DeFi is one of the most attractive and fast-growing industries in the cryptocurrency market for investors. It attracts many people with the prospect of potentially high earnings with relatively low risks for the cryptocurrency market.

A year ago, skeptics predicted that the DeFi's bubble could burst in 2021 due to its rapid growth, but this sector, on the contrary, has developed even more. In August 2021, the global cryptocurrency market capitalization exceeded $3 trillion. In general, the globalization of the market has significantly increased in comparison to last year. According to Coinmarketcap, the market capitalization of DeFi tokens is $167.97B.

The explosive growth of the DeFi sector is explained by the growing popularity of cryptocurrencies, their gradual acceptance by society and the states, as well as the necessity of integrating blockchain technologies with each other and with traditional finance.

New startups appear almost every day, and leading international venture capital funds are actively investing in them. If the dynamics continue and the crypto market will be growing in 2022, then we can expect that the DeFi sphere will become even more developed and offer more opportunities. Therefore, let's figure out what DeFi means and how it works.

What is DeFi?

DeFi is called decentralized finance. It is a financial form based on blockchain that doesn't work with central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial tools, and instead uses smart contracts on the blockchain, the most widespread being Ethereum.

The most popular products in this area are lending, decentralized stablecoins, decentralized exchanges (DEX), and token issuance services. A new proprietary financial system is emerging around the cryptocurrency market, superior in quality to the traditional one.

A distinctive feature of DeFi products is the lack of centralized management and many of the disadvantages of the traditional financial system, such as slow transactions, a large number of intermediaries, the need to verify identity and sources of income.

Relationships in decentralized finance are built on the basis of smart contracts — special algorithms in the blockchain ensuring that the parties comply with the terms of the contract. Smart contracts virtually eliminate human error.

The decentralized nature of the system, the availability of tools, the efficiency, and transparency of the blockchain attract millions of users to DeFi. Among other things, the reason for the interest in decentralized finance is the high profitability of this sector. Thus, a huge number of people use different types of investment in DeFi. Let’s take a closer look at them.

Types of investments in DeFi

Yield farming is a type of DeFi investment that allows liquidity providers (LP) to lock up their digital coins in a smart contract (it is also called a liquidity pool). This profit can be transaction fees percent, interest from lendings, or a governance token.

These incomes come in the form of an annual percentage yield (APY). As a huge number of investors add their coins to the corresponding liquidity pool, thereby reducing the cost of issued income.

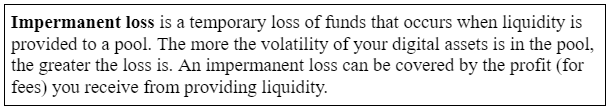

It is worth noting that placing your assets in liquidity pools can lead to an impermanent loss.

During the initial period of time, a lot of investors staked in famous stablecoins DAI, USDC, and USDT. However, this situation has changed as the most popular DeFi protocols currently function on the Ethereum network and provide governance tokens that are also called liquidity mining. Digital assets are held in these liquidity pools in return for giving liquidity to decentralized exchanges.

Liquidity mining means when a participant of a yield farming receives a reward as digital assets. Liquidity farming got known after Compound began issuing the rapidly growing COMP, its management token.

Staking is a kind of investment in the form of storing crypto assets in a special wallet that supports the Proof-of-Stake (PoS) blockchain network. To make it clearer, staking is like a deposit on which a certain amount is locked in order to receive passive income from it.

Lending & Lending Protocol — earnings on P2P lending. In decentralized lending, lenders and borrowers interact through the blockchain. The borrower takes out a loan in cryptocurrency at interest, leaving collateral also in cryptocurrency. The investor, on the other hand, invests his assets in a common pool and earns on interest.

P2P lending platforms offer loans to anyone without checking their credit history and no ID. The only condition is a deposit. Usually, it is about 150% of the loan amount. At the same time, the smart contract guarantees that the lender will return his funds with interest even in the event of a fall in the value of cryptocurrencies or non-repayment of the loan by the borrower.

Margin trading (leveraged trading) on DEX is a way to trade on an exchange using leveraged funds. Thanks to leverage, a trader can use in the process amounts several times larger than available. This is where the trader borrows assets from decentralized credit protocols. You can invest by providing your unused cryptocurrency to traders at a percentage. The risks of losing funds are regulated by smart contracts.

Investing in DeFi tokens is a common purchase of assets based on their growth. The attractiveness of this method of investing in cryptocurrency is that a few hours after the release of the DeFi token, it can rise in price by thousands of percent. But there is also a problem - the volatility of new tokens is very high. You can earn a lot quicker, but you can also lose your funds.

What should every investor know before investing in DeFi?

Investing in DeFi carries certain risks that can lead to huge losses on the part of the investor. Therefore, let's take a closer look at the possible risks of investing in DeFi.

Risks:

Loss of invested assets as a result of hacker attacks on the project

In order to minimize this risk, it is better to invest in a proven protocol that works for a long time and has already proven itself. Usually, such projects pay attention to their own safety and are better protected than new ones.

Investing in scam projects

In order to avoid losing funds due to investing in a scam project, you should make sure that the protocol has been checked by auditors. You can check the registration of a smart contract in special explorers of the blockchain and websites that track DeFi projects (DeFiPrime, DeFiPulse, DeFiMarketCap). You can also read publications and monitor social media of projects to get acquainted with their environment and audience.

The volatility of crypto assets

Diversify your investments, invest in different projects and protocols. Or invest in projects based on stablecoins pegged to real currencies, such as the dollar.

Where to Buy DeFi Tokens?

You can buy Defi tokens on centralized exchanges, decentralized exchanges, cryptocurrency wallets, and trading platforms where multiple exchanges are integrated offering to buy a DeFi token. Let's take a closer look at them.

Centralized exchanges

Here are several centralized exchanges that allow investing in DeFi projects:

Binance

This exchange pays special attention to users' sentiment in the cryptocurrency market. Thus, when DeFi began to gain immense popularity, this exchange was one of the first to provide a list of DeFi tokens and various ways to invest in DeFi. To date, almost all of the top DeFi assets are listed on Binance. In addition, there is a Binance Launch Pool platform for the farming of new coins; new protocols are regularly deployed on the BNS blockchain.

Huobi Global

Huobi is investing millions of dollars in the DeFi sector, and they have even set up a special fund for this purpose. A department has also been formed that will work on research, investment, and development of projects in this industry. Although the management of the department notes that this investment sector is still poorly developed and has many problems. Nevertheless, no one doubts its prospects.

Coinbase

Coinbase is working to bring increased security to the DeFi ecosystem as well as reduce systemic risks. To this end, the exchange has implemented price oracles for BTC and Ethereum for DeFi projects. Coinbase Wallet also allows getting a percentage of decentralized finance applications.

Gate.io

Like other exchanges, Gate is actively involved in the ongoing development of the DeFi space and regularly announces the availability of new tokens for trading. In August 2020, the exchange announced the creation of a highly secure DeFi ecosystem of Gate Chain, which includes USDG stablecoins.

Decentralized exchanges

There are several examples of decentralized exchanges where you can buy DeFi tokens:

Uniswap

Uniswap has been called one of the most promising DeFi projects. This is largely due to the fact that new tokens enter the crypto market through this exchange. On this platform, it is possible to purchase such DeFi tokens as WBTC, COMP, UMA, SNX, etc.

Curve Finance

Curve Finance is one of the adherents of the DeFi investments. The protocol started functioning in January 2020 to operate as a liquidity pool exchange for highly efficient stablecoin trade.

Crypto wallets

Some crypto wallets allow you to buy DeFi tokens with Bitcoin or other cryptocurrencies. This can be convenient if you use this wallet in one way or another.

There are service examples:

Trust wallet

The wallet supports various assets located on the Ethereum blockchain (ERC-20). In the app, you can exchange crypto assets using KyberSwap and Binance Dex.

Coinbase Wallet

This crypto wallet has full functionality for working with DeFi, for example, you can allocate funds for lending in protocols and track interest charges on them directly from the wallet. Almost all ERC-20 tokens are supported in this crypto wallet.

Argent

This wallet supports over 80 assets on the Ethereum blockchain, including promising DeFi tokens (WBTC, DAI, MKR, etc.). This Decentralized Wallet is also able to integrate with credit protocols to use lending services.

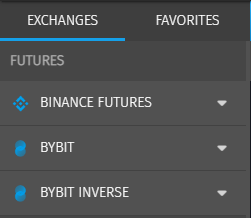

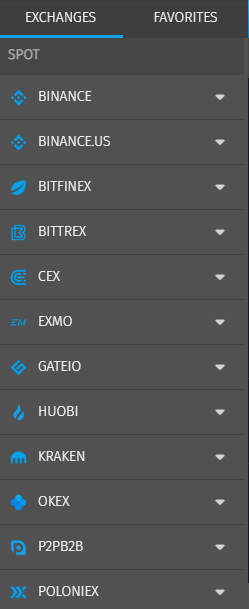

Besides the options mentioned above, you can buy DeFi tokens through cryptocurrency trading platforms that have multiple exchanges integrated. Cryptorobotics is considered one of the best crypto trading terminals. This platform includes fifteen exchanges that allow you to invest in DeFi tokens. Among them, there are only the most popular platforms such as Binance, Huobi, CEX, Kraken, Bitfinex, etc. Therefore, if you want to simplify the process of acquiring Defi tokens or use one of these fifteen exchanges for these purposes, you follow these steps:

Register on this website.

- Set up an account on one of the exchanges integrated into the terminal.

- Bind your account that is set up on the exchange to the Cryptorobotics trading platform by using the API key.

- Start buying DeFi tokens on one of these exchanges available in the terminal:

Conclusion

Summing up, we can say that investing in DeFi carries certain risks. Therefore, each investor needs to carefully study various projects and invest the number of funds that you are ready to lose.