Financial responsibility is a crucial aspect of adult life. While we all enjoy some indulgence from time to time, it’s essential to identify and address the habits that can lead to unnecessary financial losses. In this article, we’ll explore five common money drains, such as daily Starbucks coffee purchases, and calculate the monthly cost of each. We’ll also provide alternative solutions to help you save money without sacrificing too much of life’s pleasures.

The Daily Coffee Fix

Monthly Cost: $90 — $150

Many of us start our day with a cup of coffee, and while that’s perfectly fine, indulging in daily visits to coffee shops like Starbucks can quickly add up. Let’s do the math: assuming an average spend of $3 to $5 per coffee, a daily habit can cost you between $90 and $150 per month. That’s a substantial amount leaking from your wallet.

Alternative Solution: Invest in a good-quality coffee maker and brew your coffee at home. You’ll not only save money but also have the freedom to experiment with various coffee blends and flavors.

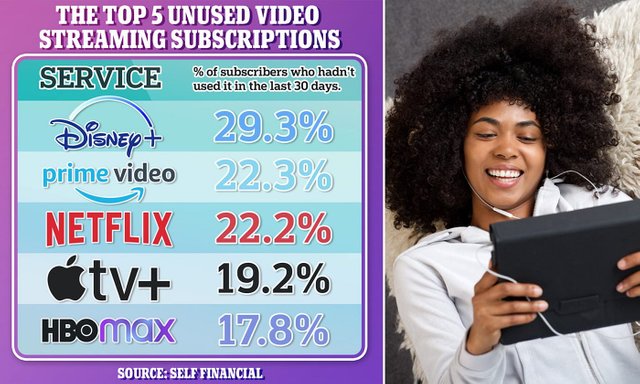

Unused Subscriptions

Monthly Cost: Varies

Subscriptions for streaming services, magazines, or gym memberships can be convenient, but they often go unused. The monthly cost of these subscriptions can range from a few dollars to much more.

Alternative Solution: Review your subscriptions regularly and cancel those you no longer use. Opt for pay-as-you-go or free alternatives whenever possible.

Dining Out Excessively

Monthly Cost: $200 — $500+

Eating out is enjoyable, but it can take a significant toll on your finances, especially if it becomes a regular habit. The average cost of dining out for one meal can range from $10 to $35 or more.

Alternative Solution: Limit dining out to special occasions and cook at home more often. Not only will this save you money, but it’s also a healthier option.

Impulse Shopping

Monthly Cost: Varies

Impulse shopping, whether it’s for clothing, gadgets, or home decor, can lead to unnecessary spending. The monthly cost depends on your habits and self-control.

Alternative Solution: Create a budget and stick to it. Before making a purchase, ask yourself if it’s something you genuinely need.

Unplanned ATM Withdrawals

Monthly Cost: $20 — $50+

Frequent ATM withdrawals, especially from non-network ATMs, can result in hefty fees. These fees can add up quickly if you withdraw cash frequently.

Alternative Solution: Plan your cash needs ahead of time and use your bank’s ATMs or those within their network to avoid unnecessary fees.

In conclusion, small expenses can add up to significant financial losses over time. By identifying these money drains and implementing alternative solutions, you can improve your financial well-being. It’s essential to strike a balance between enjoying life’s pleasures and being financially responsible.

FAQs

1. How can I track my monthly expenses more effectively?

Consider using budgeting apps or spreadsheets to track your expenses. This will help you identify areas where you can cut costs.

2. Is it okay to treat myself occasionally, even if it involves spending money?

Absolutely! It’s essential to enjoy life and treat yourself, but do so consciously and within your budget.

3. What should I do with the money I save from cutting these expenses?

Consider saving or investing the money for future financial goals, such as retirement, a vacation, or emergency funds.

4. How can I avoid the temptation of impulse shopping?

Before making a purchase, take a moment to evaluate if it’s a need or a want. Stick to your budget and avoid shopping when you’re stressed or emotional.

5. Are there any tools or apps that can help me save money?

Yes, there are many financial apps and tools available that can help you budget, save, and invest your money more efficiently.

Hello @kamlah.

I saw that you recently arrived on the platform.

On a blogging platform as big as Steemit, you run the risk of not moving forward and not getting the desired results if you do not follow the right path.

There are some basic rules to follow such as posting original content, spamming, plagiarism and AI are not allowed, images must be owned or sources must be cited.

Did you know that there is the Newcomers' Community on Steemit, which helps new users to achieve basic goals step by step in order to be ready for the Steemit ecosystem?

If you are interested in learning more, I recommend you take a look at: Newcomer Guidelines you will find a lot of information that will be useful.

You may also entering some competitions organised by the various communities that's a great way to gain more visibility and make yourself known on the platform.

Try to find the contest that suits you, visiting Contest Alerts: Active Contest List.

I hope I have been a little helpful and good luck with your blog.. ;D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit