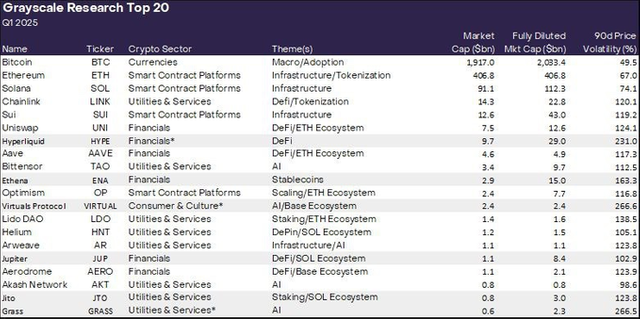

In a significant move that has caught the attention of the crypto community, Grayscale Research has recently updated its list of the top 20 cryptocurrencies for the first quarter of 2025, introducing six new assets: $HYPE, $ENA, $VIRTUAL, $JUP, $JTO, and $GRASS. This update reflects the dynamic nature of the cryptocurrency market and marks a strategic shift in investment focus. In this article, we delve into what these additions signify, their potential impact on the market, and what investors should consider.

Overview of New Additions

1. $HYPE (Hyperliquid)

- Project Focus: Hyperliquid is a decentralized finance (DeFi) platform focusing on high-speed trading and liquidity provision.

- Relevance: The inclusion of $HYPE suggests a growing interest in DeFi solutions that offer enhanced trading experiences and liquidity, especially in light of the evolving regulatory landscape post-U.S. elections.

2. $ENA (Ethena)

- Project Focus: Ethena is known for its focus on synthetic assets, particularly stablecoins, which are not backed by traditional collateral but by complex financial mechanisms.

- Relevance: The addition of $ENA points towards a burgeoning interest in synthetic assets, which could be pivotal in scenarios where traditional financial systems face volatility or regulatory hurdles.

3. $VIRTUAL (Virtual Protocol)

- Project Focus: Virtual Protocol aims to bridge the gap between virtual reality and blockchain technology, offering unique digital asset experiences.

- Relevance: This addition underscores the merging of tech trends like VR with blockchain, potentially expanding the use cases of cryptocurrencies beyond financial applications into entertainment and digital ownership.

4. $JUP (Jupiter)

- Project Focus: Jupiter is part of the Solana ecosystem, focusing on decentralized exchanges (DEXs) with an emphasis on speed and efficiency.

- Relevance: The inclusion reflects the increasing dominance and potential of the Solana ecosystem, which is known for its high throughput and low transaction fees.

5. $JTO (Jito)

- Project Focus: Jito operates within the Solana ecosystem as well, focusing on staking solutions and liquidity provision.

- Relevance: With staking becoming a significant part of DeFi, $JTO's addition signifies the importance of infrastructure supporting staking and yield farming, particularly in a low-volatility environment.

6. $GRASS

- Project Focus: Details are less forthcoming, but $GRASS appears to be linked to decentralized AI technologies or platforms.

- Relevance: This could be indicative of a broader trend towards the integration of AI in blockchain solutions, enhancing automation and decision-making processes in crypto applications.

Market Impact and Investor Insights

Market Sentiment: The introduction of these assets has sparked a bullish sentiment, particularly for those with a focus on DeFi, AI integration, and blockchain-based virtual experiences. The mention of these tokens by Grayscale, a major player in the crypto investment space, often leads to increased interest and investment.

Strategic Investment: Investors should consider the following:

- Diversification: With these new entries, there's an opportunity to diversify into sectors like VR, synthetic assets, and enhanced DeFi platforms.

- Regulatory Watch: Post-election, the regulatory environment might shift, impacting DeFi and staking platforms. Keeping an eye on legislative changes will be crucial.

- Technological Adoption: The success of $VIRTUAL and $GRASS will depend heavily on the adoption rate of VR and AI technology in mainstream applications.

Risks and Considerations:

- Volatility: All cryptocurrencies carry inherent volatility, and these new entries are no exception, especially given their speculative nature at this stage.

- Project Maturity: Some of these projects, like $GRASS, are less known, implying higher risk due to less transparency and historical performance data.

Conclusion

Grayscale's decision to include these six new cryptocurrencies in its top 20 list for Q1 2025 is a testament to the evolving landscape of the crypto market. Investors should approach these opportunities with a blend of enthusiasm and caution, performing due diligence to understand the technology, team, and market potential behind each asset. As we move forward, keeping abreast of technological trends, market sentiment, and regulatory changes will be key to navigating this dynamic space effectively.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit