to be an investment asset. Steem Power is the investment asset in our case.

The incentive is the same as in Bitcoin's case - that in the future there will be someone willing to buy it from you at a higher price.

For me, the lock down period of 2 years is good: I invest long term anyway (so I'd keep Steem long term even if there was no lock) and it protects me from sudden devaluation. Indeed, it's not an interesting offer for short-term speculators.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I understand that you remarked its importance but if you invested in it long term basically means you undervalue these psychological and fundamental aspects. You don't invest in something because you and you alone believe it will go up, you invest in something based on an holistic analysis of how the crowd, investors and speculators will react in the future. Then you can take a look at the technical analysis and see what's a good price to get in.

But as I stated many times, the problem is in its fundamental analysis, Steem or SP it's not supported by anything that says the value will appreciate in the near or long term future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed. But please note that this^ refers to all crypto-currencies in existence, including Bitcoin and Ethereum. I bet on Steem because for me it has the biggest chance to go mainstream.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't agree with BTC and ETH (potential for appreciating both in the near and long term is there). However I do agree that Steemit (due to its social media nature) has the most adoption potential of them all (not Steem though...).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for these helpful insights and I like the way you used common misconceptions and highlighted poor analogies. I believe as @steemrollin says it's only s matter of time before big company's see the value of this network and craft strategies to help drive more of their revenue. I hope the community embraces this new ad model and sees the benefits and potential of a Steem economy. Those are big goals!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I totally agree with @steemrollin's vision - we can expect a lot of interest from advertising and sponsorship companies. But I also think @moonjelly has a valid point:

So we cannot rely entirely on that - we will have to see how it works in practice. Whereas, demand for SD, once Steem as a social network becomes popular, is a much more robust foundation for Steem's appreciation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On a side note it's very refreshing to discuss all these different yet very valid points of views in a civil manner without any stupid circle jerking or fud going on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's the power of Steem. Most people do care here - both about the system as a whole (because they are shareholders) and their reputation (because it's expansive to lose).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great back and forth, interesting to see the various thought patterns going on in Steemit in relation to this subject. I'm a bit too tired tonight to comment but I have enjoyed reading this posting and comments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great back and forth, interesting to see the various thought patterns going on in Steemit in relation to this subject. I'm a bit too tired tonight to comment but I have enjoyed reading this posting and comments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The value of steemit comes from the value of any currency, the confidence of people that the currency has value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You misspelled @clains :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Sorry about that. Fixed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

While I do not know what the limit on steem dollars should be, I do think it is a good idea and would add value to have a limit.

I am not a fan of fiat money.

Steem on,

Mike

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm a fan of all money (fiat and crypto), I just don't have enough of it! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate the post. I'm here to get away from twitter. I enjoy writing and sharing my life. Maybe if i ever write anything of value i will find reason to learn more about the power of steem. Best wishes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, I believe there will be huge demand for SD in the future, but what could happen if there is not any demmand for Steem?

Could SD hold its peg if nobody wants steem?

I would like to read your thoughts on this matter.

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It goes like this: demand for SD will drive demand for Steem (because SD are made out of Steem), not the other way round.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Initially I thought my argumentation would end here, but now I think there is an extra twist to it.

Is inflation such a bad thing?

The answer is no! Actually, inflation is crucial when you try to bootstrap a new currency, as it enables its distribution to a wider population. You just cannot do it without inflation. Bitcoin would have never taken off if all tokens had been already created and stayed in the hands of the first initial miners.

Without inflation Steem would fail because the whole ecosystem wouldn't be able to expand. So inflation is an asset, not a liability, and we should embrace it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The inflation is too damn high. Had half the steem power but twice the value a month ago.... Wtf?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are confusing inflation rate of plain Steem (which is huge indeed) with the inflation rate of Steem Power (which is around 10%). The amount of your Steem Power rises quickly to counteract 90% of the effects of the inflation affecting plain Steem. But this does not mean Steem Power has a high inflation rate - effectively it's only 10% per year.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Right now it is not 0.19% inflation a day but 1% more or less... so one gets diluted by 0.10% dayly even holding Steem Power... If I understood correctly, this will go on for 12 months when the algorithm changes... Right now it is in distribution mode and even holding SP you loose 30%/year if you do not provide any content by upvoting or writing articles/comments....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know the exact numbers but surely an inflation of 30% per year for SP is incorrect. Your calculations must be wrong.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No... you missunderstand me... each time the steem supply doubles you loose 5% as a holder (you have 190 and should have 200). So at an inflation rate of 0.19% you only loose once the 5% as it takes exactly a year to double the supply... right now the system is doubling the units every 2 months at roughly 1%. so you loose 5% each 2 months.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think a lot of these misunderstandings come from people not understanding how the economics here work. I'm no expert so apologies in advance if I'm wrong but here is what I think:

The true value of STEEM comes form the effort required to produce content on STEEMIT - in the future there may be other direct sources of value. One could look on this as being equivalent to mining for BTC in some ways.

With STEEM the whole intention is not to have valuation held hostage by speculation so there is not necessarily a need for a limit in the amount of STEEM produced because of the relationship between SBD, STEEM and SP.

Putting a finite limit may end up encouraging MORE speculation on STEEM which is not helpful.

Further the question becomes how much of a limit is necessary?

Set too low and it will cause practical problems as the limit draws closer - increasing the price and speculation pressure.

It could also be creating a future quandary as to what would happen from a technical perspective as the limit approached.

Imagine if Steemit reached the size of say a Facebook or Youtube eventually. That cap could become a massive problem.

One could envision the kind of battles that have occurred over the BTC blocksize occurring as a result of this.

Set too high and people will complain about it devaluing the currency too much.

I also seem to recall that ethereum does not have an upper supply limit either.

Right now things seem to be working as they should. The value has been too high for people to buy in easily.

What we are seeing is a natural correction in value and a setting in of the effects that the founders @ned and @dan envisaged the Steemit economy creating.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right, finding the optimal level for the total supply cap is quite hard. But if we make the maturity date very far into the future (e.g. year 2140) it would only mean that before this date Steem will have to somehow reinvent its economic model. Please note that the same problem is faced by Bitcoin and nobody seems to be very concerned about it. It's just too far into the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will prove you wrong!

RemindMe! January 1, 2140

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually, it's May 7th 2140.

I'm gonna find you then :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It seems to me that having no limit on the amount of steem that will be created is greatly reducing the possible value of steem . I'am beginning to feel like I'm in a chain letter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is also no limit to fiat money inflation - do you feel like in a chain letter when holding cash? It's all about perception, there is little rationality in this. But I don't blame you - I feel the same.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Again, you can't do those comparisons. Yes we all know fiat is a ponzi scheme basically but when they print debt based money you are "buying" it with your work time. You understand that fiat has value disregarding the inflation and the "money from thin air" concept because you know how much any consumer product is worth in dollars.

Steem can't pull the same tactic because Steem itself the way it is conceived doesn't have any isolated value associated with it. Content created here definitely has value and so does SD, but Steem is not associated to anything really. The platform is free to use and could keep running like Reddit, Medium and Facebook if Steem price was $0.001 for all we care. That's the single point of failure in my opinion. If Steem was scarce with a cap limit, let's say 100 millions, it can definitely go up in price in the future. The problem with this is that the whole gimmick of 20k payouts per post will end and user retention will be cut in half at least creating a snowball effect. We have to admit 95% of Steemit success so far is because of the interest generated based on these payouts. Other than that Steemit is not groundbreaking in any sense for the average user.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So basically you are OK to give 1M USD per day to Bitcoin miners but not OK to give 100k USD per day for posting & curating? In Bitcoin's case it's not a gimmick?

What is Bitcoin associated to then?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If Bitcoin didn't have an upper limit of only 21 millions (more like 16-20 in our lifetime...) I guess it would be valued at less than $100. Bitcoin value also got to these levels because there are a lot of startups and interest on it, it's the true king of cryptocurrencies. It invented blockchain technology, it has a black market portion, it has proven its worth (whatever that is) ten times. And it's scarce so as long as it works it will tend to appreciate, that's the common thinking. And most average users don't even know what a Bitcoin is, but with five more years under its belt it can rival gold and other similar storage of wealth options.

You are just wishful thinking that Steemit will soar but I don't really see anything special if you take out the high payouts and rewards, if those are not sustainable, users will just lose interest. The market has been saying the same thing for many weeks now, so unless something change drastically (and we both made plenty of proposals) this is a sinking ship.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The bottomline in our discussion is that I'm not a investor (not by choice at least) but maybe I will be in the future if I see some clearer projections. You are invested on it so you are more emotional than me in this debate.

I hope you are right though, I wasn't around when Bitcoin started but it was definitely just as risky if not more than Steem right now. It evolved and I bought my first share at $200 after it crashed. I would need to wait and see if Steem can prove it's sustainable over a much longer period of time (at least an year) before I truly invest on it. However the 2 year SP lock is something I don't take lightly, at all. That's my opinion though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I respect this opinion (though I don't share it) and that's exactly why I proposed the supply limit for Steem.

All crypto-currencies go through those cycles. Including the major ones: Bitcoin, Ripple, Ethereum. Short-term price fluctuations don't mean anything.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

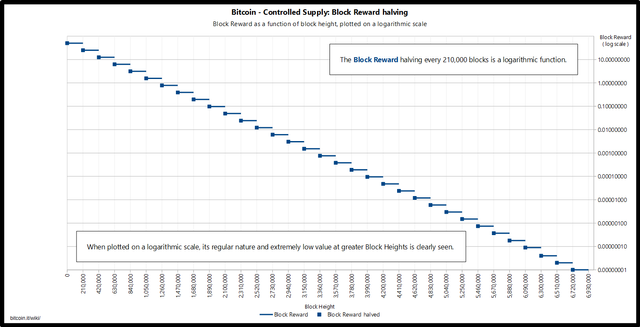

Because i was missing some pictures to your bitcoin-analogy, this is the Bitcoin supply, as you can see, you dont have to wait so many years of inflation, because there is the block halving by 50% every 210,000 blocks, (or 4 years) so there will be less and less new bitcoins, flooding the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

OK, the shape of this curve weakens a little bit my argumentation but the main point still stands: Bitcoin has succeeded despite having a significant inflation. Even now, after 8 years, about 1M USD of fresh fiat investment is needed ever day to sustain its price. And it will get worse when Bitcoin appreciates in value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah thats true, but only if every bitcoin is sold on open markets every day ;) There are still many people Hodling ^^

The thing is, Bitcoin wasnt meant to be deflationary , its a planned inflation where everyone knows, how much it is and how long it takes until next reward halving. So there is much time for adoption and 1M isn’t much for a global finance market right now .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly the same applies to Steem!

There are many people (me included) who have not spent any funds from their author/curation rewards - they are holding. They behave just like some Bitcoin miners who believe in Bitcoin's future and have access to cheap electricity - they just accumulate and hold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is worth trying if it would push the demand up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit