ROAD TO E-CURRENCY

Imagine living in a third world country where more than half of the working population were illiterates. Most people could not write a simple letter not to talk of understanding the concept of technology. The commonest means of communication you had back then was the phone booth. People had to wait in line for their turn to make a phone calls and the "wealthy" ones bought themselves a mobile phone, good for making calls only. This was the situation in Ghana back in 2000 . The dawn of the age of technology had just surfaced within the country and people were yet to get acquainted with it.

The most common means of earning for the average ghanaian was petty trading and the only form of payment was by cash. Even long distance trading payments were made by cash and the money got to the seller through a third person. Our bank systems were not being utilized and there was no financial intermediation between rendered services. It wasn't until 2002 when the government of Ghana decided to launch the Ghana Interbank Payment and Settlement Systems Limited (GhIPSS) which was going to make own and manage various e-payment systems being introduced in the country.

Popular among such initiatives was the National Switch and the Biometric Smart Card Payment System (ezwich). This provided customers with an e-zwich card providing access to both bank and retail services. The purpose of this was to promote cashless transactions in the long run. Several efforts in the form of promotions and advertisements were seen with this but many people were still stuck with the cash payment system. The use of cheques began to rise to fame within the country as many establishments began to accept it.

It wasn't until July 2009 when the country witnessed its first stable mobile payment system with the MTN Mobile Money (Momo). This method of payment was a game changer as people only needed phone numbers to make and receive payments at the nearest agent. At the end of 2009, the number of daily active Momo agents was around 124,000 with more than 5,000 mobile canvassers. Many other telecommunications networks such as vodafone and airtel also began to introduce their versions such as the Voda Cash and the Airtel money respectively.

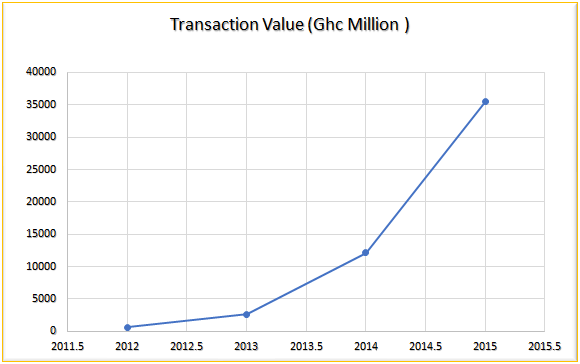

The popularity of mobile money was widely noticed in 2012 when its transactioin volume reached 594 million cedis and was increasing rapidly over the years. According to the Bank of Ghana's payment and statistics report in 2015, the transaction volume of mobile money had reached 34.4 billion cedis in that particular year. This was a 5,866% increase in the number of transactions within the country. These numbers suggested that the issue was not about e-currency itself, it was the method within which it was propagated within the country. This therefore established the undisputable fact that mobile money was a huge success and something that had come to stay.

I made this chart based on Bank of Ghana annual payment statistics report

CRYPTOCURRENCY ADOPTION

One would expect mass adoption of cryptocurrency in the country when Bitcoin began to gain worldwide recognition based on the numbers above. However, this was not the case. People who were already crypto inclined delved into the trading of it and since it was an unregulated venture there was no restrictions governing its processes. The government issued a fair warning to all traders to be extremely cautious when dealing with various cryptocurrency sites especially the ones promising high returns on small investment. This was also around the same time when scamming had become rampant within the country and this instilled a lot of fear among Ghanaians.

Also, trusted people who had foreknowledge about the crypto space and were investing failed to provide simplified explanations when asked what crypto currency was and how it operated. Cryptocurrency was therefore seen as a behemoth that would swallow them upon investing.

MOBILE MONEY MADE ALL THE DIFFERENCE

Day in day out, smart traders were devising newer methods to make payment systems trustworthy as well as user-friendly in order to get more people to buy from them. This included establishing websites like ebitcoinics who accepted mobile money and mostly dealt in bitcoin. There was no KYC verification needed with this site. All you needed to do was to create an order on the platform and send the money through your mobile money wallet to complete the transaction. This worked pretty well for such traders and they began to gain some recogniton as trusted dealers.

source

Lucky enough, most of these platforms came just around the time when Bitcoin was heavily on the rise. Many ghanaians therefore created accounts with these trusted sites and placed orders using their mobile money wallets. As a result, these websites began adopting other currencies that were excelling in the crypto space. The commonest strategy many people adopted was to buy Bitcoin when it falls and sell their stock when it rises. However, due to the standard of living of the average ghanaian, it was difficult to buy in currencies in bulk. Those that could afford hit it big when it hit its all-time high in December 2017.

However, when Bitcoin started lurking around $3,500 in 2018, many ghanaians withdrew from their tokens thinking it would not rise again. Who could blame them? They had already been cautioned about the high volatility in the crypto world and it's not as if they didn't need the money at the time. But the smarter investors bought more bitcoin and altcoins now that they were selling at a cheaper price. This definitely paid off for them as bitcoin started rising steadily some months later.

A GLIMPSE INTO THE FUTURE

Cryptocurrency remains unregulated in the country and as a result of that anyone can dive into its commercial trading. The way I see it, this would be a good thing as the avenue for its trading would remain broad in the country. However, ghanaians have a very low risk appetite. As such, many quickly lose faith in a currency as soon as it shows signs of dropping in price. Due to this fear factor, ghanaians might not be the ideal long term holders for this currency. Instead, why not develop a method of inculcating the use of cryptocurrency in our mobile money operation. With this, people will not have to hold on to their tokens if they don't want to.

source

As the acceptance of bitcoin as a payment option is growing on a daily basis, we are likely to see many other altcoins would follow suit. This new payment system would then create the avenue for cryptocurrency circulation and wide adoption and for our mobile money users, the fear in losing funds will depreciate slowly. There would be crypto agents stationed at vantage spots within the community who would charge a small transaction fee for withdrawal.

Based on the numbers we see in the chart above, it is definitely feasible.

I think the future of cryptocurrency in Ghana largely depends on its linkage to our mobile money. This would foster wide adoption and a dramatic surge in major cryptocurrency prices would see the new mobile crypto payment system taking over.

Thank you for your attention.

cc:

REFERENCES

https://assets.kpmg/content/dam/kpmg/ng/pdf/dealadvisory/ng-KPMG.

https://www.bog.gov.gh/wp-content/uploads/2020/06/AnnRep-2019.pdf

It was same situation here in india back in 2000 - 2003 and after that mobile companies started evolving and reached to all normal people.

In india, PayTM, Freecharge and Airtel money and few more started giving options for online recharge and payments using mobile app I think from 2009-10.

Yes, I am sure crypto will be soon available on these mobile apps with an option to pay utility bills etc.

Nice post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes @neerajkr03, I strongly believe that as well. Providing the option to make all forms of payments in crypto will be a game changer and would impact the impact the lives of everyone.

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Twitter share : https://twitter.com/bananmuni/status/1318850554819346432?s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nigeria's story is just about the same. Even till today, a lot of people still prefer cash, to them, cash is the ultimate. Next to cash is mobile bank transfers. The problem with mobile bank transfers however, is that network sometimes is poor and this can lead to some very serious confusion. Some time the buyer has been debited but the seller hasn't been credited. This can take days to be rectified and this is a major challenge with mobile bank transfer. Then there is POS but due to costs, it is mostly used by big merchants. Crypto is not inclusive. I hope in the future, it will.

#onepercent #nigeria

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mobile banking is good but has a lot of hiccups due to our network conditions. This is exactly why africa as a whole should largely adopt the cryptocurrency mobile payment system.

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

“This post has been rewarded by @oppongk from @steemcurator04 Account with support from the Steem Community Curation Project."

Keep posting good content and follow @steemitblog for more updates!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit