The cryptocurrency markets try to put their recent collapse behind them and look for a chance to recover at the start of the new year. The main tokens are performing better in the first few days of the course than other activities, such as actions or bonuses. Currently, the recovery plan is starting to bear fruit thanks to increased investor optimism in the traditional market.

Imagen de fabrikasimf en Freepik

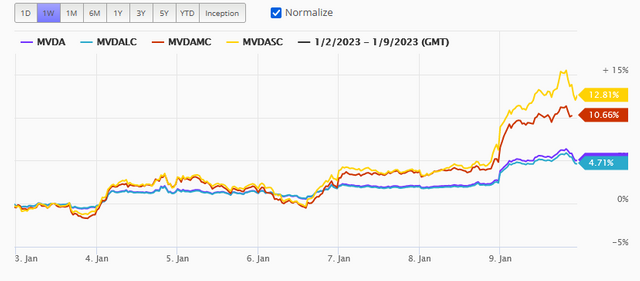

In the early days of the exercise, actions, bonuses, and gold have advanced, but cryptocurrency exchanges have also done so and more significantly. This difference in performance can be seen in the MVIS CryptoCompare Digital Assets 100 Index, which includes the major tokens and has gained 7% over the past month, surpassing increases of 2% in variable rent, 1% in bonuses, and 3% in precious metal, according to Bloomberg.

In the last six days, Bitcoin has advanced, marking its best run in over a year since February 2022, according to the same data. This Monday, the main cryptocurrency is down around 2% and is over 17.200 dollars. The previous seven days saw a gain of 3%. Ether, the second-ranked stock by capitalization, increases by 4% during the day and by more than 8% during the week. This token may be exchanged for 1.300 dollars.

imagen actualizada

por marketvector.com

Imagen de vectorjuice en Freepik

Imagen de vectorjuice en Freepik

The gains are supported by a greater optimism after recent macroeconomic indicators, such as the United States' December labor market statistics, which show that employment is still growing, that the unemployment rate is low, and that wage growth is being restrained. All of this leads one to believe that the economy is resilient to the monetary cycle and opens the door to a gentle aterrizaje. Additionally, perspectives on the state of central banks and the end of the adjustment, which is thought to be closer, are improving. Once more demonstrating their correlation with changeable rent, cryptocurrencies have followed the trend of actions, this time to the altitude.

In the best macroeconomic setting, a vendor-exhausted pressure is added, however the cryptoactives still need to surpass some technical hurdles. This week, "crypto" will have new catalysts and be able to halt price increases if US inflation data confirms the decline in prices.

In every case, the system's rake is higher in tokens than in bitcoin. For instance, solana has increased by 47% over the last week and by 21% during the past 24 hours. Before 2022 was through, the token had lost 94% of its value due to the FTX crisis. It was one of the cryptocurrency networks that Sam Bankman-Fried, the platform's founder, supported the most. Other "cryptos" that rise strongly include Cardano and the Binance Token. In the most recent hours, the first one advanced by 12% and the second by more than 6,5%.

Along with the challenge of maintaining gains and having to overcome obstacles, the market for "crypto" also faces the challenge of regaining lost confidence. There are many cryptocurrency projects that have been launched in 2022, including the Terra and FTX projects, among many others. In addition to monitoring macroeconomic benchmarks, investors are now looking for greater transparency. It partly depends on whether the last labor crises' "crypto" functioned to fix the market's floor.

Without more to contribute at the moment, we are on the lookout for these critocurrencies and their evolution to keep you up to date.

Until a next post. @bullbearyun tells them