Warning! This is going to be a LONG post, but hopefully also a helpful and informative one!

This post has been a long time in the making, but I’m happy to announce that I finally today have purchased STEEM with retirement funds in an IRA account! I am very excited to be able to invest in cryptocurrency with my tax-deferred retirement funds and I expect they will provide significantly greater returns than the traditional stocks and funds in which the money was invested previously.

Obviously I understand that there are risks, and things may not turn out the way I expect, however I am quite far away from retirement and I am comfortable investing these funds in cryptocurrency knowing that my day to day life will not change at all if I were to lose it.

Show Me The Money!

Some of my more curious (a.k.a. nosy) readers might notice that no STEEM has been transferred to my account recently! There is a good reason for this, and that is that my retirement funds are never allowed to be held in my name or co-mingled in any way with my personal funds.

Therefore I used the very helpful Anon Steem service created by @someguy123 to create a new Steem account that has no ties to my personal account in which I could deposit the funds. The account is @mjrcrypto if you’re curious.

I’ve only invested a portion of what I ultimately plan to invest so far because much to my chagrin the price of STEEM went up around 30% just a few days before my funds were finally available - ARGH! In the meantime I’m keeping the rest of the funds in BTC in the hopes that it continues to go up and that perhaps STEEM might fall back down in which case I will purchase a lot more.

Anyway, if you also have an interest in investing your retirement funds in cryptocurrencies, I’ll take you through the process that I used so that you can be prepared for what’s involved and learn from my mistakes!

PLEASE NOTE: I am not a financial advisor and I am not advising you to invest your money in any way! This is for informational purposes only.

How Retirement Accounts Work

I will start off with a little information about how retirement accounts work (in the US at least). As I mentioned above your retirement funds can never be held in your own name or co-mingled in any way with your personal funds. Any retirement funds that you have are owned by a custodian - typically a bank or financial services provider - and you are the beneficiary.

Also most IRA custodians will only allow you to invest in a specific list of things - usually mutual funds managed by the custodian itself. I originally used E*Trade as my IRA custodian because they at least let me invest in a larger array of options - but certainly not cryptocurrency!

As a side note - If you’re not interested or able to invest in cryptocurrencies and would like an exciting stock opportunity (in my opinion), please check out this post: A Stock Recommendation - AMS - The Future of Cancer Treatment

So I needed to find a custodian that would allow me to invest in cryptocurrencies. As you might expect there are a number of them popping up recently. Some of the more heavily promoted ones are Coin IRA and Bitcoin IRA - but these only allow you to invest in a relatively small list of the top cryptos by market cap and they hold the keys. They also charge enormous fees.

Broad Financial

But then I discovered Broad Financial and their Self Directed Bitcoin IRA You can read more about it using the previous link, but to summarize their service offers the following:

Total fees come to around $1,500 plus about $200 / year ongoing - this might sound like a lot but it is FAR cheaper than any other services I have seen

You can invest in any cryptocurrency you want (or even any other investments approved by the IRS for retirement accounts) with pretty much complete freedom

You hold the keys for your cryptocurrency investments and can store them any way you like - hardware wallet, paper wallet, whatever

The only downside is that the responsibility is on you to make sure you use the funds in an allowed way. As I mentioned you can’t co-mingle them with your personal funds and you can only use them to invest in things that are approved by the IRS for retirement accounts.

Luckily cryptocurrencies are an approved investment, in addition to things like real estate, precious metals etc. You can’t go out and use it to buy a new car or go on vacation! The good news is that Broad Financial has a support team specifically to help advise their clients on how to do things properly - I asked them a lot of questions, they are great!

The Process

What Broad Financial does is they create a special type of LLC which is owned by your IRA but you are the beneficiary and manager of. Then they provide all of the paperwork and instructions for you to rollover your retirement funds from your current custodian to the custodian they work with called Madison Trust Company.

You then go to any bank of your choice and set up an account in the name of the LLC and then Madison will “invest” your retirement funds in the LLC and transfer the money to the bank account you have set up.

This all takes a few weeks to get set up (since there’s government agencies involved to create the LLC) but it’s very easy since Broad Financial does most of the work and walks you through the whole process.

The Hard Part

The hard part (for me at least) came after the funds were sent to the bank account that I set up in the name of the LLC and it was finally time to invest it in cryptocurrencies. To do that you need to set up an account with a licensed cryptocurrency exchange in the name of the LLC. It’s very easy to set up an account in your personal name, but let me tell you it’s not easy to set up an institutional account for a business!

I tried Coinbase first since that’s who I use for my personal funds but you need to contact them and to this day they still have not responded to me. I tried Gemini next and they actually responded after a few days but the process was extremely lengthy and more work than I was prepared for.

I ended up being successful with itBit. They were relatively quick to respond and even had a support representative that I could talk to on the phone to help me! I sent them all the paperwork for the LLC and it took them about a week to process it and set up my account. Then I wired funds from the bank account I set up to itBit (they arrived surprisingly quickly!) and finally I was able to buy Bitcoin using my retirement funds!

We’re In!

Once you have one crypto then it’s very easy to convert it to others - so I just sent some BTC to blocktrades and converted it to STEEM and I was officially invested in STEEM through my IRA!

Again, I will note that I am not a financial advisor and I am not advising anyone to do this, but if you should decide that you want to set up a similar self-directed IRA then I would highly recommend going through Broad Financial.

If you do so, I would appreciate if you mention my name - Matt Rosen - as I will get a referral fee. I am NOT recommending them just to get the referral - I am recommending them because I used them myself and they were great and seem to be by far the best option available right now.

So there you have it - the whole month and a half long process I went through to be able to invest my retirement funds in STEEM, among other things. Thanks for reading! Feel free to ask me questions or tell me how stupid I am in the comments, or you can PM me on discord or steemit.chat!

Help Support My Projects!

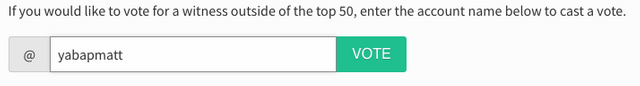

If you would like to support my projects and/or my ideas and vision for the future of the Steem platform, I would greatly appreciate your witness vote. To cast your vote you can:

- Go here: https://steemit.com/~witnesses

- Scroll to the bottom

- Write yabapmatt and vote or set yabapmatt as a proxy

- Use Steem Connect to vote for me as a witness

- Or Use Steem Connect for proxying your witness votes to me

** EDIT **

It looks like I'm not the first Steemian to do this through Broad Financial: https://steemit.com/ira/@papascrubs/bitcoin-ira-vs-broad-financial-solo-401k-save-some-money

Great Post Matt. This seems like a lot of work but really the way to go!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sounds good. However I live in the UK and pensions work slightly differently. Iam looking for a way to buy crypto through my pension but not yet found it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea I don't know about how to do it anywhere outside the US, sorry! If you do manage to do it please post about it so more people in the UK can learn from you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am going to look into this more at the weekend. I’ll be sure to post if I find anything useful!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is actually a very good information. I don’t even know that thing is posible. Maybe in the future we could crypto currency as our IRA

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have an IRA. I want to pull it out of fiat. I've been waiting for this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Go for it! PM me if you need any help or have any questions.

I'm not a financial adviser, invest at your own risk, blah blah blah :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You know, $1500 really isn't that bad. $500 is what it costs generally just to make the LLC in MA.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea, some other services I checked like Bitcoin IRA don't publish the fees on their site since it's so high, but it looks like they charge 15% of your total investment which is just insane in my opinion. Plus you can only invest in the cryptos they support and they hold the keys.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great idea, I want to support going to make you witness ...thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah its nice ! But please provide small post its very hard to read and undeestand bro !!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I prefer to provide more information rather than less, especially for something as important as this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh i just lolz at you bro make more post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ha nice! You got me there :-) Maybe I should make them shorter, would save me a lot of time writing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bro am from India I totally don't know how to use this steemit but everyone is earning more and more I cannot able to do give me some tips..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice, best of luck, i support you, steem on steem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Im going to jump this post and tell anyone reading, who will listen, that this is THE WORST IDEA THAT ANYONE EVER GAVE YOU.

Don't put your retirement in to STEEM.

If you want to risk retirement funds on crypto, split your investment across BTC, ETH, LTC, and DASH.

That has much better chance of you being able to retire.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If you bought it at 10 cents and leased it out you might have come out "OK". lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, the same logic that reports buying Amazon or Google 10 years ago or MSFT 20 years ago was a good investment.

NO SHIT SHERLOCK.

You can pick a million things to have invested in in the past, that would make you rich today. But so what?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree that it's probably not the best idea to put ALL your retirement savings into STEEM. I only have some in Steem myself and some in some of the other cryptos you've mentioned as well. Regardless I hardly think it's the quote "worst idea that anyone ever gave you"!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, @yabapmatt: I'll read better next week. :)

@remind.bot 1 week

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Reminding @amico of this post as requested!

Please consider upvoting this comment to keep this service running.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mentioning and replying to you here on Thu, 24 May 2018 14:58:28 GMT to remind you of this post.

Please consider upvoting this comment to keep this service running.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, I wanted to reach to you in private but I couldn't . I want to add my upvote to boot system . Can you be in charge me for it . @yabapmatt

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @mrswhale - not sure what you're asking exactly but you can contact me on https://steemit.chat just search for "yabapmatt"

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm writing in https://steemit.chat . Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 58.82% upvote from @upme thanks to @suggeelson!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

a tomar en cuenta

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was just what my sweetie and I were looking for. I sent him the link after reading a few paragraphs. And of course we will mention your name.

Thanks Matt...Smiles

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 100.00% upvote from @postpromoter courtesy of @yabapmatt!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit