STEEM ARBITRAGE OPPORTUNITY REPORT (ISSUE 3), AUGUST 16, 2016

Hi fellow Steemians!

I am a professional trader and arbitrageur and I arbitrage in different Bitcoin markets for a living. As I continue my research in the STEEM market, I would like to give you an update about the opportunities in this market today.

INTRODUCTION

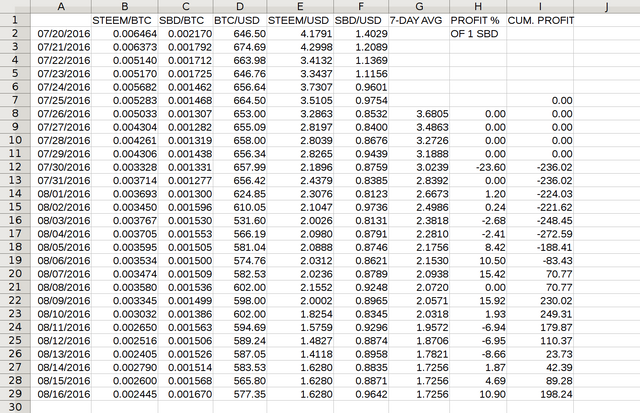

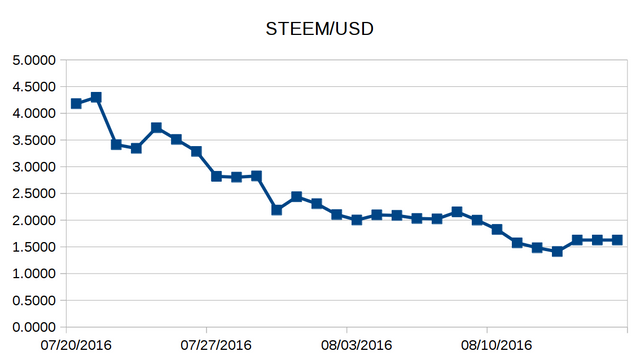

Above is a spreadsheet showing the prices of STEEM/BTC and BTC/USD since July 20, 2016. Data are taken from the Poloniex exchange with today's price still changing. As we can see in the figure below, the price of STEEM has been steadily decreasing. But luckily, the market seems to be stabilizing.

METHODOLOGY

As the time this report was written, the price of the STEEM DOLLAR (SBD) was $0.9624. As you may know, on the Steemit platform, you can request to convert your SBD into STEEM using the 7-day hourly average price in the 7 days into the future. This report shows you the cumulative profit in USD you would have made if you have bought 1000 SBD each day when the price of 1 SBD drops below $0.965, and sold the converted STEEMs for USD. Let me explain what the columns mean on the spreadsheet.

COLUMN B and COLUMN C show the prices of STEEM/BTC and SBD/BTC respectively on the Poloniex exchange. COLUMN D shows the price of BTC/USD on the exchange. With these prices, we calculate STEEM/USD and SBD/USD and show them in COLUMN E and COLUMN F respectively.

COLUMN G shows the trailing 7-day average STEEM/USD price. This would be the rate at which the SBD you bought 7 days ago got converted into STEEM. Here we have assumed that each closing price in COLUMN E indeed represents the day's average price, which should not be far away.

COLUMN H shows the percentage profit you would have made by selling the converted STEEM immediately in the market, if the strategy suggested buying 1000 SBD 7 days ago. According to our strategy, we would buy 1000 SBD each day when the price of SBD/USD drops below $0.965.

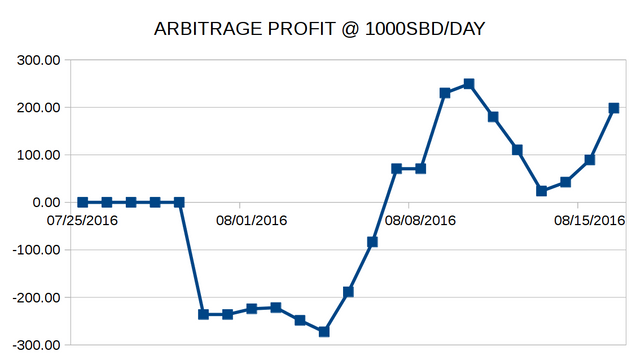

COLUMN I shows the cumulative USD profit you would have made by following this strategy. The figure below shows a chart of the cumulative profit.

CONCLUSION

Since July 20, 2016, the strategy has made $198.24 in profit, or 2.83% return in 27 days. During the same period, STEEM has lost 61.04% in value against USD. This strategy would be much more profitable if STEEM had been rising or stable, as you can see in the results for the last few days in the figure. I hope this helps your trading or accumulation of more STEEMs. I will keep reporting to keep you updated.

Q & A

Q: Isn't the rate of STEEM/SBD reported to the blockchain, instead of STEEM/USD?

A: If you look at the protocol behind the STEEM blockchain, 1 SBD is meant to be pegged to 1 USD. To enforce this peg, 20 witnesses report hourly to the blockchain the rate of STEEM/USD. The hourly average of this rate over the future 7 days is used to convert SBD to STEEM for every such request. Therefore the rate reported by the witnesses is not STEEM/SBD, but STEEM/USD.

Q: Do I need to convert between STEEM and USD, or between SBD and USD?

A: USD was just used as the unit to show how much USD in STEEM you would gain using this strategy. In reality, you convert 1000 SBD each day, and after each 7-day period, you sell the amount of STEEM so that you get back 1000 SBD and possibly have some STEEMs left. That remaining STEEMs is your profit. We plot the profit in the last graph in USD because its value is more stable than STEEM.

If this information is good and one can make money out of it, and considering you stated you are an investor and arbitrageur, why did you share this information instead of doing the arbitrage yourself? The more people are aware if it, the less opportunities will exist (if it is good).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your comment. Arbitrage is a low risk strategy, so you can definitely make some money out of it. As I said, I am mainly doing arbitrage in Bitcoins right now. The liquidity of the STEEM market is not that high yet and it is of higher risk, so I have not put money into it yet. For the concern that the more people know it, the opportunities will be diluted, that's true in some sense. But let me say that I am writing this out of my own interest and trying to help the market to be more efficient, which benefits the whole community. But I guess my reports are not that popular yet, and not many people will really do it due to the 7-day wait time of the conversion, so it's mainly for the sake of sharing ideas. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok. I think it is valiable. In terms of risk, arbitrage is meant to be riskless in essence. But I believe there are operational and technological issues that brings some risks to this strategy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, this strategy is not completely risk-free. Let's at SBD is $0.9 now. If during the 7-day period of the conversion to STEEM, the price of STEEM drops more than 10%, then you will lose some money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Column C is wrong in the image. It is SBD/BTC, not SBD/USD

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! It's been corrected now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit