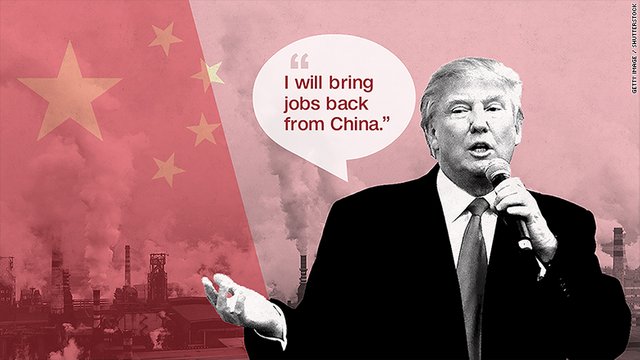

As the US presidential election approaches in November, both Hilary and Trump are shaping their platforms and policies. One of Donald Trump's signature issues is US and China trade reform. I will dissect how this policy could lead to big increases in cryptocurrency prices in the near future.

According to Trump's campaign website, China has been devaluing its currency for many years which is unfair to America. China does this in order to encourage people to purchase Chinese goods since the prices are so cheap. Trump wants China to stop this because American goods cannot compete FAIRLY in the global marketplace if Chinese prices are too low. Trump wants to hold China accountable for their actions and implement free trade. America has fully opened its market to China but China has not reciprocated and uses unlawful tariffs and barriers to keep American companies out of China.

Donald Trump has developed 4 approaches to achieve his goals:

- Bargain with China and declare it as a currency manipulator.

- Force China to uphold intellectual property laws (that are already in place and unfairly ignored) to protect American companies and technologies.

- End China's illegal export subsidies and child sweat shops to revive American dying manufacturing sector (creating million of jobs for Americans).

- Strengthen America's negotiation position by lowering corporate taxes and increasing military defense.

If Trump is elected and goes through with these plans, the value of cryptocurrencies will soar. Trump's plan is basically to do everything he can to stop China from pumping too much cheap Yuan into the global market. He's going to do this by forcing China to enforce global economic laws that they have been breaking. This means that China is going to feel pressure to have another source of purchase besides US assets. Cryptocurrency is one of the top choices out there that China can take advantage of. Given the fact that China has been threatening to govern Bitcoin throughout the years, it is very plausible that the Chinese government will purchase massive amounts of Bitcoin, Steem, Ether... instead of US assets. This way, they can still pump out cheap Yuan while circumventing global trade laws, since there are no global treaties affecting cryptocoins.

If China purchases large bulks of cryptocoins, their values will increase significantly. This can be a good or bad thing depending on how you look at it. As an investor, it is probably in your best interest to purchase cryptocoins if Trump is elected president. However, in the long run, new laws could be developed globally to regulate cryptocoins which defeats the purpose of a decentralized market.

Personally, the minute Trump is elected I am planning to purchase as much Steem, Bitcoin, and Ether as I can afford. I am expecting to be selling them in late 2017 to mid 2018 before the the market sells back off. What do you think about my plan. Let me know in the comment section.

Not the topic. I wonder if Hillary becomes President she will avenge her husband Bill ...)))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit