Although it sounds like something a Muppet would say, this is actually a fairly important issue. My guess is that close to half of the decrease in steem value we've seen since the external markets first started offering SBD is due to this effect.

It should be emphasized at the outset that there is nothing wrong with exploiting an arbitrage. THis is not intended to be an accusation agains those doing so. As a matter of fact, it should be considered a given that precisely the process I describe below would occur when an arbitrage opportunity came into existence. In fact, my suspicion, based on wallet watching for the past few weeks as I observed this phenomenon is that at least one of the most reputable members here on steemit has driven much of this volume.

In general, the arbiter is not the bad guy, the arbitrage itself is. An arbitrage opportunity is a flaw in a marketplace. A dysfunction. It tell us that something is not working correctly. In this particular case, a secondary symptom of that dysfunction is that the value of steem is falling.

There are two immediate ways to convert SBD and steem back and forth. The internal exchange and an external exchanges like Bittrex or Poloniex. The internal exchange offers direct conversion of SBD to Steem Dollars. The external exchanges do not offer direct conversion, but allow bitcoin mediated conversion. That is to say, one can sell sbd for BTC and use the proceeds to buy Steem, or vice versa.

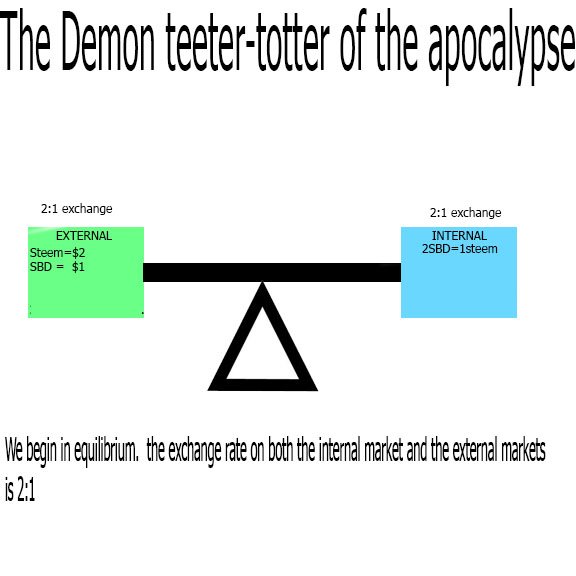

We'll start with a 2:1 steem to SBD ratio on the internal market. On the external market, steem is valued at $2 (in btc obv, but im using a dollar figure to make the math easier) and SBD are valued at $1. Thus, we have equilibrium between the two markets.

Equilibrium

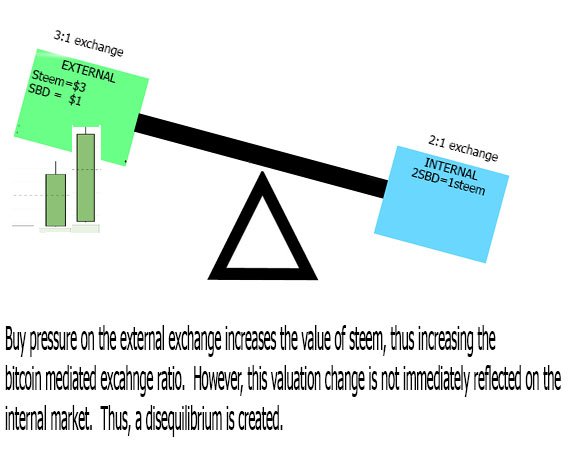

Now imagine that there is heavy buy volume for steem on an external market, and that volume increases the market price to $3. This increase will increase the mediated exchange rate on the external exchange to 3:1.

Buy volume creates disequilibrium

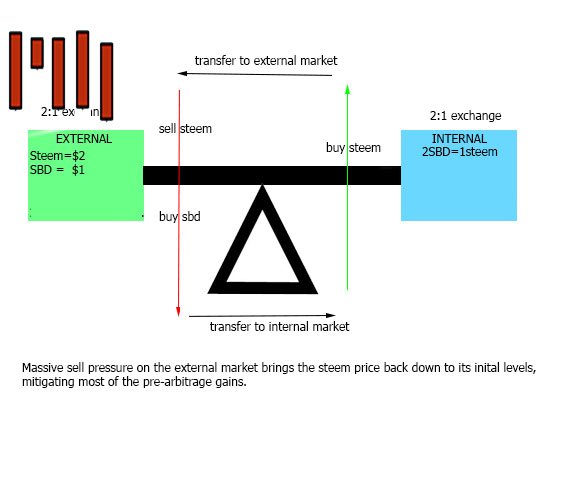

This increased exchange rate creates a disequilibrium between the two exchanges. In the normal course of events, this dis-equilibrium would most likely be cured by the internal exchange moving into alignment with the larger and higher volume external exchanges. However, the disequilibrium also creates an arbitrage opportunity. Traders are able to profit by doing the following:

- Sell off all steem holdings on the external exchange for BTC.

- Use the proceeds to buy SBD.

- Transfer the SBD to the internal exchange

- Use the SBD to buy steem on the internal exchange

- Transfer the steem back to the external exchange

- Start the proccess over again at 1

If a user were to start with 100 Steem on the external exchange.

He would sell the 100 for 300SBD, transfer the 300SBD to the internal exchange, and exchange the SBD at the 2:1 ratio for 150 Steem. He could now send that 150 steem back to the exchange and repeat the proccess.

You can see an example of a user that does this here (first one i found watching it happen the other day that wasnt linked to someone famous who might get pissed if i start speculating about his finances)

This user actually only does relatively small amounts, and he does it with one account, which makes it easier to see what is happening.

The order book "bids" will be depleted by arbiters

On the external exchanges, offers to sell a currency are called bids. There are many bids below the current market value. So if the market value were $3 for steem there might be a list of bids like

400 steem at 2.99

700 steem at 2.85

1900 steem at 2.40

1000 steem at 2.20

5000 steem at 2.10

15000 steem at 2.03

Of course, our arbiter can make a profit by selling his steem at any price above $2. But, time is a constraint for him, because the market (and probably other arbiters) will correct the disequilibrium fairly quickly. So he will simply buy off all of these bids, then sell them. He will obviously make very little money on the steem he buys at 2.03, but very little is better than none at all.

When he has finished buying all this steem, the price will be at 2.03, since his acceptance of the bids will have changed the last market price. Note that the amount of steem available for purchase on the order books doesn't really matter, because the arbiters can simply cycle their money to buy all of it very quickly.

The mechanism does not work in reverse. Thus, it has the effect of ratcheting down the price of steem

I'm not precisely certain why this process only works one way. I can tell it only does by looking at the accounts and transfers of the people who do it. I suspect that it only works one way because of SBD resistance to price change (ie the dollar peg)

Normally, any currency will go up and down as part of the regular course of events. This mechanism essentially stops steem value from increasing, but allows it to go down normally. IN even the medium term, this will assure a decrease in value.

Potential Solutions

None of these are pretty, but the reader should bear in mind that until something is implemented to close this arbitrage gap, the price of steem is going nowhere but down. It should also be noted that a bad actor could conceivably use a relatively small amount of steem to create havoc with the markets. Im pretty sure i could tank the market right now if i wanted with just the willingness to sacrifice a few thousand steem

1.Close the internal exchange: There is already a convert SBD function (the one that takes a week) for users wishing to convert their funds instantly can use either of the two external exchanges.

The original purpose of the external exchange was to use liquidity rewards to incentivize the conversion of SBD to steem at rates close to a dollar. Now that liquidity rewards aren't being distributed anymore, it is no different from any other exchange service offered.

2.Get the exchanges to stop offering SBD trades. I think though most people would probably prefer #1 to this.

3.Build in a delay when converting steem to SBD on the internal exchange. something like 10-15 minutes would likely be sufficient to allow the markets to catch up to one another. At the very least, it would limit the ability of arbiters to use a very small amount of steem to create a very large amount

IDK how viable any of these is, but i'd be really interested to hear other potential solutions.

We need more volume and more liquidity and more exchanges to support the system. It can only come with adoption but I think it will come no problem. This place is on a rocket to mars.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

more volume won't make a real difference vis a vis this particular mechanism. Because the arbiters are able to generate basically infinite volume to bring the price back down.

I like steem, and i really hope it does well, but i don't know how you can look at the charts and the price action and think its on a rocket to anywhere.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The price action is totally expected. Buyers are funding a huge wave in growth and there was way more money being generated than able to sustain it. This price washout will be a gift and i can't wait to get in at the bottom and watch the door close. I really think people are sleeping when it comes to steem and they going to regret it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, to start out, i have to say i hope your right. I currently have about 6K in sp, and even if I did not, I would want it to succeed for the sake of the platform and so that others here could make money.

That said, i don't think youre right for several reasons. I think steem can go to mars. I think whether or not it does depends largely on the decisions made in the next few months.

IMO, a big part of the problem is people that are thinking the same way you do. I mean here i show you, literally tell you how you can watch the price being dragged back down every time it tries to recover, and your first reaction is to get on message and say "everything is getting better . price hype price hype."

Its a shame, because there was this poster who had this story about carpenter ants and i can't find it now. But the point is, if an overabundance of enthusiasm short circuits your ability to think critically and solve problems, then its going to harm you in the end.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Im longsighted so i understand this process we go through right now takes time to grind its way out. Its the incubation period where buyers are bailing everybody out and my guess is this period will be long, drawn out, boring and totally demoralising. But once it begins to change it will change because fundamentals have taken over.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

replying here due to nesting:

Well, you get that the price can only drop so far before the system becomes unworkable, right?

I mean youre talking about double digit percentage drops almost every single week. ANd these are only going to get larger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i get what your saying, it could go like way low. But i think it will take care of itself. I think they did a great job designing the platform. Iv good faith but I'm not betting the farm. Infact I'm not betting anything I'm just buying what i can from trading. All my profits will be dumped into steeem power. The dream of finding an income so i can travel might then come true. :) If not no real loss.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@blakemiles84

which way do you want me to play out. The way where miners and witnesses have to operate nodes at a financial loss (which they won't do at least not forever), or the part where the decrease in value (and the subsequent increase in the steem value of SBD) kicks off super hyper mega inflation, or the part where the value is never going to be .001, because liquidity concerns (and the two points above) make it far more likely for it just to skip to zero.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I disagree with this ... play out how it would become 'unworkable' ?

People may leave, but there are still rewards. Even if Steem went to 0.001 cent per, there would still be rewards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hopefully it's not a korean rocket LOL

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It works both ways, but now it is only profitable in this way.

If there would be sudden buy presure at poloniex, this strategy wouldn't be profitable. But you could start do the opposite, with profit.

Usually the internal market react much slower than poloniex, so basicly those who offer liquidity at the internal market lose money to the arbers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

could you please expound on this, because ive been trying to figure out why this would be the case. I can look and see whos doing it, and i can see they're only doing it one way, but i cant figure out why, for example, if steem decreases in price, the exact reverse of what im describing doesnt happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It really depends on the actual prices, now selling steem at poloniex and buying at the internal market works, but a month ago it wasn't profitable. The opposite was profitable, buying steem at poloniex and selling at the internal market.

If you check the prices 1 month ago, you can see the opposite strategy worked.

Here is a post from steemit archive:

https://steemit.com/steem/@cryptorune/steem-dollar-poloniex-pump-is-a-arbitrage-goldmine

I need do more research in this subject but I assume the main problem is that the witnesses set the price feed (sbd/steem ratio) and they are not so good in that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yeah that was when it first started right... when polo. first opened up to SBD and steem and the SBD was like 1.40 on there... If SBD got up again really high, i could see something like that happening again.

But i was thinking an opposite effect driven by a decline in steem price. So steem price starts to go down, but then the reverse direction arbitrage kicks in and pulls it back up... but that never seems to happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jasonmcz produced www.steemprices.com that is the go to place to know when and where to buy and sell :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

like i said, i have no problems with the arbiters exploiting this. Its what theyre supposed to do in a free market. But the powers that be should take a real look at whats happening, because AFAICT, the arbitrage window always ends with the price dropping back to the initial levels. That is to say the arbitrage kills growth in value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The price drop is being affected by 100% inflation per year also, the arbitrage should spread the volumes across all the exchanges. There might be more stability with shapeshift recently coming on and Kraken in the future

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no, its really not. the money supply theory of inflation is a complete myth.

As to additional exchanges, etc. I don't think any amount of volume will cancel out the negative effect of the arb.... because at the end of the day it can use very little capital to produce a massive downward pressure on the currency value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@cryptofunk i proposed some ideas at the end of the post. There is no pretty solution... either get rid of the internal market entirely or put a time delay into the trades... make the proceeds available after like 15 minutes or something...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What do you think could remedy this so that we have stability or upward trend?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

by the way, if you want to see this actually happening, its pretty easy. Sit on bittrex and wait for a big green line. After that comes up, there will be a big red line almost the same size. sometimes it will be broken in two.

After that, you can check bittrex's wallet. You'll see a few people cycling money in and out... theyre always sending steem in, and getting SBD back out a few mins later, then sending steem back in.

Also incidentally, astute observers will note that there have been a couple of OK sized recoveries (like 2 weekends ago we went from 135 to 150 or so).

This is because simultaneous buy pressure on SBD and Steem in the external marketplaces does not create the arbitrage opportunity. This increase came along with an increase in SBD value from 82 cents to like 95 cents.

Its basically like lifting up the teeter totter from both ends, rather than pivoting it.

The problem is, there is only a certain amount of room for this, because SBD isnt very variable, and wont often go above $1. (and in general terms tends to move against Steem, not with it)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for this long awaited explanation. Much needed in my case. In summary, there are different supply-demand dynamics between the internal and external markets. Increased demand in an external market can raise the price of Steem THERE while the price of Steem remains low on the internal market which gives the arbitrager an opportunity. Sell Steem outside, buy Steem inside, then sell that Steem outside. But most importantly this dynamic makes the internal markets into a kind of anchor which drags down the price of Steem on external markets. If I could emjoji applause I would :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for the kind words

The important thing to take away is that the feedback mechanism between the internal and external markets... Because of people exploiting the arbitrage, the (lower priced) internal market is able to pull the external market prices back down when they start to go up. There have been a couple of times ive watched at least a small recovery started, then be smacked back down by arbitrage volume.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great point, I amended my initial comment to highlight that point.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will you do the same as described in your post?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

are you asking if i have? No i havent. If i hadnt powered up 5K and i still had it liquid, i might mess around. But right now, im not confident enough in where the price is going to buy more steem to do it with. Because for it to be worth my time to monitor it and jump on it at the right time it would have to be a pretty significant chunk i was cycling.

Ive known about this for quite a while. That said, eventually i might decide to set an employee to wacth that Jasonmcz website and start the arbbin if they decide not to close the loop hole.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting for sure. I was surprised that the SBD itself could be cashed out when I heard weeks ago, seemed to me also that the internal transfer should apply primarily. And yes, the "Steem Dollar Teeter-Totter" sounds like a childrens poem title lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The process absolutely works both ways. Arbitrage does not drag the price down or up. Its sole function is to correct inefficiencies in the wider market by tying various markets for the same asset together. An arb trader simply finds traders on one market and connects them to another market where they could have themselves bought or sold and got a better price if they knew better or were willing to go through the trouble(sometimes involving 2 or 3 other assets). For example if the price on poloniex STEEM shoots up, that price does not reflect the full market because not all orders/traders are on poloniex. The buy orders must fist reconcile with all the other markets where traders are selling STEEM either for BTC or SBD, or any other asset. The arb trader simply makes those connections. Arbitrage does not effect the real price, it helps to equalize the price across all markets to establish and find the real market price, where all traders are accounted for. Only when there is no arb opportunities left can you say you have the real market price.

You've likely been seeing this one way action because that is simply the direction the market has been going. There is a good deal of sell pressure from STEEM that needs to work its way out of the system through both STEEM/BTC and STEEM/SBD/BTC.

Anyone buying SBD and then converting using the SBD 7 day settlement function is not technically doing arbitrage. They are speculating and risking capital on a bet that after 7 days the price of steem will be to their advantage. All markets are subject to this type of speculation.

There is no speculation in arbitrage. I hope this makes sense : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

http://www.zerohedge.com/article/why-citi-common-crashed-and-why-common-preferred-arb-could-be-next-volkswagen

this is an explanation of how a similar arbitrage/short implosion almost sunk citibank

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

also wanted to check to make sure, but convertible note/securities arbitrage is whats widely associated with the "black monday" stock market crash in 1987. SO yeah, it can and does have disasterous effects.

http://www.nytimes.com/1988/04/13/business/economic-scene-soft-case-against-index-arbitrage.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That arbitrage was associated with does not necessarily imply that arbitrage caused the crash. See this quote from that article speaking against restriction on arbitrage on the basis of the crash.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yeah, i did see that. I realize in that case that its unclear whether the arbitrage was the apocaplyse or just the horn.

that said, i shipped 20 steem to you i think you had the best commentary of all the ppl that disagree with me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the steem. You are an interesting person, @sigmjin. I'm still trying to work you out. You have some insightful points of view, but also seem to attract controversy and heated debates. I try to look through the bravado and point scoring of who is right or wrong and learn more about how steem works and contribute constructively to the conversation where I can.

With regards to the current topic, I think you give a good explanation of how arbitrage works, but I don't (yet) see enough evidence that price movements only go one way. That is a strong claim that goes against my intuition of how arb works and I can not yet why that would be the case. It seems from other posts you mentioned somewhere that a month ago (from just before my time here on steem), the arbitrage was going the other way and it was also coincident with increasing steem prices. To me it seems the internal market lags the external. I think the solution is more volume and arbitrage on the internal exchange not less, to decrease the price difference users experience.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Powered Up:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@brendio I attract controversy here because i don't back down and i don't pander to whales. Mostly thats because 1.im a shithead. But its also because 2.i don't care about money (at least, not in the amounts that someone could make on this site) and 3.im not used to dealing with people who don't know im always right.

It can go both ways, but only when sbd and steem are simultaneously increasing in price (which was the case a month ago)... its basicaly the same as lifting a see saw up from both ends.

Your idea of arb (which is usually correct) is that a buy on the internal market and a sell on the external one would wipe each other out, and have 0 net effect on price. I can prove thats not true even without an arb.

I can prove this works by simply cycling a bunch of money through the internal and external market and using the mechanism discussed to crash the price of steem, which is precisely what i am going to do this weekend.. Since the transactions are so fast, i can most likely do so with 5 or 10K steem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I understand there is no speculation in arbitrage, and i was not discussing the 7 day settlement function, i was discussing the internal steem/sbd marketplace.

As to your assertion, yes, arbiters exploiting an arbitrage can absolutely drag the price down artifically. There are many textbook economic examples of this happening. The term for it is arbitrage drag.

It should be obvious that that this drag creates a significant amount of artificial sell pressure on the markets. ANd you don't have to look too hard to see that this artificial pressure almost always wipes out all gains the currency makes.

In a healthy market, the arbitrage would cause the prices to converge somewhere in the middle. But because the internal market is less reactive, the price always goes down to exactly where the internal market started.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This idea that arbitrage can "exploit" anything is non-sense. Are the bids and asks on the internal market not real? Do the orders not represent an actual individual interest to exchange at a particular price? Should traders avoid markets that offer better prices? Is someone forcing them to sell or buy? Why do you think the internal market is slow to react? is 1.5 seconds too long? There is nothing limiting the internal markets from reacting just as quickly as anywhere else.

What is artificial about it? Do the orders on the book secretly not really want to trade, or secretly want a different price? Why place an order you don't want filled?

This isn't true. It has nothing to do with "health"(whatever that means) and everything to do with volume. A large enough order will always bring all other markets to meet it's price, not the bottom or the middle. The internal market price would easily be exhausted and made inconsequential with a large enough order placed elsewhere and vice-a-versa. Where the price meets is simply a reflection of the relative pressures in each market. It has nothing whatsoever to due with "health"

Steem lacks buy pressure. Plain and simple. I don't think we'll see many people crying about arbitrage "artificially" keeping the price high. Even though it's the same mechanism and process in either direction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

replying here due to nesting:

YES... thats exactly my point of contention.

What youre saying, that the sell orders on the one exchange and the buy orders on the other negate each other, is absolutely whats supposed to happen. And on bittrex and polinex, for example, it works exactly like that.. thats why theyre not dragging each other down.

But theres something about the internal market that makes it not work the same way. Partt of it is because theyre not really the same trades on the internal market (theyre direct sbd-steem conversions)

That is to say, on the internal market, they must move in opposition to each other, but on the exchanges they can move independently. So for example, on the external market, the price of steem can increase without the price of SBD decreasing, and on the internal market it can't because they trade directly.

TBH, i feel like there is a term for this on the tip of my tounge that i just can't remember. It fucked up the price of silver once too thats why they had to create silver certs.

RIght, so lets say market A is the external market, and market B is the internal market. When price started to go up on the external market, there is always a better price on the internal market. So everyone wants to sell on the external market and buy on the internal market. This will cause the price on "A" to go down until there is no longer a price difference. Which is exactly what im saying is happening.

The thing is, individuals can voluntarily set their own price. Just not in the same currency. So for example, lets say we start at the 2:1 ratio i describe in my post in the internal market. Then the price goes up on the external market. This creates buy pressure for steem on the internal market. So lets say all that buying steem raises the external market price to 2.5:1

That doesnt actually change the bitcoin price of steem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is just a "triangle" arbitrage which has exactly the same results. You would sell steem for BTC, Buy steem for SBD, and Buy SBD for BTC. You are both buying and selling each of the 3 items. Again in all of these examples the orignal buyer could do all of these trades himself to get the best price but he doesn't because he is either too lazy, unwilling, or unable. So the arbitrager does it for him. These are all legitimate markets and you cannot say you know the true price of something until you considered all of them. Thankfully you don't have to consider them. The free market does this on its own. But anyway, the price cannot move up or down until it exhausts the orders on the books for all these markets.

If I have a banana farm and there is some dude who has lots of Steem and loves bananas. We can trade Steem/Bananas until I am out of all my bananas. The fact that he sold them to me in exchange for bananas means there was less selling pressure on Poloniex. This is just to illustrate that every market needs to be considered if your trying to determine the real price. I can also trade Steem for Gold, Steem for silver, Steem for Ethereum etc etc. The fact that these other markets exist is not sabotaging the price of steem. They are all elements necessary in order to determine the real market price.

If i can buy more bananas with the steem I earn from selling them. I will continue to do so until the market price of bananas increases too much from my buying them all, or until the steem i can get from selling bananas is too little to replace the bananas i sold. There are millions of markets like this and they will all effect the ultimate price of steem (and bananas)

Sorry for the somewhat silly examples. It gets complicated to describe pretty quickly and evidently I'm not finding an easy way to say it. : )

Here's one last attempt: If there is a buyer for Steem with USD at $1.50 and he has an infinite amount of USD. If you can buy Steem with $1.40 worth of gold. or $1.30 worth of pumpkins, or $1.35 worth of Ethereum, or $1.38 worth of BTC etc etc... Someone will do all those things and sell the Steem to this infinite USD buyer at $1.50 until the price of steem in gold is $1.50 or more, the price of Steem in pumpkins is $1.50 or more, the price of Steem in Ethereum is $1.50 or more etc etc. This is just the market. How it equalizes. How price discovery works.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How are you boss? I need to contact you about lending if possible @enki

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree. Im not sure what i said that made you think i thought otherwise.

of course not. Like i said, i have nothing against arbiters. It would be absurd not to exploit an arbitrage. But markets that are not as responsive, like the internal market, should not be allowed to drag the price down. And yes, it absolutely is doing so.

Of course they are real. However, the abriters are effectively selling the same X steem over and over again. So for example, lets say there are asks for 20K shares steem. Those asks will all be filled by the same arbiter selling 1000 shares 20 times. The same would be true if there were asks for 100K shares. NO matter what, thearbiters will fill asks by selling the same shares over and over until the sell pressure forces the external market price down to the internal market price.

There are many examples on bittrex and polinex of massive buy volume drivbing the price up, only to be immediately offset by equally massive arbitrage sell pressure setting it back down.

Im not sure if youre intentionally pretending not to understand what im saying, or if im just being unclear (ftr, i'm aware that you do this, so i know you understand what im talking about perfectly well). That said, i do appriciate you coming here and talking about it.. while none of the "powers that be" have done so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It makes no difference whether an arb trader connects the markets in a single order or whether he recycles the same steem over and over. I hope this isn't your point of contention. Any selling he's doing in one place, he is buying the same amount somewhere else. The net sell or buy pressure from an arb trader is zero. If he's selling 10k Steem on Bittrex, hes buying 10k steem on Poloniex.

For any order that is being arb'd , it would be the same result if the owner of the original order had simply placed his order on these various markets himself, where the arbiter ultimately does. In fact, he would get a better price but the result is precisely the same as if the arbiter never existed. The only difference is that the Arbiter is doing this action for him and is taking the profit that would have been the savings of the original order had he done it himself.

That is normal and is exactly what should be happening. If the massive orders on an exchange are not enough to also fill the orders on these other exchanges then the price will not move up. The individual buying with massive volume on one exchange would be better off splitting his buy order on to all the different exchanges to get the best prices. If he is lazy, unable, or unwilling to do this. The arbiter will do it for him and profits the difference. But again, the result is the same. The arbiter has zero net affect on the price.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

OK, i want to at least try to find some common ground here...

FOr the sake of argument, humor me and imagine 2 markets, basically offering the same exchange. Lets call them A and B.

Imagine market B has some sort of mechanism that makes it less responsive to buy pressure. Just for the sake of humoring me just assume that it exists... THe market is somehow flawed in such a way that it won't adjust to increased buy volume.

Can you agree with me that if we take it for granted that market B actually has this problem, that market B will drag market A down when an arbtirage exists between the two that makes it profitable to sell on A and buy on B?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think anyone buying at market A is foolish because market B evidently will always have the better price.

Market B sellers would also be foolish to continue selling on B when they can get a better price selling on A. But I guess for this hypothetical the sellers on B are forced somehow via this flaw to continue to sell even when they don't want to, or have better options.

What devilry is this!? : )

what is the market without the individuals voluntarily setting their own price. This flaw is pretty wild. I suspect it has to be either the exchange will go insolvent because the displayed books are not representative of the individuals placing their own orders, or there is some mind control device effecting the behavior of these individuals. It could also be a result of a non-free market where access to the different exchanges is restricted or limited, in which case the arbiters are a blessing for those poor soles unable to trade where everyone else can. : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Quite an interesting post.

I'm not sure I've got any input to give, but I'm happy you've enlightened me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post, you seem to know what you're talking about; I think solution number 1 sounds like the most sensible solution, or at the very least number 3.

Cg

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

my gut tells me that people arent going to like #1, but personally i think its a great solution. Though im not an expert in computer stuff, i imagine that it consumes a lot of resources to run a market 24/7 on the blockchain, and theres really no reason for it at this point. There are several other options for immediate conversion on the externam markets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just resteemed this post. This trading stuff is all way over my head, but the theory is consistent with what I noticed here. STEEM peaked and made a sharp downturn on July 19, within a day of when SBD started trading on poloniex, and it's been moving continuously downward from then on. The timing could be coincidental, but that would be quite a coincidence.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I never bothered to try my experiment. I am still convinced that this is really an issue, but its certainly no longer the biggest one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I get ahead-ache thinking about the complexities of the exchanges and fees, but here's what I see:

I get what @enki was saying about market prices finding the right level, and I'm not knowledgeable enough to draw any conclusions, but to me the above facts all seem to be consistent with the idea that something about the launch of the external SBD market altered the price-finding mechanism .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Personally I find the internal exchange to be clunky and buggy so I wouldn't miss it too much if it closed down. I used it a little at first. Today I sold some SBD on BitTrex and it all went much more smoothly. I guess the internal exchange is convenient when you want to convert your SBD to Steem, and that's largely why I used it earlier. But I would have all kinds of issues where I'd put in a specific limit order and it would change it to a different price, or I'd try to trade at market rate and it woulf change the price to make it a limit order.

I think the arbitrage may be inevitable when you have two currencies going. and one of them is pegged to the dollar. I suspect the end result will be that SBD and STEEM are both worth the same, around a dollar, and people will wonder why there were ever two.

The downward trend in STEEM price doesn't surprise me. It's a pretty normal pattern that lots of new coins follow when they first get on the market. It will turn around as long as the fundamentals remain sound. The arbitrage may exacerbate it but I don't think is the cause.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this is a little known "feature" that @tombstone is denying the existence of in the other thread... the less SP you have the more it changes your order price...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cross posted from other thread for clarification on the order pricing mechanism with respect to order size (rather than SP).

@wiser, I think this is the reason for the behaviour you saw:

The internal market seems to operate on the basis User X wants y SBD for z STEEM. Example from steemd.com:

The market rate displayed is the derived from these parameters rather than being coded in the algorithm, with the result that the higher the order size, the greater precision one can achieve, because each value for STEEM and SBD is limited to 3 decimal places.

Hope this helps and someone can correct me if I'm wrong. I've been playing with the market a bit to observe this functionality.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wanted to make a quick clarification for everyone regarding the discussion with enki:

I do realize that, in general terms, arbitrage functions the way enki describes. That is to say that an arbitrage in two normal markets (like bittrex and poloniex for example) won't really effect price.

There is something... im not 100% sure what, that makes the internal market here... stickier. Less responsive to buy pressure. Part of it could be the dollar peg. Another part of it is the inverse valuation relationship between steem and SD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sent here by @rok-sivante, thanks for the analysis!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article and I appreciate your honesty. I find a lot of users just assume Steem will work out and everything will be fine and dandy because, well, magic internet money. Following you from now on, keep em coming

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Brilliant insight.

disappointed that this post hasn't gotten more attention/rewards. and greatly hoping this key issue spreads up the food chain to be properly addressed and the kinks worked out.

great job on articulating this dynamic...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks rok. hopefully someone in high places will take a look at the issue.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

working to help bring attention:

The Killer Flaw That Could Sink The Steem Ship: How Steemit May Be Doomed Like The Titanic Without Fixing This Leak...

stated in it to not upvote the post unless also upvoting yours. if that post does end up getting unproportionately rewarded, I'll split the SBD payout 50/50% with you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no need. i typically give away most of the SBD i make from posting anyway. ANd you just got married you probably need the money more than I do.

that said, i do think its hilarious that in spite of your caveat, your post has already made 7 times more than mine

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks mate.

though in the end, mine got downvoted to back below yours. lol.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Rok, i think thats really unfortunate. And i think the excuse used was shitty. IMO the only reason this one didnt get DV'd too is because its past the 24 hour window (and wont appear on the regular tranding page)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah it's too bad people just vote for the money and are't reading the posts, I myself am guilty but I do try and read the majority of posts I'm upvoting. That is what lead me here, and this is definitely an issue worth discussing personally I'm all for #1. I don't mind that one bit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Shouldn't the 3rd sentence of the 4th paragraph read: "The internal exchange offers direct conversion of SBD to Steem."? Apologies in advance if I'm confused.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes, youre absolutely correct. i missed that one and i think its too late to edit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post like always. I just love how you always say the truth and point to weaknesses of steam. You do it with a solid background and excellent explanations. But with honest intentions for better of steemit and you jump in constructive discussion about it.

To be honest I don't have a lot of mathematical knowledge and deep trading or market knowledge almost at all.

Reference: SD (steem dollars internally, SBD steem dollars on external market)

Similar conclusions as yours occurred to me. Since trading of SBD is available for trade on poloniex things you are talking seems to swirl in an ongoing circle. I was also surprised (as is one of your commenters here) when I saw SBD implemented on external market and was unsure why could something like that happen. I with my ignorance was sure that SD could be sold only to buy STEEM or to be traded internally on the platform.

After that, I came to a conclusion that SD in a way of SBD on another market is a good thing to prove its own market value.

But then I had a revelation when I was reading your post and comments. If we can trade SD in means of SBD on other markets we drop the value of STEEM because it just becomes obsolete since it's easier to just pump your SD out and trade them for what ever like. Now the internal market is a good way to get SD(or SBD) for your STEEM because users that want to have steem power will trade it internally and are willing to pay a bigger price either because it's more convenient or because they are ignorant.

This in fact as you pointed out in your post brings the price of STEEM down and it will be flat to 1 SD or 1 SBD if there is no bigger demand for steem on internal and even more on the external market. So it looks that STEEM by design is created to be worth 1 $ because of his twin brother SD unless there is big market demand for STEEM. Since both are liquid and SD is more convenient to use in a way of SBD since you don't have to convert it or buy it internally first.

This for me explains the circle of ongoing sales on which some profits through current means of arbitration.

Sorry if I'm just completely wrong, but I just like your content, points, and discussion on a table and this is just my uneducated opinion.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appriciate the kind words.

WHat youre describing is called gershams law. Bad money chases out good. that is to say if one type of money is better (either because its likely to increase in value or because its less likely to decrease) people will hoard the "good" type of money and spend the bad type of money. This is precisely what happened with gold coins in the latter part of the 19th century. (because gold was increasing in value more quickly than silver)

Thi shas played a role, but its a symptom as much as a cause. Because the thing that makes sbd better than steem is the fact that steem is declining in price. In early july, im sure steem looked like the better money

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

also just one further note:

I can see two things happening in the coming days.

The prices will start to orbit $1, rising and falling between like 1.15 and .85 inversely

the prices will start to orbit a degrading point, rising and falling inversely between a declining central value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I answer here to your other post because it says something about dept and I couldn't reply.

The VEST calculation are just confusing.

I just do basic math from the data that is displayed in people's wallet.

1700 steem power gives you 70 steem power interest per week.

Each week you will be able to withdraw 16 steem, so it means that your balance will increase by 54 steem every week when you power down.

This is simple calculation, anyone understands that if I receive more steem power per week than I can get out my balance will be in a perpetual increase.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, enki is testing your claims on the market now, we will see how his conclusions end up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

seriously?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, I might be wrong but he was one of the most active on the internal market or his bot is. And he is doing a similar strategy like @steemgrindr is with withdrawing steem and SD. You can check his steemd.com and see for yourself.

But on the other hand, he may be on synero hype train like I feel most of the whales are.

Sorry for disturbance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rok-sivante sent me here ;) thanks for letting us know about this!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very good information you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for posting this valuable information for all to read and digest.

I'm so glad we have thinkers like you out there to break situations like this down for the rest of us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was watching this. I was calculating how I could just make money trading. But, I'm not a trader, I'm an artist and being an artist takes time.

There's only 24 hours in a day and need to get to the beach before summer's over.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow... Sneaky! I wouldn't of thought to do that... Sneaky sneaky. But I'm not a day trader or Stockmarket guy...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i don't know as there's anything particularly sneaky. As ENki pointed out, generally arbitaguers are doing the market a service.

Also, iirc, @complexring and @jl777 both posted pretty detailed articles on how to take advantage of the arbitrage (at the time, it was in the other direction)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see. As I said I'm not a Stockmarket trader, all this is new to me... So much to learn, and I'm learning more everyday. Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit