I have modeled the STEEM price scientifically, then forecasted it, and the results were shocking!

I don't use technical analysis to predict prices because it's pretty unreliable, and I have yet to find a scientific research that have proven it's accuracy over long term. I might use technical analysis sometimes for illustrative purposes, but if we want to be serious we need to use real mathematical tools.

I use Quantitative Analysis and Econometrical tools to model financial markets, just like any Ph.D. Quant professional on Wallstreet.

I have demonstrated the usefulness of quant models in my previous articles:

- https://steemit.com/bitcoin/@profitgenerator/let-s-calculate-the-probability-of-bitcoin-going-to-1000usd-and-above-pt-1

- https://steemit.com/bitcoin/@profitgenerator/let-s-calculate-the-probability-of-bitcoin-going-to-1000usd-and-above-pt-2

- https://steemit.com/steem/@profitgenerator/scientific-forecasting-of-sbd-volume

In this article I will forecast the STEEM price about 42 days in the future, and the results will be pretty dramatic.

Modeling STEEM

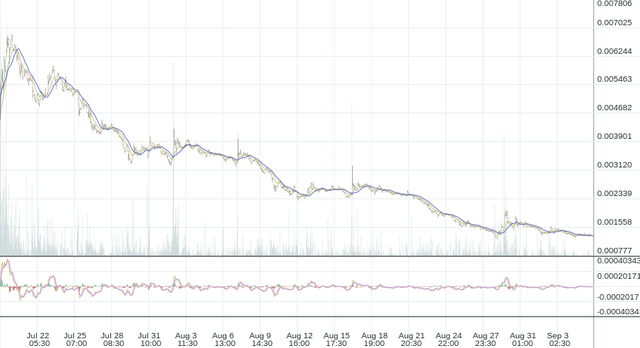

I have downloaded the STEEM_BTC price from Poloniex with their API system, by calling:

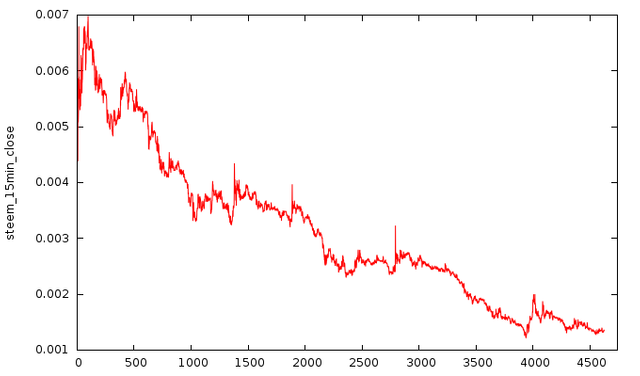

https://poloniex.com/public?command=returnChartData¤cyPair=BTC_STEEM&start=1&end=9999999999&period=900It is price data in 15 minute timeframe (lower timeframes have too much data, and high signal to noise ratio, and in some cases many null values, that distort stats severely, so I have chosen 15 minute). We have 4625 elements, until yesterday, spanning from

Tue Jul 19 04:15:00 2016 UTCtoMon Sep 05 08:15:00 2016 UTC.I have used the good old

ARIMAmodel to model the price, and we will achieve very low statistical error numbers.I converted the

JSONfile intoCSVso we can work easily with the data.

- We look for a trend, which is obvious that there is one, if we just look at the chart, but we use objective tools to measure it, like unit root tests:

Augmented Dickey–Fuller Test:

| type | asymptotic p-value | model |

|---|---|---|

| with constant | 0.5833 | (1-L)y = b0 + (a-1)*y(-1) + ... + e |

| with constant and trend | 0.2408 | (1-L)y = b0 + b1*t + (a-1)*y(-1) + ... + e |

| with constant and quadratic trend | 0.135 | (1-L)y = b0 + b1*t + b2*t^2 + (a-1)*y(-1) + ... + e |

We observe that we have a constant at least and probably a trend , so we will need to differentiate having a d>0 in the ARIMA(p,d,q) model.

Kwiatkowski–Phillips–Schmidt–Shin Test:

T = 4625

Lag parameter = 70

Test statistic = 0.765265

P-value < .01

The KPSS test has an inverse null hypothesis so a p<0.01 also confirms that we need to differentiate.

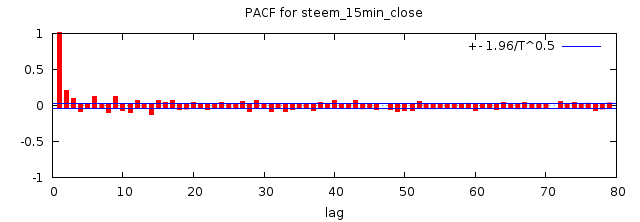

- Then we look for the

pandqvalues with a Partial autocorrelation function

We observe that the p and q values will probably be between 0 and 1. But I have tested all possible combinations from 0 to 4.

- Then I went through all combinations from 0 to 4, an surprisingly the best model is

ARIMA(0,1,0)orI(1), technically we just have a constant and a differentiation of it.

Constant coefficient: −6.79381e-07

Constant standard error: 9.27125e-07 (very accurate)

- According to Wikipedia an

ARIMA(0,1,0)with a constant resembles:

An ARIMA(0,1,0) with a constant, given by

— which is a random walk with drift.

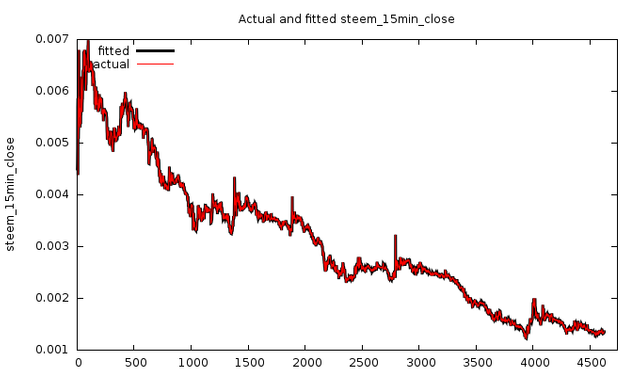

- The model fits perfectly (I have made 1 line wider to be more visible):

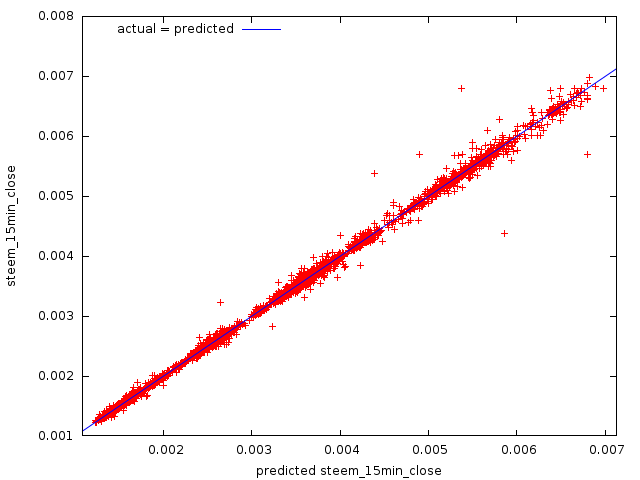

- The actual vs predicted chart shows that they are aligned very well, with a few exceptions:

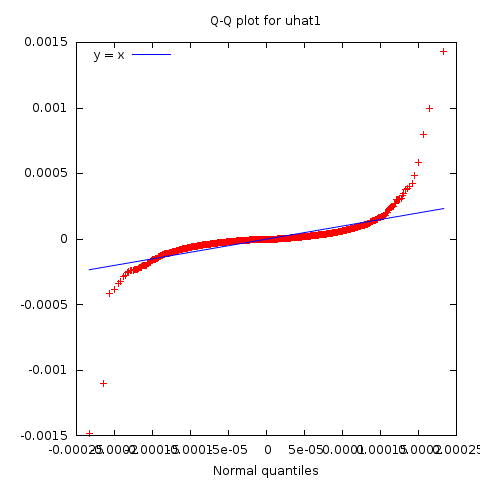

QQ Plot:

Forecasting STEEM

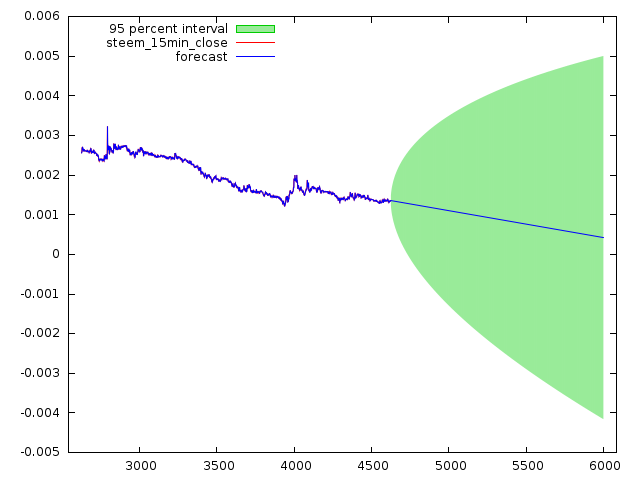

I have forecasted the STEEM_BTC price to 4000 units in the future, which for 15 minute chart means 41.6(6) days.

So if our last data unit is Mon Sep 05 08:15:00 2016 UTC this means that our forecast will last until Mon Oct 17 00:15:00 2016 UTC.

The error numbers are ultra low (for the actual data of course), so this means that our forecast data should be very accurate:

| Error | Number |

|---|---|

| Mean Error | -1.0082e-20 |

| Mean Squared Error | 3.9738e-09 |

| Root Mean Squared Error | 6.3038e-05 |

| Mean Absolute Error | 2.9055e-05 |

| Mean Percentage Error | -0.012379 |

| Mean Absolute Percentage Error | 0.91349 |

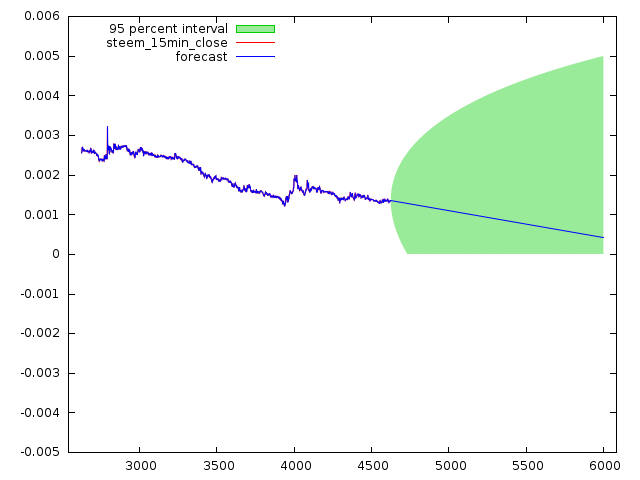

And since the price can't go below zero perhaps a more correct chart would look like this:

Where the area below the line has an equal probability of happening with the area above the line. So the price should be inside the green area with a 95% probability.

We also observe that it's very unlikely that the price will go above 0.005 BTC, with the probability of <2.5% of that happening in the next 41 days.

This means that the STEEM price at Oct 17th should be :

0.00043 BTC

Last price is 0.00131450 BTC, so this would be a -67.28% drop in the next 41 days!!

So given that our model is pretty accurate with an absolute error of only 0.000029055 from the mean, I think we have some problems.

I don't want to scaremonger here, and I could be wrong, but if I am not, then we have a problem, and the community has to do something about it. I hope @dan and @ned is already aware of the instability of STEEM and are looking for solutions to stabilize STEEM.

The market cap has already went down a huge amount so a further decrease is not unlikely. We as a community need to do something about it, to make STEEM stronger and more trusted.

I will write my next article about how to stabilize the STEEM price and ideas for long term growth. Stay tuned!

Disclaimer: The information provided on this page might be incorrect. I am not responsible if you lose money using the information on this page! This is not an investment advice, just my opinion and analysis for educational purposes.

Title Image Credit: @d3m0t3x

Chart Image Credit: https://poloniex.com

OK so . this is the EMERGENCY situation. Something we have been discussing before. The problem is that nobody listen. I have a very easy and very quick emergency scenario . The problem of steemit is that steemit has no income side. We have to build one and I can tell you how.

There are two big fat whales on the list who are benefiting from the steemit and from steemit customers and shareholders as well. This big whales are Bittrex (row 22) and Poloniex (row 11).

They are holding massive amount of Steem and Steem Dollars. Both of them get this amount for listing STEEM and SD to their exchanges what is perfectly fine. I have no problem with this (but). As a shareholders of Steemit they also have very best interest to protect and support their investments. Here is the thing. They are making bunch of money by collecting fees from all of us. What is not very positive sign of investor relationship.

In my opinion as a shareholder I would like to give them chance to prove, they are those investors who want to support their assets. They should support buy side of the market in amount of 100% their collected fees as a single event. This is not a bad solution for them. They can massively support buy side and help to stabilize market. This solution is not temporary . They should keep buying every day in amount of 100% of daily collected fees and prove they deserve massive part of shares from early stage of the project. This is the way how they can demonstrate contribution to Steemit.

If Poloniex and Bittrex decides to do this action, we can take some time and build another steps to increase value. Steemit should have create this solution as a first real income in his history.

If Poloniex and Bittrex will not by willing to do this reasonable gesture, then steemit have to consider the option of rebuild an existing internal market and add BTC. Every new member of the steemit should have chance to change his BTC for STEEM without any fees. this could be also attractive for new members who wants to trade on the transparent internal market where people believe in steemit in long term.

Lets stop draining money out of the steemit.

What you think about this ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is completely wrong. Those coins do not belong to them, the belong to their customers who have them on deposit with the exchange

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From my little fees I always convert them to steem power :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

An interesting solution but I think the issue is more complex.

If whales start to buy more STEEM and STEEM POWER, then everyone will cry that Steemit has big inequality.

If whales power down and sell STEEM POWER, their % vesting power decreases, and Steemit becomes equal, but then the STEEM price goes down.

So the community really needs to decide what do they want? Stable STEEM price, or social equality?

You can't have it both.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you miss something. (or me) Look at the last column on the table. This is not amount what can make inequality. This is amount for slow down the market a bit. I am not sure if this amount will be enough to stop free fall, but if yes , then its better to start this way.

https://steemit.com/steem/@airmike/how-to-save-1-of-any-steem-transaction-on-the-exchange

I was not talking about powering down at all. I was suggesting trade on the fair market and get funding from new members of community. There is lot of people and companies out there who will fund thousands of dollars just for promotion once community has reasonable size.

Yes, community have to decide what they want, but look at your 41 days forecast :D . Do we have enough time ? . I guess no. We have to take an action. Easy and quick action.

No time to wasting money. This project was full of wasting money from beginning. Take a look at the fat exchange whales I was talking about before. Take a look on the Market-making rewards. (absolutely nonsense spending)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Perhaps some big companies start to get into here.

I am sure since the new Promotion feature was added, many companies would prefer to advertise here. Perhaps extend the 24 hour period, and leave promoted content for 1 week, would help. It could become a very attractive feature.

If big SIlicon valley companies would join us, that would be a breakthrough.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Poloniex earning interest from holding deposited SBD. It's 10% a year, payed every month - if nothing has changed. They have almost $200k, which is 20k a year! I guess that 1400 SP they have is funded with this, but maybe I'm wrong.

Anyway, people shouldn't keep SBD at exchanges because they loosing interest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And next:

I don't understand your logic, feel stupid.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Because it's a probability distribution. Our model fits perfectly on the actual data in the past values, so our estimation will probably be reasonably accurate as well.

However the future is uncertain, anything could happen, so we cannot forecast anything with 100% accuracy.

This is why we have an area of confidence where the price could land on. It can be anywhere inside the green area, with 95% confidence, and outside it with 5% confidence.

It should be distributed along our forecast line, but it can deviate from that, for any reason. Also the further we forecast, the less certain our prediction is. So quant models should be used to forecast in the nearest future possible for good accuracy. Here I just used the data available to do it as accurately as possible. It might be inaccurate, after all we still have mean errors, and variance errors, but it is what we have.

Think of it like playing darts, for example we know with 95% chance that the dart will land on the board and 5% that it will land on the wall or fall down. We would like if we could hit bullseye, but it might not happen , instead we will just hit some spot on the board.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WTF... I don't understand a damn thing in this post. lol

Steemit will be $1.25 that my guess in 41 days.

:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's just math. :)

We shall see what the price will be.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your warning! Very good analysis!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, but remember this is not investment advice, I could be wrong.

If the developers reduce the inflation in the next weeks, and add more features, then the Steem price could stabilize in the end. I hope this scenario happens, instead of my analysis scenario.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I understood that not an investment advice. But indeed there is some balancing necessary. The best for steem would be producing realistically fantasy for the future :-) And - good substantially posts of the community ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just hope for the best, there is potential in Steemit, it can be the next reddit or facebook, a few more features and we are ready to go big!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Better to jump off a bridge or drink mystery kool-aid?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think we just need to make STEEM more stable. I am bullish for Steemit longterm, I see great protential in it.

But the inflation is too high, making the price drop. And the demand is not that high either, we need more Steemit users.

I will write my next articles with tips how to fix this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, most people vested in the platform are bullish for it long term, but for that to be realised being bearish for the next 4-5 months is a good idea.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea except the price will pretty much be 0 if this trend continues for 4-5 months.

So the bearish trend should pretty much stop in the next 2-3 weeks, and for that we need some extra features, many more users joining us, and going mainstream fast.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well that isn't going to happen in the next 2-3 weeks, development is slow, its just the nature of how the world works.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really enjoyed this post. I know steemit is growing, but I guess not fast enough. It looks like turbulent days ahead.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Perhaps, in users, but not entirely in demand.

There are also a lot of inactive accounts as well:

https://steemit.com/stemmit/@elyaque/steem-report-september-5th

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for compiling all of this data... i look at a lower price being a good opportunity to buy but getting wary that it hasn't started going back up yet?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well i think the inflation is the most destructive force at the moment, until the inflation is not shrunk, the price will probably continue to go down. We currently have about 100% inflation yearly, which is too big.

We also need more users and to go mainstream if we want further demand. I have faith in Steemit, but I think everyone in the community has to work to make it better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The data was way over my head and I'm too mentally wiped out to try and comprehend the details...

The counter-argument you will receive is that the GOAL is to lower the value precipitously so more users can buy more Steem tokens.

I was originally under the assumption that when someone was powering down, they would be unable to vote or have deprecated voting power. Obviously, thats not the case, though I still argue there should be obvious, valuable incentives to remaining powered up beyond simply not losing established VESTS.

All that said, we're missing adoption, particularly more users who can easily on-ramp currency (bitcoin and fiat) into the platform to invest more value into the tokens. Obvious, but thats the crux of it without some sort of incentive to stem the bleeding created by "free" power-downs.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thats not a good argument, because if the price would be lowered in order to get more people to buy STEEM, then the

market capwould beconstantand thepricewouldgo down.But in reality both the

market capandthe priceisgoing down, so we are losing value entirely.People don't have faith in Steemit, instead of powering up to SP they cashout their SD to BTC.

There are multiple solutions i will propose in my next article, it's too long to talk about in a comment box. But I agree with you otherwise, SP need to be better featured and we need more perks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The price is always right... why does anyone need to do anything about it? Who would have thought that marketing to anarchist would be so valueless? Me. That's why I have not bought any YET... There is obviously value in this technology. Is Steemit the perfection of it? Are the economic levers set optimally? Perhaps they are, but time will tell. Besides, nobody complains about stability when the price is going up. Stability should not be the goal. I'm not sure what the goal is, but perhaps mass adoption, which compared to my favorite crypto experiment Steemit is already doing exceedingly well at. Congrats steemit, you are still a winner in my book.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The constant bearish trend is pretty worrysome. We don't want the STEEM price going down because then our SBD and SP will be worthless.

We need to make the STEEM price go up, and that is only done if the community has trust in it, and people buy STEEM.

And of course that will probably happen with more adoption, and restricting the inflation of SP and other things.

I don't think the levers are set optimally, the inflation is pretty high, decreasing that would give more stability to STEEM.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually, we do want for the next several months for the price to go as low as possible and stablilizing there. With the current distribution of steem power things are very skewed, so only a few whales and orcas usually decide if the post pays in anything above $1. As soon as the power is more decentralised growth should result with more users seeing their efforts rewarded. This post among many others explains why this is so, and why the whales are powering down, thus forcing the price of the token down.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I disagree.

We might want more equality between SP in the hands of Whales and Minnows, but that should not mean Steem going down.

If the Whales sell all their STEEM, that is bad, it siphons money out of the system. They should instead just use Steem Dollar, for shopping or other things.

We have a marketplace for example: https://steemmarket.sharetribe.com/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is not for buying things for money, and about 25-50 accounts have 90% of all the steem power. Besides they can't sell ALL of their Steem, since it is locked in the SP, only 1% per week. The problem with that is alarmism, and well disillusionment with the system as it is.

And yeah, it is good to buy Steem, especially if it goes any lower, and use SBD for payments. For best results there might be some need for SP transferrals. Hmm, perhaps I should suggest it in the bounty discussion.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also the ARIMA(0,1,0) model implies a random walk with drift, which suggests a very efficient pricing mechanism, with probably no price manipulation going on. So the market price pretty much reflects the value of STEEM.

So the values of STEEM is declining, I think we need to decrease the new supply by decreasing the inflation a lot and boost the demand with many new users to fix the bearish trend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You make the assumption that previous data predicts future data. However the price of a commodity is not driven by natural processes, or sustained pressure. It is driven by people and their emotions. This leads to quite a bit of unpredictability I would say.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well it does, to a certain degree. Not necessarly enough to predict it in a way that we will make money consistently.

Most the quant models are mainly used to assess risk. It is the "sell side" of the investment world, quants are almost always working in the risk management departments of the wallstreet banks or hedgefunds.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit