Steem, Bitcoin, and many other cryptocurrencies often experience a hyper-inflationary period. Usually shortly after they are launched.

Which, as you can imagine, might be quite a drag on the price.

If the supply is ever increasing, there must also be a corresponding increase in demand to offset the increasing supply.

If there is any dip in demand, prices go down.

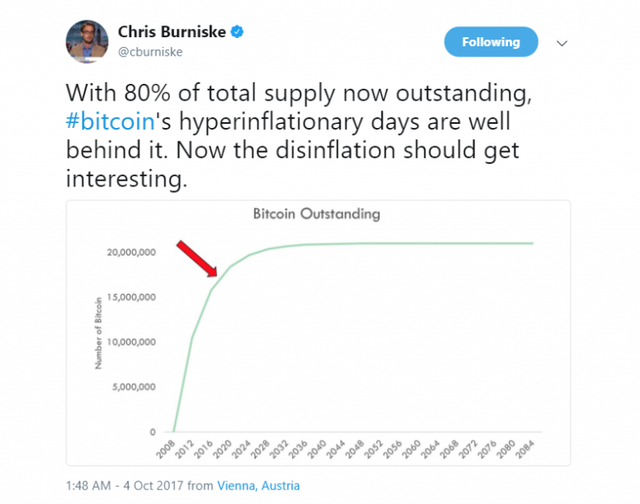

A quick look at the long term chart of Steem is a perfect example of this:

As you can see the price shot way up when payouts first started taking place only to trend down over an extended period of time.

Part of the reason for this was that at that time the inflation rate of steem was very high.

Since that time, the inflation rate has been drastically reduced.

Later on, when we saw an increase in demand earlier this year, we can see on the chart what that did for the price.

The price rallied from a low of around $.07 to a high of just under $3 per coin.

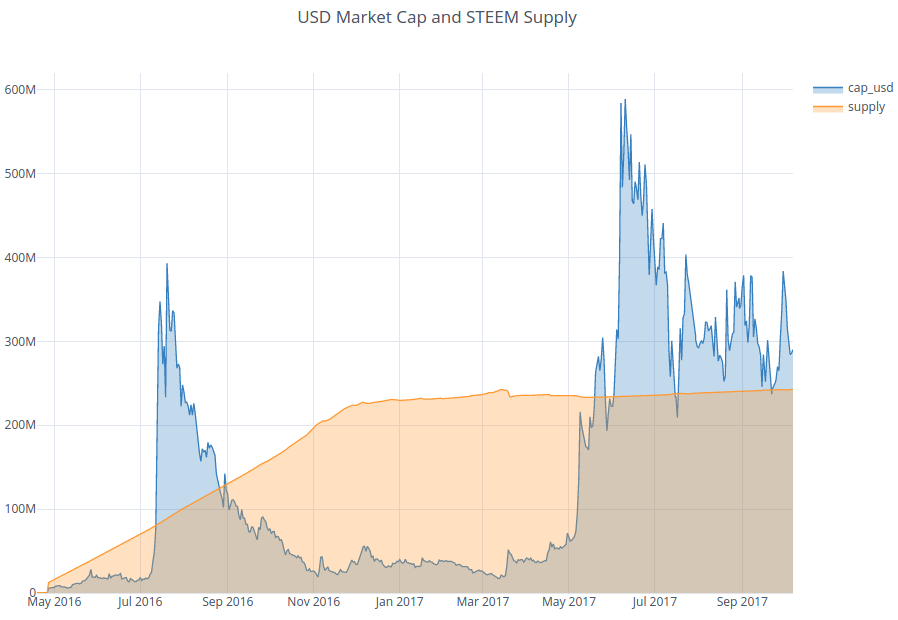

Bitcoin has just passed the 80% total supply mark.

Meaning that at this point, 80% of the entire supply that will ever exist for Bitcoin is already out there.

Check out this chart to illustrate Bitcoin's supply:

This is very important information because it means every new Bitcoin will be harder and hard to obtain. Which means if demand stays relatively constant, prices will go many multiples of where we are today.

If demand were to increase, we are talking about a moon shot for the price.

Steem is not quite in the same position as 80% of its supply is not already outstanding, but roughly 50% of its supply already is outstanding and the same principles apply.

Both coins likely to increase in value?

With each year that goes by, it will get harder and harder to obtain steem, and that is if demand just stays constant. If demand were to increase it becomes that much harder.

Basically, the thought process is the same for both coins, with one (Bitcoin) being in a slightly more advanced stage of its cycle.

Keeping this information in mind, it makes sense to accumulate as many coins of each as you can now, and enjoy the higher prices years later when it gets harder and harder to obtain both coins.

That is my plan at least.

Stay informed my friends.

Sources:

https://www.cryptocoinsnews.com/will-disinflation-bitcoin-lead-long-term-price-surge/

Image Sources:

https://coinmarketcap.com/currencies/steem/

https://www.cryptocoinsnews.com/will-disinflation-bitcoin-lead-long-term-price-surge/

Follow me: @jrcornel

That was extremely well explained! Thank you, even I got it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you. Seeing that chart of Bitcoin and how much the supply curve flattens out was pretty neat to see laid out like that. I can't wait till the supply curve of steem looks similar to that. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steem supply chart

The supply curve looks already a bit similar...

Source: https://steemdata.com/charts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's why I'm holding on to all I can!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I tots Agree! Great explanation!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ask for your help @richq11 and @jrcorner like my post hh

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The most misused terms in crypto are "bubble", "inflation" and "hyper-inflation".

Bitcoin has a set distribution scheme. This is not "hyperfinflation", which implies it is an uncontrolled runaway force. It isn't. Even arguing its "inflation" isn't close to the mark, since the supply is limited to a set amount.

This will become more apparent when the next reward-halving occurs, which is some time around June of 2020.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That bitcoin graph puts it into some serious perspective... Although I'm not sure what you mean when you say "about 50% of its supply is outstanding" - steem is a inflationary currency, so while the amount issued wil go down to about 1% inflation per year, theoretically speaking the future supply is infinite. Am I wrong here?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nope you are right. For some reason I had thought the supply spigot got turned off after 20 years. It does look like that .9% number though may go on forever?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This the good news the post! I personally look forward to the next article!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well explained. Grandma would understand!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@scandinavianlife agreed! Upvoted your comment. @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @jrcornel holding might work in the short term. But be sure to sell your holdings at the right time. Many new cryptos will replace the old ones, eventually. Not in a day or a week, but it will happen. The speculation that BTC will be harder and harder to come by hence increasing it's value FOREVER is not a realistic assumption.

I put in a lot of time in my recent post. Please have a read if you're interested. I'm a crypto trader, I'm new to the steemit community and I will bring in original content from my own experience to this platform. And educate people about smart trades, risk management and how to always stay on top. Any help from the veterans like yourself will be much appreciated.

Cheers,

@amratesh

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing dear it is amazing and information for every one.really helpful post for us.

Amazing post dear........

keep it up.

and please friends follow me.

@mahmoodhassan

And please upvote my post i also upwote your all post friends..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting statistics, we have to follow the evolution of bitcoin day by day

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"but roughly 50% of its supply already is outstanding and the same principles apply."

No. Steem's ultimate supply is infinity, much unlike Bitcoin's 21 million.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Inflation rate set at 10% this year, reduced by .5% down to 9.5% the following year etc etc. Set to drop .5% each year all the way down to zero in 20 years. Check the white/blue paper.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The white paper is obsolete.

The last time I saw something similar to what you described here, it was down to a .5% and never to 0%.

If you were correct there will be no author, curation and witness rewards in the future.

Also, even if you were correct, now there is still less than 40% the "final" supply according to your assumptions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good question thanks for this! I hope you have a wonderful weekend! Resteemed! But I don't understand how Steem can have a "supply" like BTC.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The total supply of Steem that can ever exist has been coded into the blockchain. That's how blockchains work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

OK cool, but then where does the steem come from that you earn on posts and upvotes? Thanks for being an inspiring Steemian and connecting on here! 🤡 🤠 😏 😒 😞 I hope you have a wonderful day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The whole supply of the steem doesn't exist yet. It is still being mined. Think of us like miners, we make posts and create engagement to mine coins. Hence generating more steam.

When almost all steem will be mined. It will be super difficult to mine the last few steem. And in practicality all of steem will never be mined. It will just keep switching back decimals. Like 0.00000000.....0001.

Read my blog (@amratesh) I made a post intuitively explaining ICOs. I'm planning to do one about Blockchain next. It will be more technical but I will do my best to explain it intuitively.

Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks yeah I'm trying to imagine how that will impact day to day steeming. 😀 😃 😄

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For Steem "50% of its supply already is outstanding", good to know, that's the question I was going to ask. Great post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very well explained. it is true.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

crypto will dump more because it is the end of the year

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your plan makes complete sense @jrcornel. And Steem is already supported well by Steemit users-- if the user base here continues to grow and we end up with a strong economic base here, the tokens will become that much more attractive to "pure" investors who are not looking to create content, just to hold and benefit from an increase in value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have to love the simple laws of supply and demand. The dynamic is certainly setup for price appreciation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow this really help thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mad important info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing @jrcornel .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your presentation is very nice. I am very glad to read this! you are awesome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@gold84 it is very interesting to know this financial and economic details. Only constant demand will bring the price up, after playing with scarcity. Now we are believers that because of all the developments mentioned by @teamsteem and @ned , allmthe advertising that people like @jerrybanfield are doing , and the publicity made by @andrewmcmillen the other day, and the SMTs , show as that STEEMIT is doing a lot to help cryptocurrency go mainstream. @kevinwong post that in the future everyone will be able to make its own crypto , and that people are talking that STEEMIT is working to monetize the internet. STEEMIT will help to transfer and redistribute wealth more than any other process in our history, and it will sooner or later together with other crypto, help to get banks and governments from the middle, puting power and control to people, that it were it belongs. Thanks for sharing. Just upvoted. @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am an artist by profession and after the 2008 financial crash affected my career I decided to study the mysteries of economics as a hobby and to educate myself as to how on earth such an economic disaster could occur.

I first learned about the greed and corruption but then I learned all about the dynamics inflation and deflation and this post explains it extremely well with illustrations that make the point very clear.

Eventually my self education all lead me to Bitcoin and it did not take me long to figure out that it was revolutionary and could change the world for the better.

Wonderfully explained and illustrated.

Great information @jrcornel :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As you mentioned "Basically, the thought process is the same for both coins, with one (Bitcoin) being in a slightly more advanced stage of its cycle." My query is what would be the value of Bitcoin at the end of this year?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

great post. i follwed you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It will certainly be interesting how much the supply situation will contribute to the prices.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Simple and explanatory, my kind of post. I thought the same thing but since i'm new at this stuff i was not really sure. It's good to now that i think the right way. Thank you for the information. Following you :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Earned my follow, well said my friend!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. Easy to understand explanation regarding inflation and deflation. But it raises a question that I have about bitcoin. I am new to this so please forgive my ignorance.

It is my understanding that bitcoin is a way to, among other things, transfer value from one person to another. This gets done by the work of miners who get paid in bitcoin. This is how new bitcoin is created (my understanding). Once all the bitcoin has been mined, how will holders be able to move bitcoin from one person to another? There will be nothing left to mine and I doubt this will be a charity driven effort.

Or am I completely misunderstanding the whole role of what miners do? Because it won't really matter how scarce something becomes, if it ceases to have utility value. IMHO

What does the post mining ecosystem look like for bitcoin? I do know that when you move bitcoin you lose some as mining fees, is the answer simply that miners will take all their fees from those transferring the bitcoin, without getting extra from the creation of new coin? Would fees then skyrocket?

Again, sorry if this seems like a very elementary question, but my mommy once told me that "the only stupid question is the one you don't ask".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article. Followed and upvoted.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Supply and demand economics at its finest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. You see this with a lot of ICOs, a big spike initially followed by a long exponential decline. For some I don't think demand will hold out long enough to revisit the initial spikes, e.g. Bitcoin Cash.

Steem I suspect will have a strong future, Steemit has a great chance of overtaking Reddit one day in my opinion.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just wrote a post along similar lines. I actually feel quite concerned at how little the current situation seems to be being talked about — i.e. the extremely fast hyper-inflation/deflation cycles-on-steroids vs the potential for cryptocurrencies to be used to actually buy things without potentially dropping in value overnight by 40% and making everything 40% more expensive.

The example you've given might make sense in terms of straight economics compared to other fiat currencies, but as long as cryptos can't be reliably used for real world spending, then I can't see how that growth will be able to continue indefinitely. It needs to be able to be used to buy things, otherwise it's basically more like shares in an imaginary company, which then starts to sound dangerously like the pyramid/ponzi examples being dished out. This is a potentially really big problem.

https://steemit.com/bitcoin/@cmaccu/bitcoin-jesus-advises-against-making-bitcoin-transactions

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit