As a kid, my first “business” was buying and selling baseball cards.

My parents were heavy seed investors. And it wasn’t very profitable…

I’d go to card shows to sell my collected cards. After every successful one, I’d “reinvest” any profits in more cards, hoping my empire would grow. In that regard, my business wasn’t much different from Tesla or Uber. (What can I say? I was ahead of my time.)

Now, my favorite was a 1985 Topps Olympic Mark McGwire rookie card. I bought it before he and fellow slugger Sammy Sosa reinvigorated baseball with their famous home run derby in 1998.

The card’s value jumped from $5 to $200. I should’ve sold at the top. Last I checked, it’s worth $5 again. So I round-tripped that one.

Young Nick just didn’t know the first rule in making money on collectibles. And I’ll share that with you in a bit. But first, here’s why we’re talking about collectibles…

Not Just a Hobby

Regular readers know we follow an asset allocation model at PBRG. That’s because a broadly diversified portfolio has lower risk and higher return potential.

In fact, various studies show that more than 90% of a portfolio’s long-term returns are driven by asset allocation. (Palm Beach Letter subscribers can read the entire asset allocation guide right here.)

Like traditional asset managers, we allocate to cash, bonds, and stocks. But we also invest in precious metals, annuities/life insurance, real estate, and private businesses, too.

And we generally allocate about 5% of our portfolio to chaos hedges like collectibles. (Chaos hedges act as “disaster insurance” to protect against possible future market crashes.)

You see, even a small percentage of wealth to these assets can make you outsized gains.

Take collectible cars, for example. PBRG guru and former hedge fund manager Teeka Tiwari says they’re one of the best-performing assets in the world:

Millionaires and celebrities have been enjoying and profiting from them for years.

Since 2005, the S&P 500 is up 145%… Yet during that same span, Südwestbank’s OTX Classic Car Index quadrupled—giving investors a 300% return. That would’ve turned $5,000 in $20,000.

And from 2007 to 2017, the classic car component of the Knight Frank Luxury Investment Index returned 334%. The S&P 500 gained just 82% during that time.

Even last year—when almost all asset classes lost money—the HAGI Top Index for rare classic cars was up 2.5%.

Classic cars have risen in value for the last 30 years. And during the 2008 financial crisis, the smart money flowed into this safe-haven asset.

That’s because collectibles like classic cars are uncorrelated to other assets. They’re hard assets that maintain their value—which is why they’re part of our PBRG asset allocation model.

However, Teeka says not all cars are collectibles. Nobody’s investing in a 1990 Ford Tempo or a Toyota Corolla. There’s too many of them made.

So you have to look for cars that are rare and in demand. And the same rule applies to baseball cards (or any other collectibles, for that matter).

Million-Dollar Assets

To find out how much some of the rarest cards are worth, I reached out to Michael Hogue of the T206 Society. (You can visit the society’s website here.)

The American Tobacco Company issued the T206 card set from 1909–1911 in cigarette packs. Only 524 players had cards made. Few people kept them—so they’re rare today.

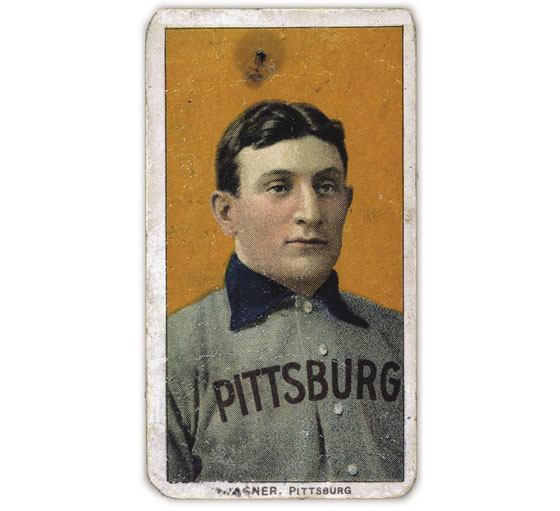

Collectors consider the T206 cards as fine art. One private collector even paid a record $3.12 million for a T206 Honus Wagner card in 2016.

An example of the Honus Wagner T206 baseball card

Michael told me that a mint-condition, professional-graded Mark McGwire Olympic card (like I had as a kid) sold for thousands of dollars in the late 1990s.

But now, it’s worth only $5 since so many were made. Plus, baseball purists soured on McGwire and Sosa—who were both central figures during baseball’s steroid era.

In fact, Michael told me baseball cards printed after 1960 won’t increase in value like the rare T206 cards. Too many were made, and collectors saved most of them. So the demand is scarce.

But if you want to collect cards of modern-era athletes, look for special edition “inserts.” For instance, a rare 2000 Tom Brady rookie insert sells for $500,000 on eBay.

Michael’s advice: “If you’re smart, buy collectibles you like that can’t be reproduced. And buy old and iconic ones.”

That sounds exactly like what we’ve been saying…

Turn Your Passion Into Profits

With all the volatility in the stock market, it’s important to diversify your assets. And investing in collectibles is a great way to do so. It’s how some of the richest people on the planet have grown their wealth.

Plus, just think about how much fun you’ll have at your next cocktail party…

While others are talking about their latest stock picks, you can casually mention the vintage Porsche Turbo you just invested in—or the red-back Ty Cobb card you sold for thousands of dollars.

So the next time you clean out your attic or basement, do a bit of treasure hunting. You never know what type of collectible you may find.

Regards,

Nick Rokke

Analyst, The Palm Beach Daily

Sincerely yours Palm Beach Reseach Group

yeah I thought I was going to be rich buying cards back in the 1980s, unfortunately that's when they really got mass produced and everyone stored them well, so they are mostly worthless. I do have a few older ones thought that I bought or traded for over the years, still up in the closet !! (-:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit