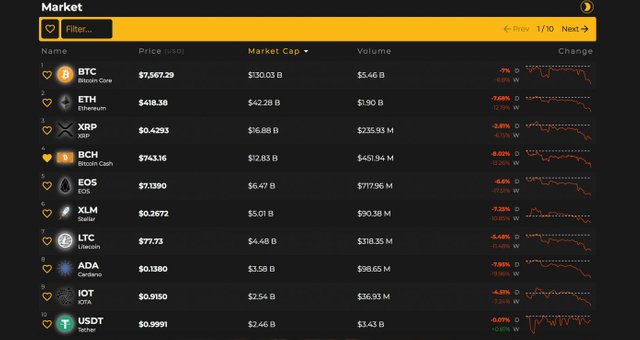

- Bearish sentiment is starting to haunt cryptocurrency markets once again as many digital assets saw prices tumble today. Bitcoin Core (BTC) prices dropped to a low of $7,503 on July 31 as the currency’s trade volume had started to drift a bit lower after the price hovered around $8,125 the day prior.

- One ETH is being traded for $418 and the market is down 7.6 percent today.

- Lastly, the fifth highest market capitalization held by EOS is also down 6.6 percent and the currency is trading at $7.13 per coin.

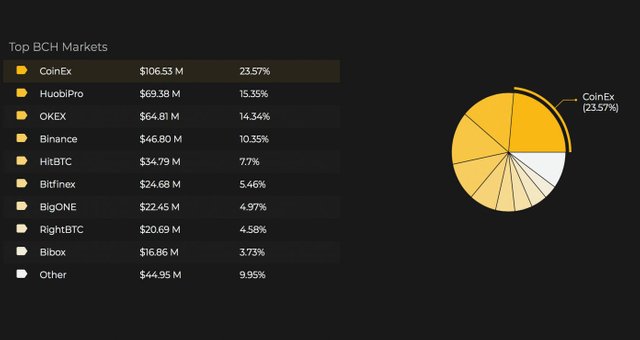

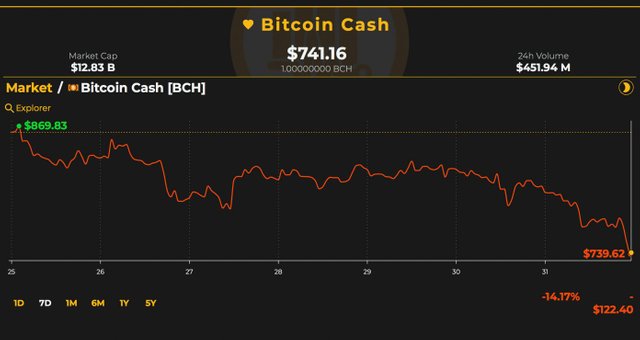

This Tuesday bitcoin cash (BCH) markets are seeing losses as well as BCH is down 8 percent over the last 24-hours. Bitcoin cash markets are also down 13.2 percent for the last seven days. One BCH is trading for $741, and the decentralized cryptocurrency has a market valuation of around $12.8Bn.

Coinex ($106.53Mn), Huobi Pro ($69.38Mn), Okex ($64.81Mn), Binance ($46.80Mn) and Hitbtc ($34.79Mn).

- This is followed by BTC (28.5%), USD (7.6%), QC (2.8), ETH (2.4%) and the KRW (1.2%). Bitcoin cash holds the fifth highest volume over the past 24-hours among all 1,600+ other cryptocurrencies.

- Many traders can see looking at charts that the price was rolling sideways for close to three days and many were convinced of a bull flag after the inverse head & shoulders. But just before the dip sell orders on popular exchanges worldwide began stacking up.

- Many traders can see looking at charts that the price was rolling sideways for close to three days and many were convinced of a bull flag after the inverse head & shoulders. But just before the dip sell orders on popular exchanges worldwide began stacking up.

- On the back side there’s solid support between now and $710 but unfortunately, books are thinner until $650

- Volumes across the board for many cryptocurrencies has been getting flatter as each day passes. Traders and enthusiasts are now unsure the upcoming ETF decision will pull prices up until then for two reasons:

- This week the current market sentiment, and our price verdict, point to far more skepticism and shade towards bullish prices returning soon.

- Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice.

- Always remember that only those in possession of the private keys are in control of the “money.”

Good job bro...

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I LOVE YOU BROTHER

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ha ha funny man 😂😂

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit