Hi fellow Steemians!

I am a professional trader and arbitrageur and I arbitrage in different Bitcoin markets for a living. Today, I started my research in the STEEM market and would like to give you a report about the opportunities in this market.

INTRODUCTION

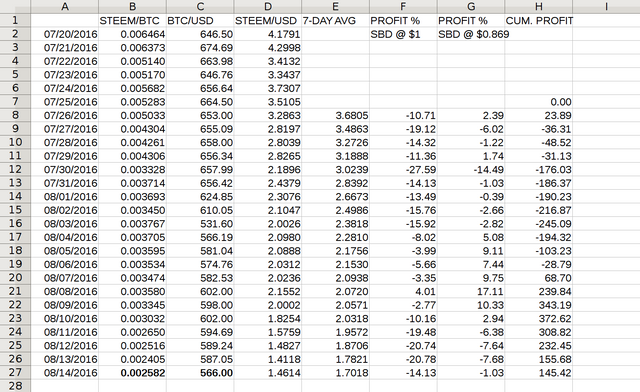

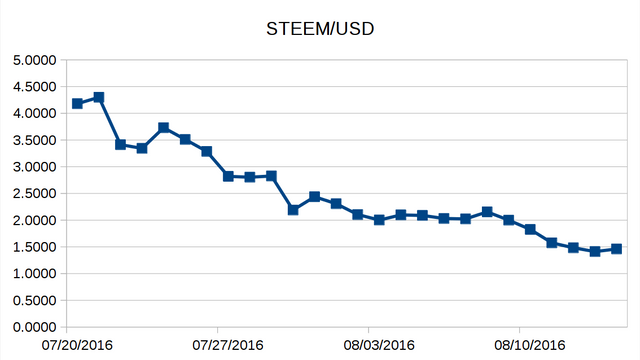

Above is a spreadsheet showing the prices of STEEM/BTC and BTC/USD since July 20, 2016. Data are taken from the Poloniex exchange with today's price still changing. As we can see in the figure below, the price of STEEM has been steadily decreasing.

METHODOLOGY

As the time this report was written, the prices of the STEEM DOLLAR (SBD) were $0.8647/$0.8737 (BID/ASK), with the MID-price around $0.869. As you may know, on the Steemit platform, you can request to convert your SBD into STEEM using the 7-day hourly average price in the 7 days into the future. This report shows you the cumulative profit in USD you would have earned by making this conversion request at 1000SBD per day, and selling the converted STEEMs for USD, assuming the price of SBD is fixed at $0.869 each. Now let me explain what some columns mean on the spreadsheet, beside the obvious ones.

COLUMN E shows the trailing 7-day average STEEM/USD price. This would be the rate at which your SBD gets converted into STEEM. Here we have assumed that each closing price in COLUMN D indeed represents the day's average price, which should not be far away.

COLUMN F shows the percentage profit you would have made by selling the converted STEEM immediately in the market, if the price of each SBD was at $1 each. As you can see, due to the down trend of STEEM, you would have made a profit in just 1 out of 20 days.

COLUMN G shows the percentage profit you would have made by selling the converted STEEM immediately in the market, if the price of each SBD was at $0.869 each, the current price. As you can see, you would have made a profit in 9 out of 20 days, which is not bad considering the continuous down trend of STEEM.

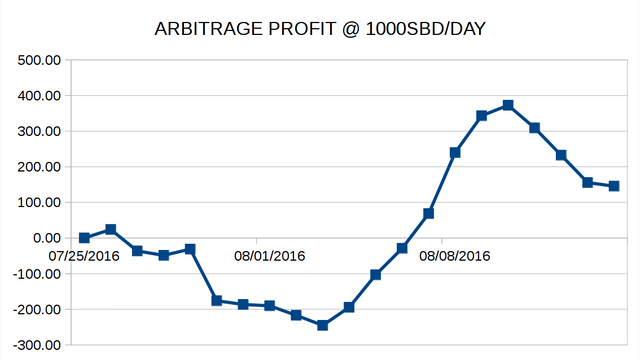

Finally, COLUMN H shows the cumulative USD profit you would have made by requesting the conversion of 1000SBD per day, where each SBD is priced at $0.869. This is just the cumulative sum of COLUMN G multiplied by 10. The figure below shows a chart of the cumulative profit.

CONCLUSION

At today's discount of SBD at 13.1%, I believe the risk of this strategy is nicely compensated by its rewards. At any time, your total investment is never more than $7000 ($1000 per day times 7), but the strategy already gave you 2% return in 20 days with the hypothetical discount rate of 13.1%. Remember, this was the return when STEEM has lost 58.37% of its value in the same period. This would be much more profitable if STEEM had been rising. I hope this helps your trading or accumulation of more STEEMs. I will keep reporting to keep you updated.

Are you averaging the Poloniex STEEM/USD price? It's not what is used for conversion, it's average STEEM/SBD price on Steemit internal market

And once you have USD you'll need to convert them back to SBD to complete the round - how do you do that?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your questions. If you look at the protocol behind the STEEM blockchain, 1 SBD is meant to be pegged to 1 USD. To enforce this peg, 20 witnesses report hourly to the blockchain the rate of STEEM/USD. The hourly average of this rate over the future 7 days is used to convert SBD to STEEM for every such request. Therefore the rate reported by the witnesses is not STEEM/SBD, but STEEM/USD.

For the second question, USD was just used as the unit to show how much USD in STEEM you would gain using this strategy. In actuality, you convert 1000 SBD each day, and after 7 days, you sell the amount of STEEM so that you get back 1000 SBD and possibly have some STEEMs left. That remaining STEEMs is your profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit