10 AUGUST

UPDATED 11 AUGUST

Let's make this analysis more in depth than the others, i will also try to explain a few trading concepts that will be re-used in my analysis.

We are still trading under the 50 MA line and the 200 MA line. On the chart we can see 2 dead cat bounces where the price tried to go over the 200 MA line for one hour and a sell off occured. This is a bearish sign signaling prices are going to go lower in the near future. We are also seeing lower lows one after another, this is a bearish sign.

I expect the price to fall back to 0.57 USD where the next big resistance seems to be. Of course, this is what is most likely to happen and the odds are in favor of a bearish scenario, but in trading anything can happen and you should be prepared for it.

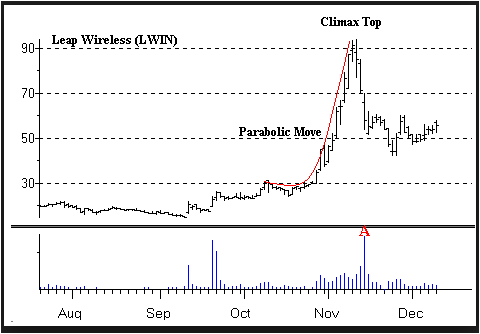

UPDATED : We are now trading at 1.53 USD from past highs of 4.39 USD, this is normal after a parabolic move.

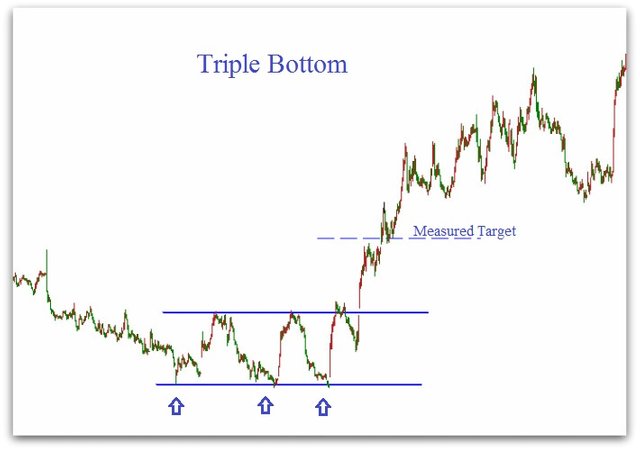

Breaking down after a triple bottom is very bearish as a triple bottom is normally a bullish sign. But instead of going higher prices are going lower, we should see new lows coming soon.

HELP on how to understand the charts

Under this line i explain how to understand the charts, i will use this information from now on to help you guys understand better how this whole thing works. If you understand trading and technical analysis, the below lines are useless to you.

What is the 50 MA and 200 MA and why does it matter ?

Link : http://www.investopedia.com/terms/m/movingaverage.asp

When the price is trading under the 50 MA is a bearish sign, meaning that the price should be moving lower in the future. The same goes for the 200 MA, but the 200 MA is a longer term trend, trading under the 200 MA is very bearish.

Bullish reversal, how to see it

You may want to know when the price is going to reverse, first of all the price should move over the 50 MA, then the 200 MA, once it's there, the 50 MA line should cross over the 200 MA line, if this doesn't happen, it's a bearish sign, if this does happen, it's a bullish sign.

So if you see the white line (50 MA) crossing over the orange line (200 MA), this will mean that the price of STEEM is going to go much higher and that the longer trend reversed from bearish to bullish.

Actually the white line (50 MA) is trading under the orange line (200 MA), this is a very bearish sign, meaning the price is most likely to go down. On the chart you can see that sometimes the price go over the orange line (200 MA), you may think that it's a bullish sign, but it's not. It's what we call a dead cat bounce and it's a good point to sell off your STEEM if you still have any.

Lower lows, what it is

Lower lows indicate that the trend is bearish and prices going down more and more, until a higher low happen, we can expect the prices to go down. If you look at the chart, we have only lower lows, meaning the odds of the price going higher are very unlikely.

Support points

The support is where the price in the past encountered a lot of buyers and where the price couldn't go lower. If a support is broken, we look for the next support and so on. Breaking a support one after another is a very bearish sign.

Resistance points

The resistance is where the price in the past encountered a lot of sellers and where the price couldn't go higher. If a resistance is broken the price might go much higher in the near future, it's a very bullish sign.

Parabolic move

When the price rise higher very fast this creates a parabolic move, when this happens almost always the price falls back to where it was before the move occured.

Triple bottom

Normally a triple bottom is a bullish sign. In our chart our triple bottom went down instead of going up. This is very bearish.

Fundamentals

Technical analysis is all good but not enough, it should be used with fundamentals. Fundamentals are information about the company itself, what is going on in the company, new products, financials, everything related to the company. For STEEM the company is STEEMIT, so we should be looking at STEEMIT and see how things are going.

The more power down, the less likely for the price of STEEM to go up.

The more cash outs from members, the less likely for the price of STEEM to go up.

The less retention of new users, the less likely the price of STEEM to go up.

And so on... Fundamentals are important, because even if the chart is very bearish, if the fundamentals are good, the chart will reverse at one point or another. I believe the fundamentals are not looking good today, so the bearish scenario is very likely.

Thanks for contributing with actual explanations of what these charts are showing - many have no clue what dead cat bounce could mean or resistance & support areas as they are not traders! How do you expect to make money if you post chart that only other traders understand and can see for themselves easily? But you took the critique like a man and improved, I hope you stay on that path.

And about the price of Steem, well I can say my investment is hurting for sure. Will this be my #1 mistake in cryptospace, I sure hope not but locking down my steem might not have been so good idea. As a hobbyist trader it hurts to have funds literally locked away! But you live and learn, that's life.

I'm personally expecting to see some kind of resistance at 0.0024773btc/steem area as this is a fib line cryptos usually like to bounce off(78%), but I agree with the notion that there just is a damn huge sell pressure and not much support so eventually we could see return to under a dollar. Maybe steem is supposed to be there with the high amount of inflation it was blessed with?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When i first started trading i lost 40 000 USD of my own money the first month. Sometimes it takes a huge slap in your balls to move forward. When that happened at first i was the most devastated person on earth. Then after a while you start to accept your mistakes, then at that precise moment you decide if you are going to improve yourself or if you are going to let it go and do something else. I chose to improve myself, bought a lot of books, joined trading groups with traders from JP Morgan, Goldman Sachs, etc. I did a lot of mistakes, but in the end i learned and i'm still learning everyday. And of course my money is back into my account :-)

All the best traders in the world had to learn and most of them lost a lot of money before understanding how to make money in the markets. I could write a book with all the experience that i have now, but no one wants to read a book by a guy who is not very successful first. So that's going to wait until i achieve all my trading goals.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Damn, 40k in a month and you made it through. That is impressive, not the losing part but standing back up. Keep posting, good practice for your book.

Maybe even go through more basics like different indicators that are widely used, stop-losses, trading account handling for long term etc.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is great! I appreciate the fact that you took the criticism on your other post and turned it into something so productive. I look forward to reading this in more depth after work.

you've got my upvote and follow.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. Good honest analysis is something Steemit needs more of. A platform can not survive if everyone has their head in the sand saying everything is great.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the post, for me it was very informative!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My pleasure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@najoh great job. This is your best analysis so far!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, the analysis is the same mostly but i added information on how things work. On my next analysis i will try to add some info to the existing info, the goal is to add value to each analysis and at the end we will have a very complete article. It's best to do this step by step.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Word @najoh. I think you are doing it right. You don't want to overload your viewers with too much info. at first. Keep it up brotha and fellow trader.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very informative and well explained from basics..thanks for the info n wish to see more analysis from u

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Some good explanations - this is useful for the newcomers.

The price of STEEM being low is actually a good thing. From my reading of the whitepaper (which admittedly was a while ago) the whole point of the way things were designed was to stop the price going too high and STEEM being used for usual pump and dump speculation which we see all too often.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, i will try to do even better next time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bloody awesome! and thanks alot for posting, have you thought about expanding upon this? I for one would love to learn more about the in's and out's of trading.

You could also start a weekly blog "najoh's weekly picks"? a rundown of what's going on in the Crypto trading sphere? I would gladly read and upvote.

I have had small successes and my fair share of failures ;) and could always learn more about not hemorrhaging money on a weekly basis lol

Once again thank you for posting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will keep posting about technical analysis only if enough people are interested in it. Today for example i bought 10 000 shares of TK company after i went over the transcript of earnings report. Last month i traded around 15 million USD of silver and gold. This month i didn't trade apart from the TK trade as i took some time off. I don't trade cryptocurrencies, but it's all the same.

But you need to understand that if i'm making only pennies on steemit i can't use much of my time to do in depth analysis. My first post on steemit was one of my trading strategies that work most of the time, i deleted it because it earned just a few pennies, and that valuable information can't be public for pennies.

As you can see the price of STEEM went down again today. I feel bad for all those guys who didn't read my analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem. Unfortunately there is a little more to Steem posting then meets the eye. If it's the big payouts you're after then you're probably better of just sticking to trading rather than posting trading advice ;).

But anyways thank you for sharing your experience.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not only the big payouts, but at least some support, votes and comments. If the price reverse the technical analysis will be more bullish and i believe many more people are going to up vote it as they like to hear that their investment is going up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Psychology does play a massive role in... well most things really but especially money, religion and marketing.

Consistency and platform research will get you where you want to be (https://steemit.com/steemit/@scrawl/the-best-time-to-post-on-steemit) I found this post by scrawl to be very informative.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

awesome Moving average and price action trading strategy.

waiting your next trading analysis :v

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ey up @najoh have you ever thought about doing a series of videos covering different aspects of trading for a novice? (like me) cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not very good at doing videos ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I updated the chart and information instead of creating a new article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"I believe the fundamentals are not looking good today, so the bearish scenario is very likely."

Isn't that usually when the price goes up? ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not really, it all depends on the "future". If fundamentals are not good today but might be very good in the future, then the price might go up. Like it did with the internet bubble and still does for a few companies like Amazon and Facebook. But Steemit and steem are way too young yet to draw any conclusion and investors are in the sidelines.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What specifically about the fundamentals are you seeing as 'not good today'?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bad user retention, a lot of whales powering down, a lot of users cashing out instead of powering up, potential problems with governments because you can't censor content. Etc etc.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would argue that your last point about censorship will be a positive fundamental, not a negative. At least in the short to mid term timeline

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit