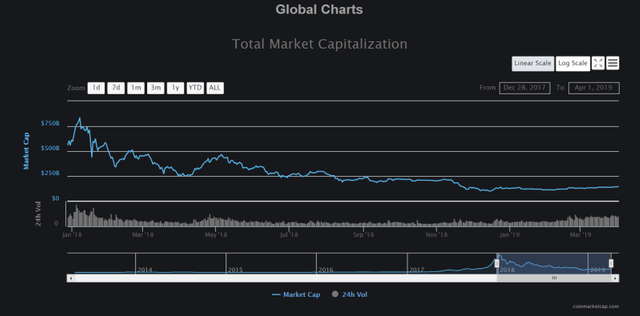

Cryptocurrencies dramatic market boom and bust has been hard on cryptocurrency businesses. Market sentiment is not the only thing down in the dumps, exchange volume, payment usage, and overall new users coming into the space are down as well.

But, there is one industry that is still growing, if not growing faster, and that is Bitcoin Loans. Bitcoin loans have proven to move independent of price, as it serves both sides. Those pessimistic about the price have borrowed and shorted Bitcoin. And those optimistic, borrow against their Bitcoin instead of outright selling. “Hodling” until the price increases again.

While the lending has been done using primarily Bitcoin, the loans are denominated in dollars. Companies that offer these cryptocurrency backed USD loans such as BlockFi are thriving in this cryptocurrency bear market. Salt Lending, which already employs 80 people, is hiring more every month as its revenue inches higher.

From “Hodling” to Shorting

What started as a way to get some cash without without having to sell and miss out on potential gains for enthusiasts “hodling”, has also turned into a shorting mechanism. Shorting works by depositing USD, borrowing cryptocurrency, selling the borrowed crypto, then later buying back at a lower price to pay back the original loan. With the combination of holders and shorters, lending platforms find themselves with twice as many customers and a continuously growing demand for their services.

Genesis Capital, a US based lending company focused institutional investors borrow virtual coins by depositing U.S. dollars, has also reported increased demand for its services. Institutional investors using this service are regularly depositing 7 figure USD sums to borrow cryptocurrency for shorting or other purposes.

New type of Margin lending

It is no secret there are many speculators in the cryptocurrency space. You could even argue that the whole space is speculatory and relatively few fundamentals or actual use cases for the currencies exists at all. But, regardless if its useful or not, 1 things speculators demand is leverage. I mean why not? If you are investing in a highly speculative asset with extreme volatility, why not leverage your bet and “go big or go home”.

Most margin lending happens and historically happened on cryptocurrency exchanges. But, wanting to get a piece of the action lending companies saw a huge opportunity with cryptocurrency backed USD loans and they took it.

While its branded differently and not done on exchanges, crypto backed loans from Nexo, Blockfi, Salt, and other lending platforms are essentially margin loans. As if you read the fine print, if your cryptocurrency holdings fall below a minimum collateral percentage, they will be sold to pay off debt before the loan goes underwater. This is essentially the equivalent of being margin called on an exchange. This ability to liquidate under-collateralized loans greatly reduces risk for lenders and enables them to offer very competitive interest rates for these loans.

Responsible borrowers benefit as well, getting low rates and lots of flexibility. However, for some borrowers who push their holdings too far or don’t pay attention to prices, they can be liquidated during down markets and effectively sell the bottom and incur liquidation fees.

What about Bitcoin Loans?

While USD denominated loans backed by crypto have thrived, Bitcoin denominated loans haven’t quite followed the trend. Volume on popular P2P Bitcoin Lending platform Btcpop.co has been reported down in the bear market. It turns out extreme volatility on the way up and down isn’t necessarily good currency for pricing your loan in. This is relatively expected in such a new market, but it has spurred Btcpop to plan for USD based P2P stablecoin loans in the future.

Other Bitcoin lending platforms such as Bitbond seem to have moved away from Bitcoin completely during this time. Only offering Bitcoin to be used as a payment method, but not necessarily used as a currency for loans on their platform though last time checked it was still a rarely used option.

Bright future for Cryptocurrency Based Lending

Cryptocurrency based lending’s resilience and continued strong growth through both bull and bear markets shows strong staying power in the industry. This strength will likely attract continued investment and development of services in the space. As investors likely desire a uncorrelated investment in crypto, which grows regardless of price volatility. Cryptocurrencies as well, have proven to be a very good source of collateral for USD based loans and reduce the overall loan risk to almost zero.

As the industry and cryptocurrencies develop. It will be exciting to see the emergent growth of cryptocurrency denominated loans as volatility decreases. USD loans are fun, but the Btcloans.org is excited for the take-off of cryptocurrency based loans, even if they are a in a crypto stablecoin form such as MakerDAO’s DAIdecentralized stablecoin.

This document has been composed with the free HTML edior which can be accessed here. Use it every time for document editing.